Looking back on hvac and water systems stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Carrier Global (NYSE: CARR) and its peers.

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 9 hvac and water systems stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.5% since the latest earnings results.

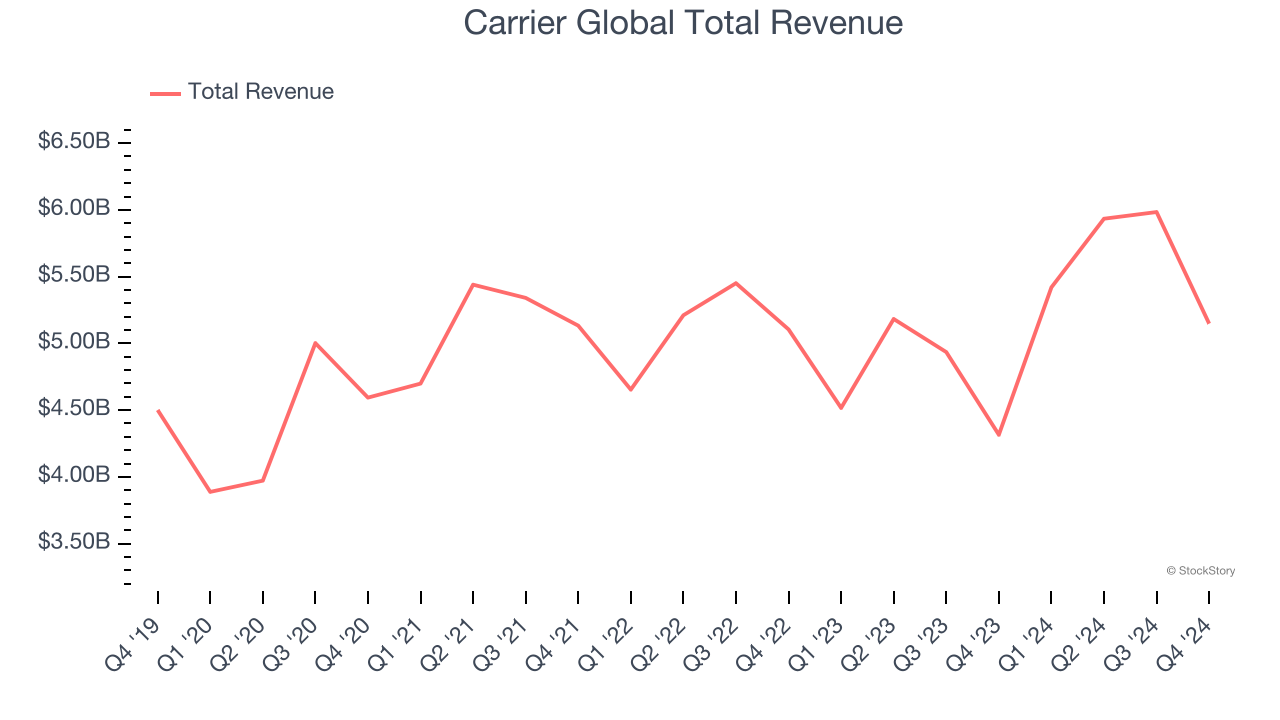

Carrier Global (NYSE: CARR)

Founded by the inventor of air conditioning, Carrier Global (NYSE: CARR) manufactures heating, ventilation, air conditioning, and refrigeration products.

Carrier Global reported revenues of $5.15 billion, up 19.3% year on year. This print fell short of analysts’ expectations by 2.2%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ EPS estimates but full-year revenue guidance slightly missing analysts’ expectations.

"We capped a transformational year for Carrier with robust fourth quarter financial results including 6% organic growth, significant adjusted operating profit margin expansion of 370 basis points and 50% adjusted EPS growth. The quarter also marked the completion of our portfolio transformation, which resulted in total divestiture proceeds of over $10 billion," said Carrier Chairman & CEO David Gitlin.

Carrier Global scored the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 17.6% since reporting and currently trades at $59.02.

Read our full report on Carrier Global here, it’s free.

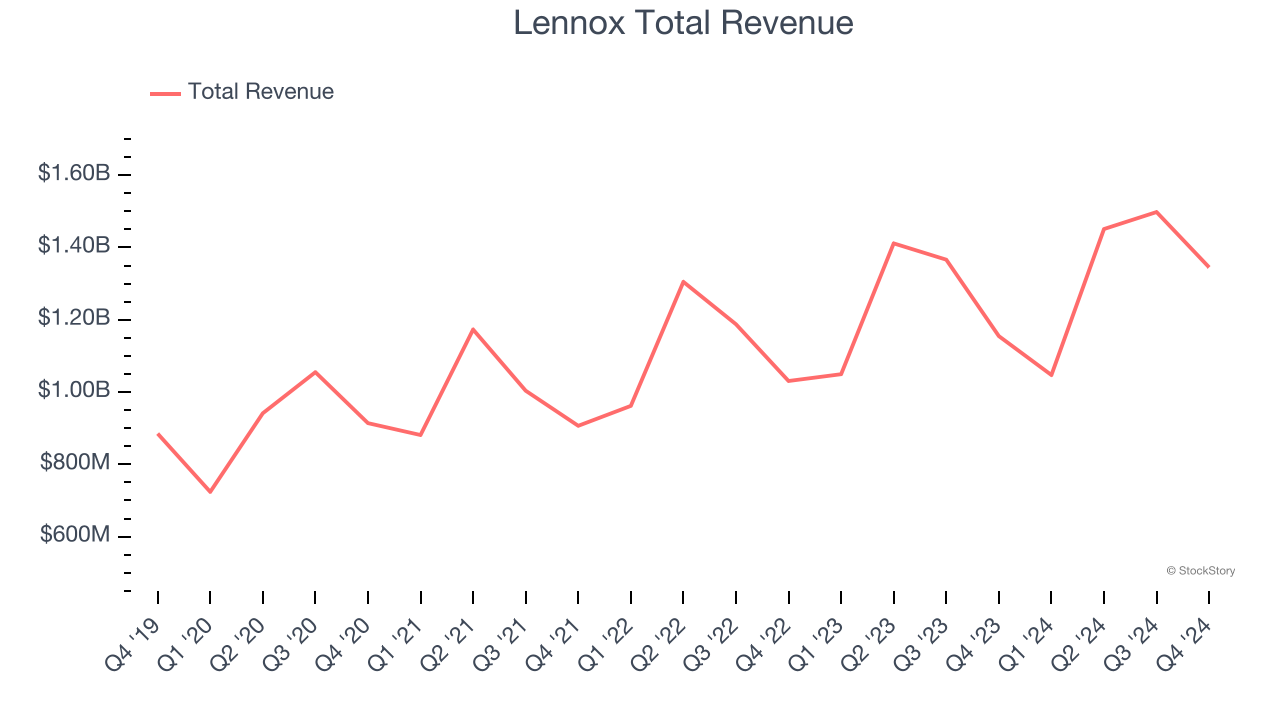

Best Q4: Lennox (NYSE: LII)

Based in Texas and founded over a century ago, Lennox (NYSE: LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

Lennox reported revenues of $1.35 billion, up 16.5% year on year, outperforming analysts’ expectations by 8.9%. The business had an exceptional quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

Lennox delivered the biggest analyst estimates beat among its peers. The stock is down 17.6% since reporting. It currently trades at $545.81.

Is now the time to buy Lennox? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AAON (NASDAQ: AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ: AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $297.7 million, down 2.9% year on year, falling short of analysts’ expectations by 7.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

AAON delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 21.6% since the results and currently trades at $80.

Read our full analysis of AAON’s results here.

Northwest Pipe (NASDAQ: NWPX)

Playing a large role in the Integrated Pipeline (IPL) project in Texas to deliver ~350 million gallons of water per day, Northwest Pipe (NASDAQ: NWPX) is a manufacturer of pipeline systems for water infrastructure.

Northwest Pipe reported revenues of $119.6 million, up 8.6% year on year. This print missed analysts’ expectations by 0.6%. Taking a step back, it was a mixed quarter as it also recorded an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ EPS estimates.

The stock is down 15.9% since reporting and currently trades at $40.38.

Read our full, actionable report on Northwest Pipe here, it’s free.

Zurn Elkay (NYSE: ZWS)

Claiming to have saved more than 30 billion gallons of water, Zurn Elkay (NYSE: ZWS) provides water management solutions to various industries.

Zurn Elkay reported revenues of $370.7 million, up 3.9% year on year. This number beat analysts’ expectations by 0.9%. Zooming out, it was a mixed quarter as it also logged an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ organic revenue estimates.

The stock is down 27.2% since reporting and currently trades at $28.76.

Read our full, actionable report on Zurn Elkay here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.