Let’s dig into the relative performance of Marcus & Millichap (NYSE: MMI) and its peers as we unravel the now-completed Q4 real estate services earnings season.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 13 real estate services stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 5.5% while next quarter’s revenue guidance was 1.2% below.

While some real estate services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.7% since the latest earnings results.

Marcus & Millichap (NYSE: MMI)

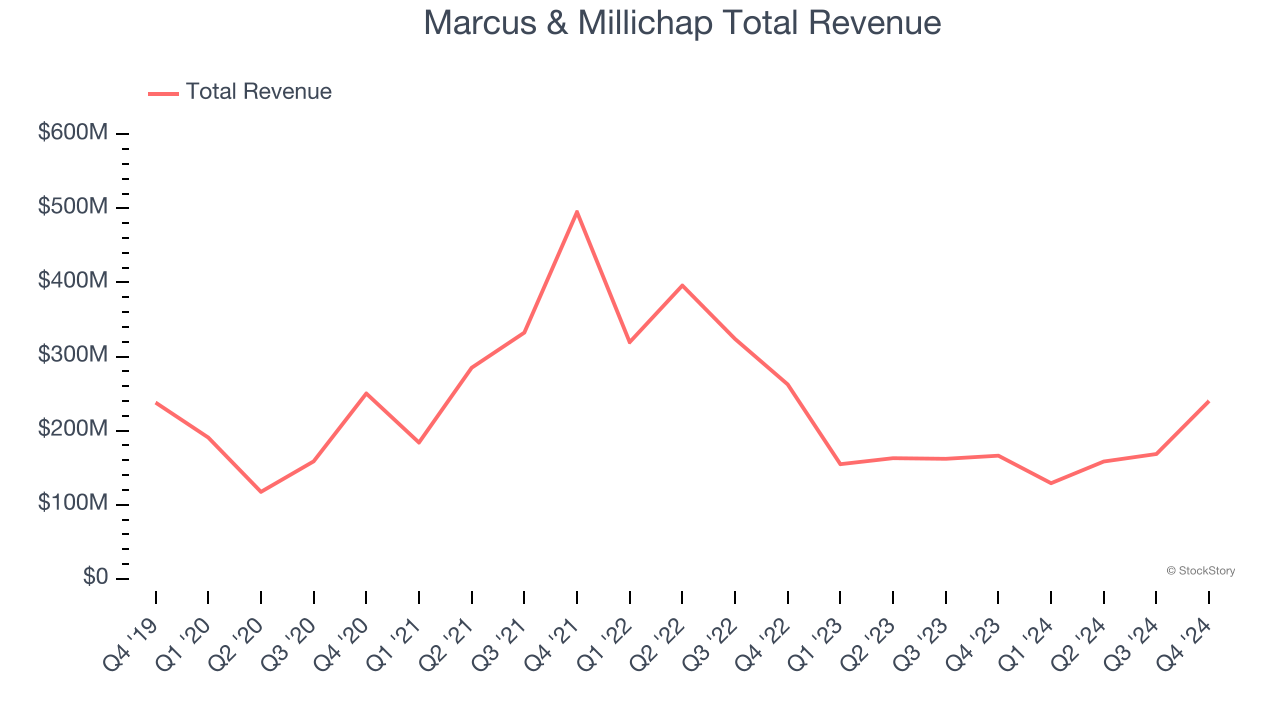

Founded in 1971, Marcus & Millichap (NYSE: MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

Marcus & Millichap reported revenues of $240.1 million, up 44.4% year on year. This print exceeded analysts’ expectations by 20.2%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Marcus & Millichap achieved the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 4.5% since reporting and currently trades at $35.61.

Is now the time to buy Marcus & Millichap? Access our full analysis of the earnings results here, it’s free.

The Real Brokerage (NASDAQ: REAX)

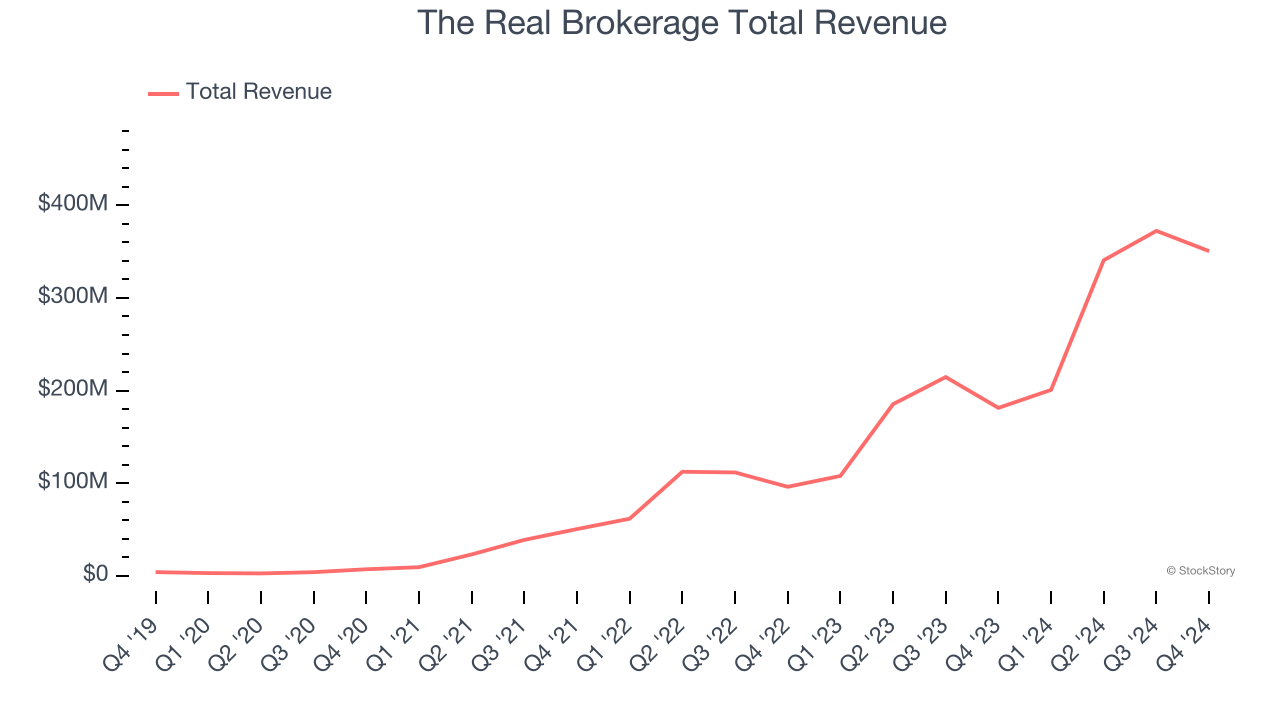

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ: REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $350.6 million, up 93.4% year on year, outperforming analysts’ expectations by 16.8%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The Real Brokerage pulled off the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 8.3% since reporting. It currently trades at $4.55.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Offerpad (NYSE: OPAD)

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE: OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Offerpad reported revenues of $174.3 million, down 27.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Offerpad delivered the slowest revenue growth in the group. As expected, the stock is down 11.1% since the results and currently trades at $1.93.

Read our full analysis of Offerpad’s results here.

Cushman & Wakefield (NYSE: CWK)

With expertise in the commercial real estate sector, Cushman & Wakefield (NYSE: CWK) is a global Chicago-based real estate firm offering a comprehensive range of services to clients.

Cushman & Wakefield reported revenues of $2.63 billion, up 3% year on year. This result lagged analysts' expectations by 0.9%. Taking a step back, it was a mixed quarter as it also recorded a narrow beat of analysts’ EBITDA estimates.

The stock is down 18.2% since reporting and currently trades at $10.65.

Read our full, actionable report on Cushman & Wakefield here, it’s free.

JLL (NYSE: JLL)

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE: JLL) is a company specializing in real estate advisory and investment management services.

JLL reported revenues of $6.81 billion, up 15.8% year on year. This number surpassed analysts’ expectations by 1.4%. Zooming out, it was a mixed quarter as it also produced a decent beat of analysts’ EPS estimates but a miss of analysts’ Capital Markets revenue estimates.

The stock is down 8.6% since reporting and currently trades at $257.37.

Read our full, actionable report on JLL here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.