As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the defense contractors industry, including BWX (NYSE: BWXT) and its peers.

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

The 14 defense contractors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 3.9% above.

While some defense contractors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2% since the latest earnings results.

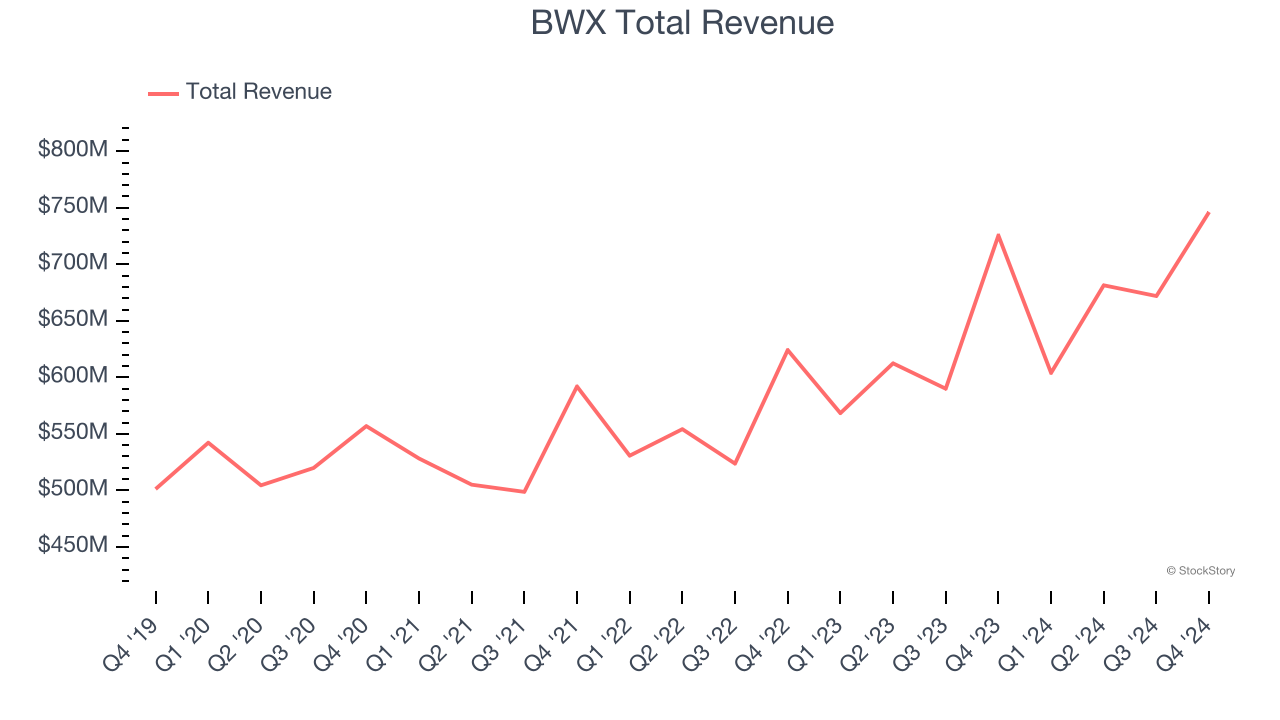

BWX (NYSE: BWXT)

Contributing components and materials to the famous Manhattan Project in the 1940s, BWX (NYSE: BWXT) is a manufacturer and service provider of nuclear components and fuel for government and commercial industries.

BWX reported revenues of $746.3 million, up 2.9% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a strong quarter for the company with full-year revenue guidance exceeding analysts’ expectations and an impressive beat of analysts’ Commercial Operations revenue estimates.

“We closed out the year with better-than-expected fourth quarter financial results and are poised for another strong year in 2025,” said Rex D. Geveden, president and chief executive officer.

BWX achieved the highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 1.8% since reporting and currently trades at $98.

Is now the time to buy BWX? Access our full analysis of the earnings results here, it’s free.

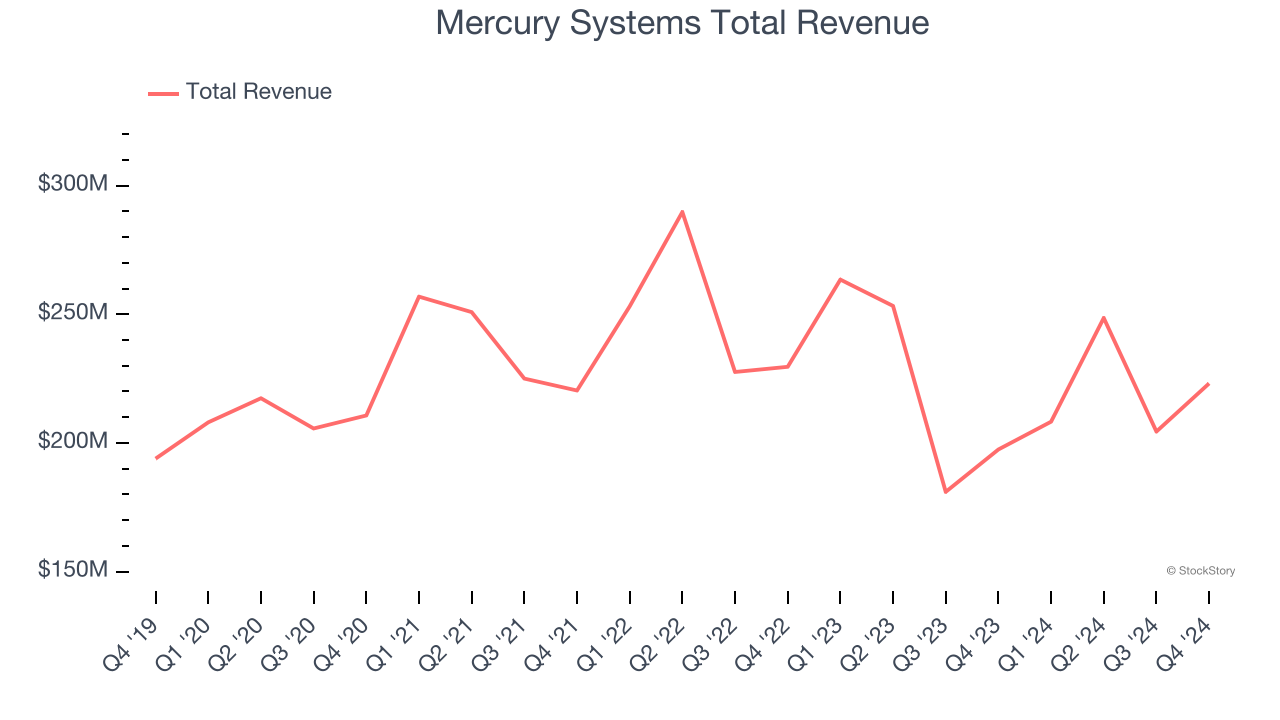

Best Q4: Mercury Systems (NASDAQ: MRCY)

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $223.1 million, up 13% year on year, outperforming analysts’ expectations by 23.9%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

Mercury Systems pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.4% since reporting. It currently trades at $42.69.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AeroVironment (NASDAQ: AVAV)

Focused on the future of autonomous military combat, AeroVironment (NASDAQ: AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

AeroVironment reported revenues of $167.6 million, down 10.2% year on year, falling short of analysts’ expectations by 10.9%. It was a disappointing quarter as it posted full-year revenue and EBITDA guidance missing analysts’ expectations.

AeroVironment delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 15.4% since the results and currently trades at $120.20.

Read our full analysis of AeroVironment’s results here.

KBR (NYSE: KBR)

Known for projects like the construction of Guantanamo Bay, KBR provides professional services and technologies, specializing in engineering, construction, and government services sectors.

KBR reported revenues of $2.12 billion, up 22.7% year on year. This result beat analysts’ expectations by 6.7%. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ backlog estimates.

KBR pulled off the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $49.73.

Read our full, actionable report on KBR here, it’s free.

RTX (NYSE: RTX)

Originally focused on refrigeration technology, Raytheon (NSYE:RTX) provides a a variety of products and services to the aerospace and defense industries.

RTX reported revenues of $21.62 billion, up 8.5% year on year. This print surpassed analysts’ expectations by 5.8%. It was a very strong quarter as it also logged a solid beat of analysts’ organic revenue and EBITDA estimates.

The stock is up 5.2% since reporting and currently trades at $131.57.

Read our full, actionable report on RTX here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.