Fiber laser manufacturer IPG Photonics (NASDAQ: IPGP) will be reporting earnings tomorrow before the bell. Here’s what to expect.

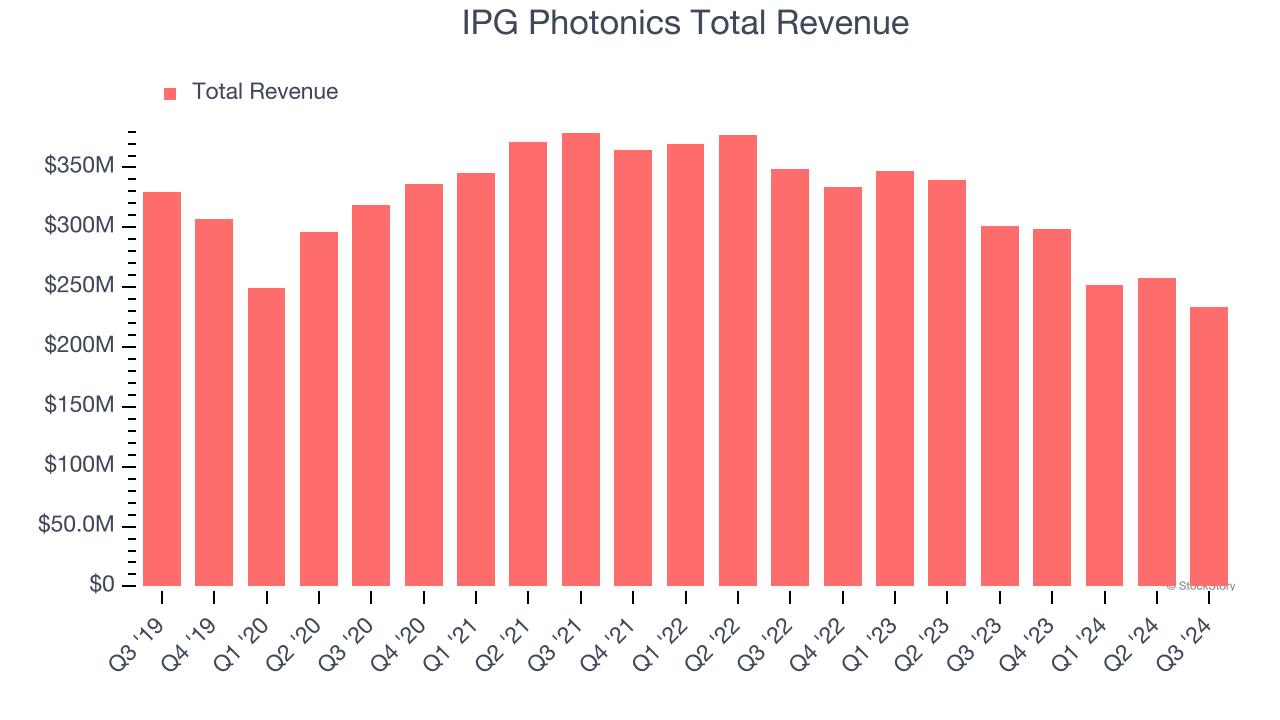

IPG Photonics beat analysts’ revenue expectations by 2.2% last quarter, reporting revenues of $233.1 million, down 22.6% year on year. It was a softer quarter for the company, with revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ adjusted operating income estimates.

Is IPG Photonics a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting IPG Photonics’s revenue to decline 23% year on year to $230.2 million, a further deceleration from the 10.4% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.21 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. IPG Photonics has missed Wall Street’s revenue estimates four times over the last two years.

Looking at IPG Photonics’s peers in the semiconductor manufacturing segment, some have already reported their Q4 results, giving us a hint as to what we can expect. FormFactor delivered year-on-year revenue growth of 12.7%, meeting analysts’ expectations, and KLA Corporation reported revenues up 23.7%, topping estimates by 4.5%. FormFactor traded down 6.8% following the results while KLA Corporation’s stock price was unchanged.

Read our full analysis of FormFactor’s results here and KLA Corporation’s results here.

Investors in the semiconductor manufacturing segment have had fairly steady hands going into earnings, with share prices down 1% on average over the last month. IPG Photonics is down 2.2% during the same time and is heading into earnings with an average analyst price target of $84 (compared to the current share price of $70.70).

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.