Looking back on specialty retail stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including GameStop (NYSE: GME) and its peers.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 9 specialty retail stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.5% since the latest earnings results.

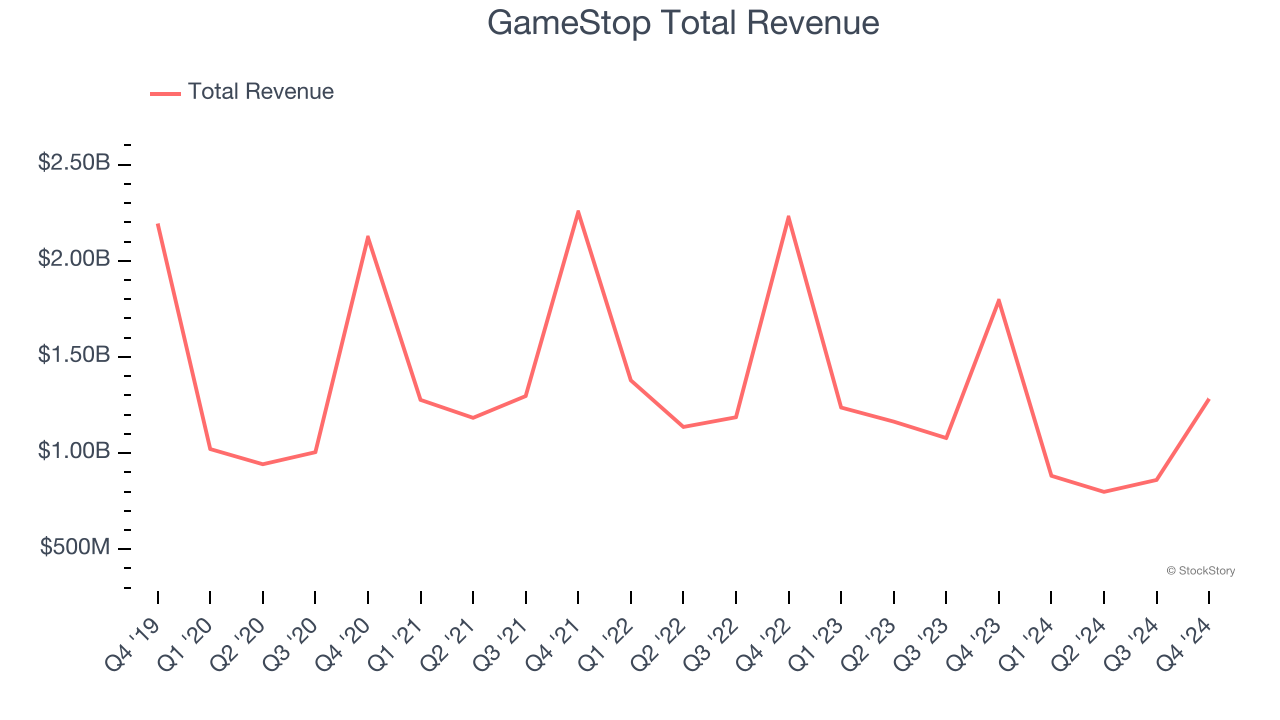

GameStop (NYSE: GME)

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

GameStop reported revenues of $1.28 billion, down 28.5% year on year. This print fell short of analysts’ expectations by 13.2%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ EPS estimates.

GameStop delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $25.37.

Is now the time to buy GameStop? Access our full analysis of the earnings results here, it’s free.

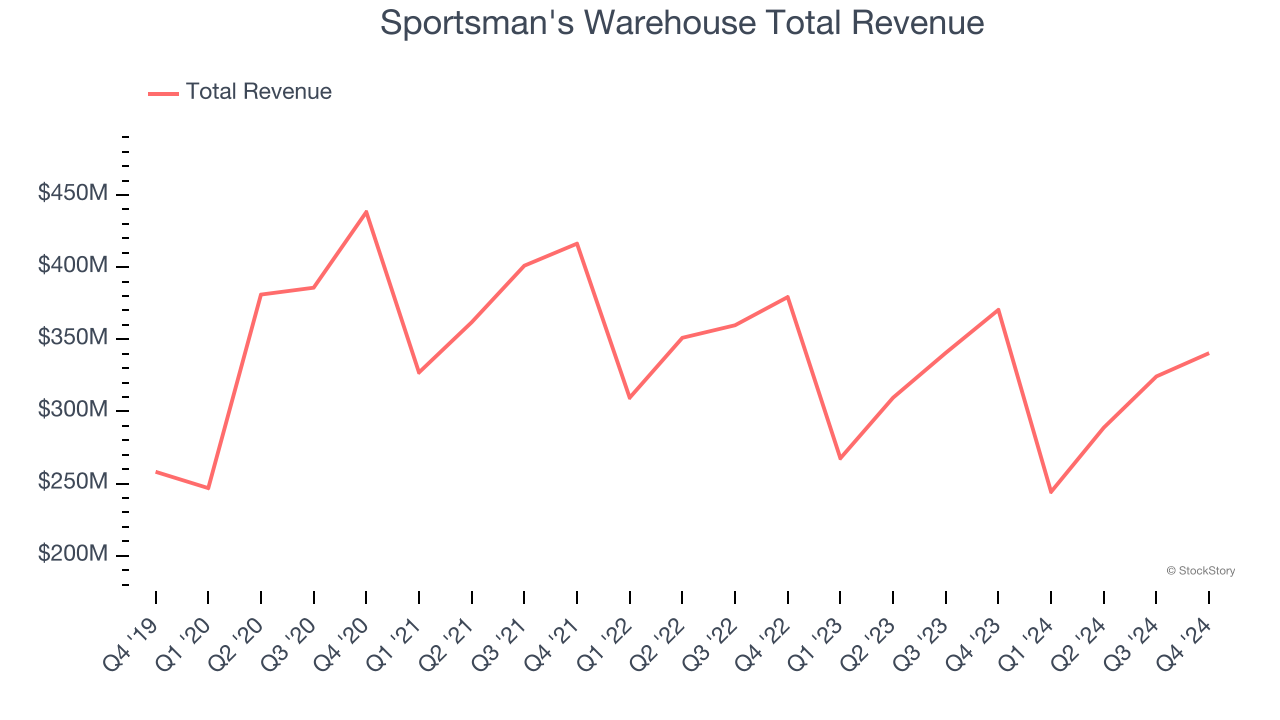

Best Q4: Sportsman's Warehouse (NASDAQ: SPWH)

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ: SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sportsman's Warehouse reported revenues of $340.4 million, down 8.1% year on year, outperforming analysts’ expectations by 3.6%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Sportsman's Warehouse achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 49.2% since reporting. It currently trades at $1.44.

Is now the time to buy Sportsman's Warehouse? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Bath and Body Works (NYSE: BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE: BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $2.79 billion, down 4.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 31.9% since the results and currently trades at $28.

Read our full analysis of Bath and Body Works’s results here.

Best Buy (NYSE: BBY)

With humble beginnings as a stereo equipment seller, Best Buy (NYSE: BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Best Buy reported revenues of $13.95 billion, down 4.8% year on year. This result surpassed analysts’ expectations by 2%. Taking a step back, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations.

The stock is down 31.2% since reporting and currently trades at $59.75.

Read our full, actionable report on Best Buy here, it’s free.

Dick's (NYSE: DKS)

Started as a hunting supply store, Dick’s Sporting Goods (NYSE: DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Dick's reported revenues of $3.89 billion, flat year on year. This number topped analysts’ expectations by 3.2%. More broadly, it was a mixed quarter as it also logged a narrow beat of analysts’ gross margin estimates but full-year EPS guidance missing analysts’ expectations.

The stock is down 10.1% since reporting and currently trades at $190.02.

Read our full, actionable report on Dick's here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.