Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Couchbase (NASDAQ: BASE) and its peers.

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

The 5 data storage stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.7% since the latest earnings results.

Couchbase (NASDAQ: BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ: BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

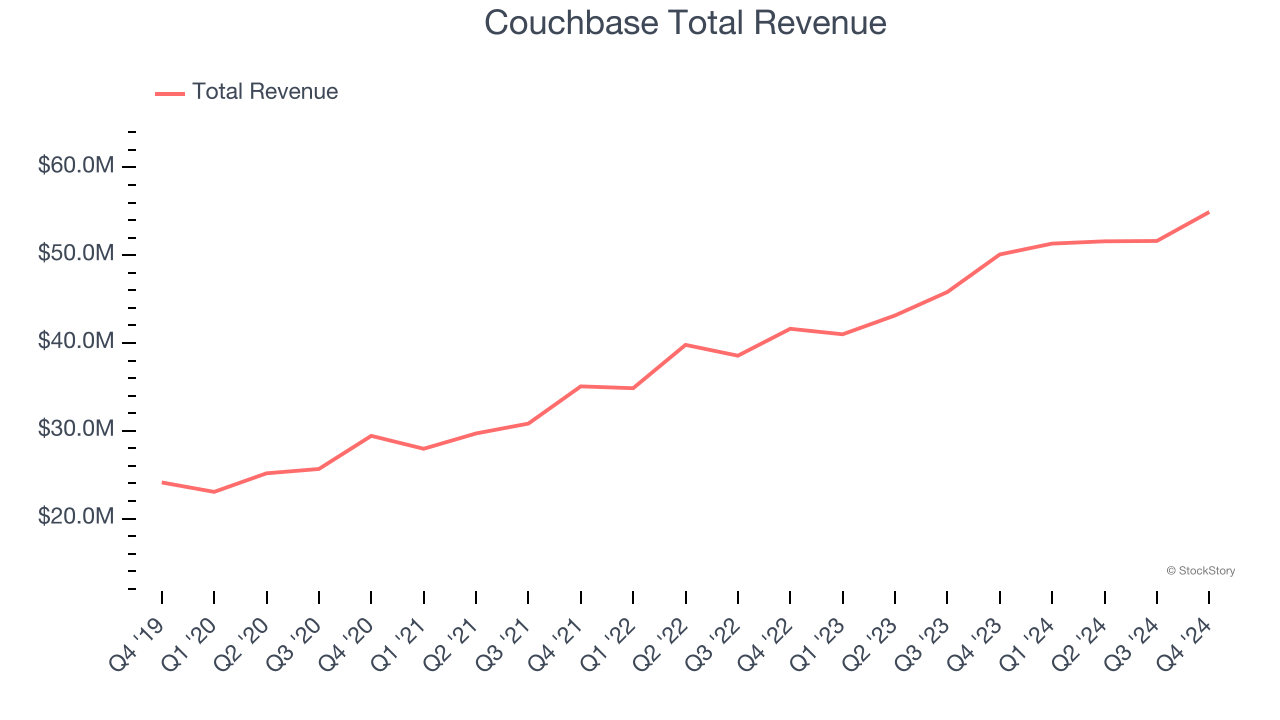

Couchbase reported revenues of $54.92 million, up 9.6% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ billings estimates but full-year guidance of slowing revenue growth.

"We finished fiscal 2025 on a strong note, including the highest quarterly free cash flow and net new ARR results in company history," said Matt Cain, Chair, President and CEO of Couchbase.

Couchbase delivered the slowest revenue growth and weakest full-year guidance update of the whole group. The stock is down 15.4% since reporting and currently trades at $13.76.

Is now the time to buy Couchbase? Access our full analysis of the earnings results here, it’s free.

Best Q4: Commvault Systems (NASDAQ: CVLT)

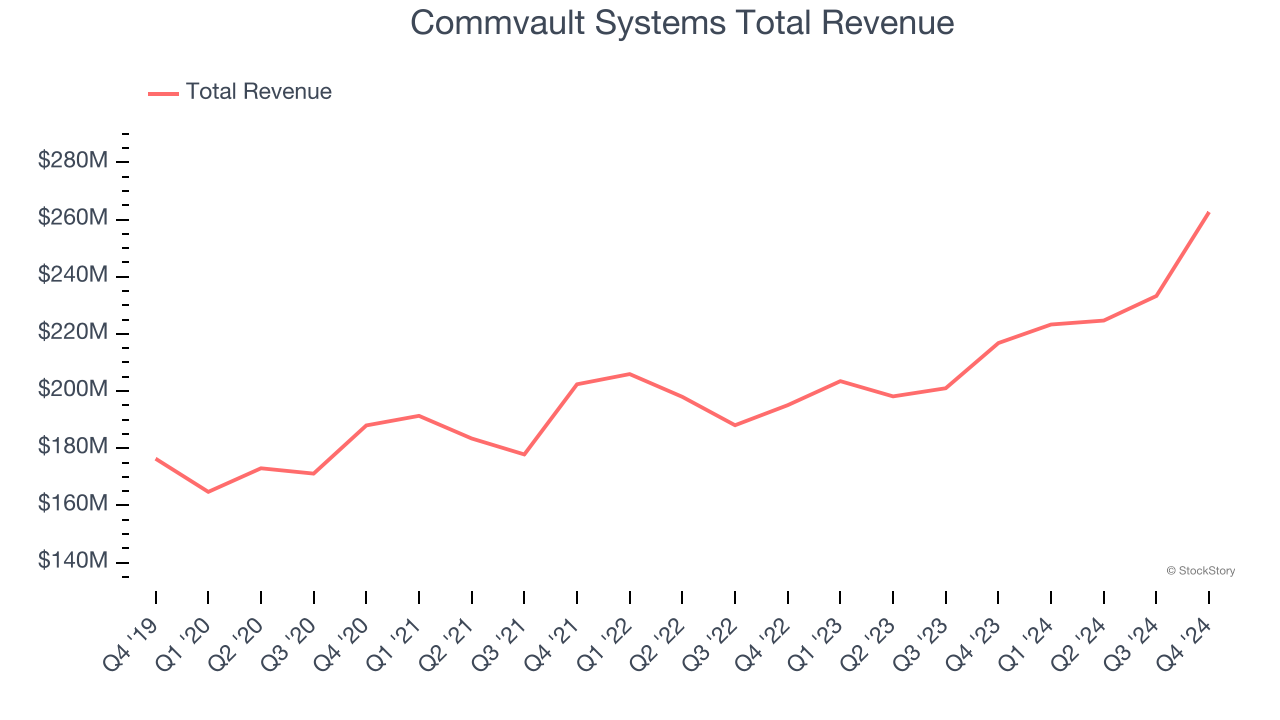

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Commvault Systems reported revenues of $262.6 million, up 21.1% year on year, outperforming analysts’ expectations by 6.9%. The business had a very strong quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Commvault Systems achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $160.06.

Is now the time to buy Commvault Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: MongoDB (NASDAQ: MDB)

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

MongoDB reported revenues of $548.4 million, up 19.7% year on year, exceeding analysts’ expectations by 5.6%. Still, it was a weaker quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 27.1% since the results and currently trades at $193.05.

Read our full analysis of MongoDB’s results here.

Snowflake (NYSE: SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE: SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $986.8 million, up 27.4% year on year. This result surpassed analysts’ expectations by 3%. Aside from that, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

Snowflake scored the fastest revenue growth among its peers. The company added 38 enterprise customers paying more than $1 million annually to reach a total of 580. The stock is down 6.2% since reporting and currently trades at $155.83.

Read our full, actionable report on Snowflake here, it’s free.

DigitalOcean (NYSE: DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $204.9 million, up 13.3% year on year. This number topped analysts’ expectations by 2%. It was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

DigitalOcean had the weakest performance against analyst estimates among its peers. The stock is flat since reporting and currently trades at $36.86.

Read our full, actionable report on DigitalOcean here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.