Fast-food pizza chain Domino’s (NYSE: DPZ) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 2.9% year on year to $1.44 billion. Its GAAP profit of $4.89 per share was in line with analysts’ consensus estimates.

Is now the time to buy Domino's? Find out by accessing our full research report, it’s free.

Domino's (DPZ) Q4 CY2024 Highlights:

- Revenue: $1.44 billion vs analyst estimates of $1.48 billion (2.9% year-on-year growth, 2.2% miss)

- EPS (GAAP): $4.89 vs analyst estimates of $4.90 (in line)

- Adjusted EBITDA: $312.1 million vs analyst estimates of $298 million (21.6% margin, 4.7% beat)

- Operating Margin: 19%, in line with the same quarter last year

- Free Cash Flow Margin: 9.4%, similar to the same quarter last year

- Locations: 21,366 at quarter end, up from 20,591 in the same quarter last year

- Same-Store Sales were flat year on year (1.4% in the same quarter last year)

- Market Capitalization: $15.97 billion

"Domino's 2024 results demonstrated that our Hungry for MORE strategy can drive strong order count growth, even in the face of a challenging global macroeconomic environment," said Russell Weiner, Domino's Chief Executive Officer.

Company Overview

Founded by two brothers in Michigan, Domino’s (NYSE: DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.71 billion in revenue over the past 12 months, Domino's is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build restaurants, placing a ceiling on its growth. To accelerate system-wide sales, Domino's must lean into newer chains.

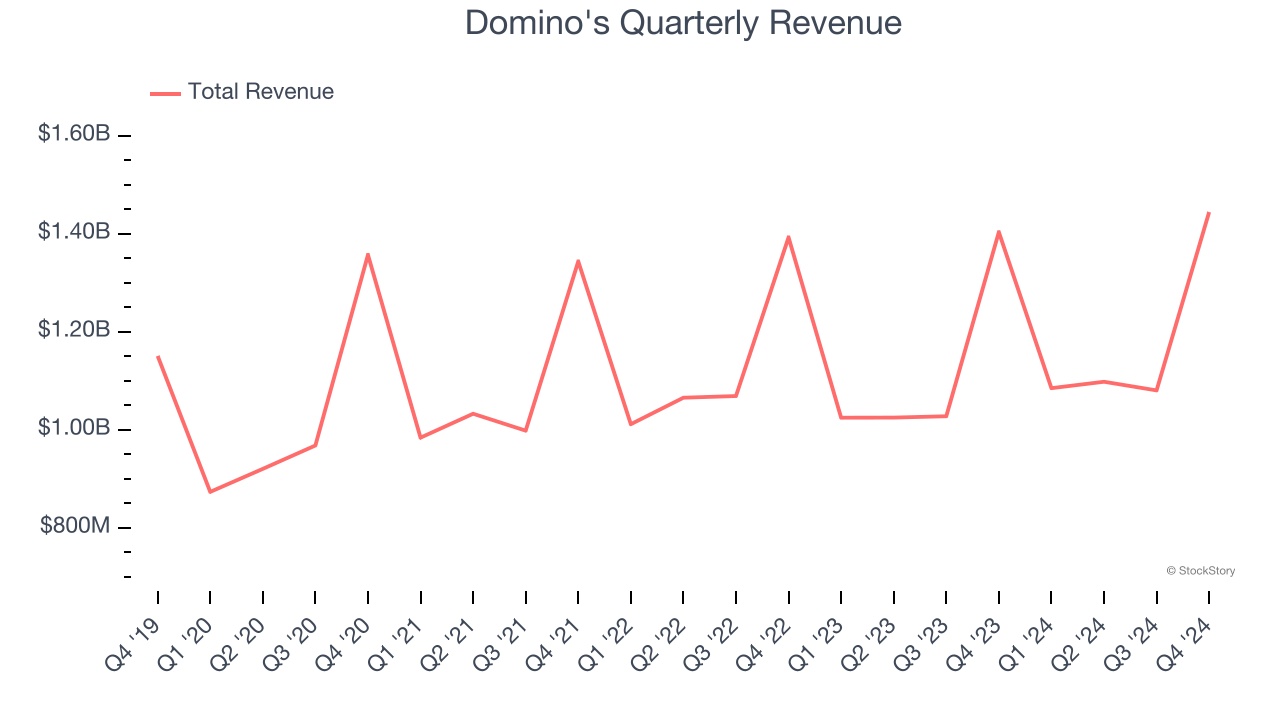

As you can see below, Domino’s 5.4% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid as it barely increased sales at existing, established dining locations.

This quarter, Domino’s revenue grew by 2.9% year on year to $1.44 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, similar to its five-year rate. Although this projection indicates its newer menu offerings will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

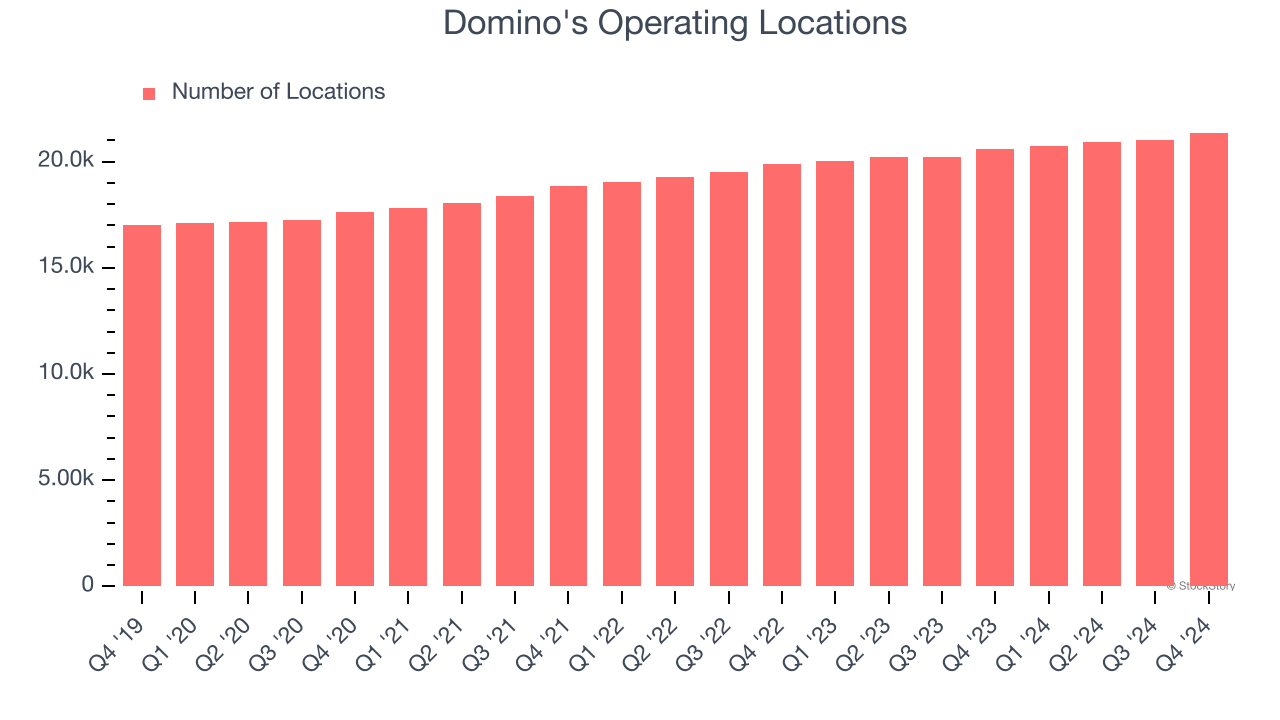

Domino's operated 21,366 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 4% annual growth, much faster than the broader restaurant sector. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Domino's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

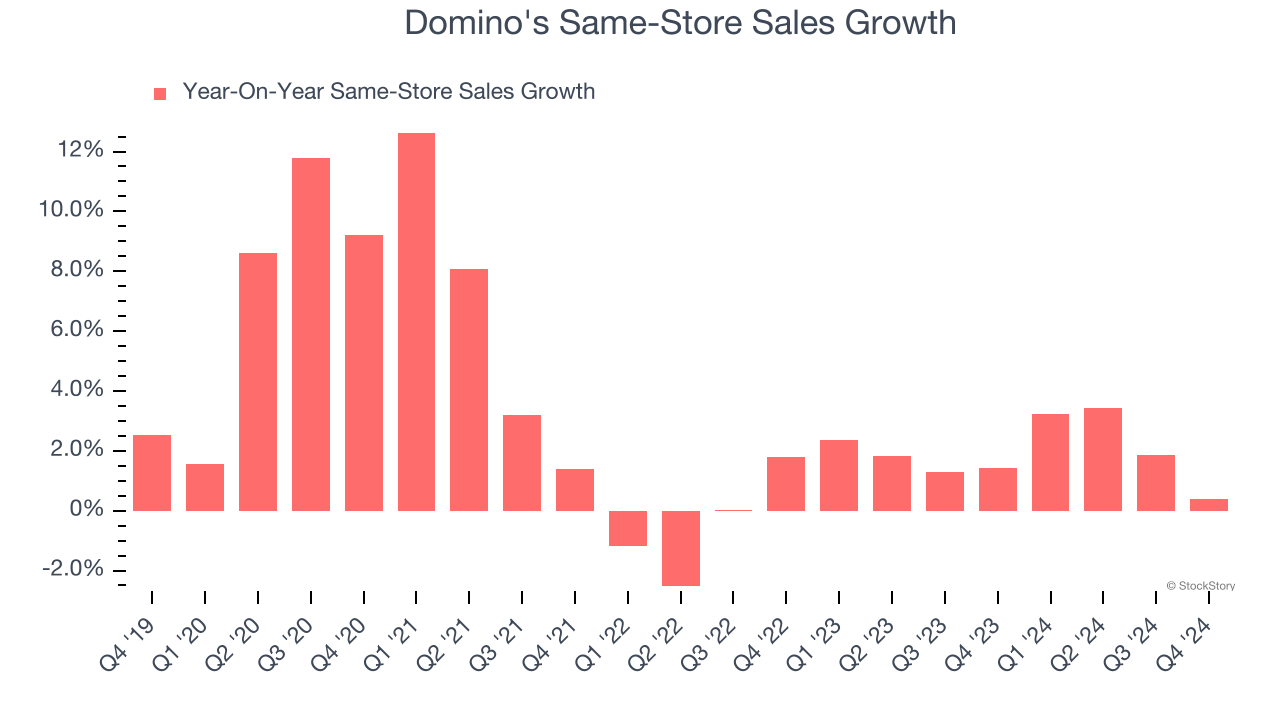

Domino’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 2% per year. This performance suggests it should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Domino’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Domino's can reaccelerate growth.

Key Takeaways from Domino’s Q4 Results

EPS was just in line. Worse yet, Domino's revenue missed and its same-store sales fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better, especially with the market increasingly concerned about the health of the consumer. The stock traded down 4.8% to $440.01 immediately after reporting.

Domino's may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.