Let’s dig into the relative performance of Tandem Diabetes (NASDAQ: TNDM) and its peers as we unravel the now-completed Q4 healthcare technology earnings season.

Healthcare Technology

The 9 healthcare technology stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.2% since the latest earnings results.

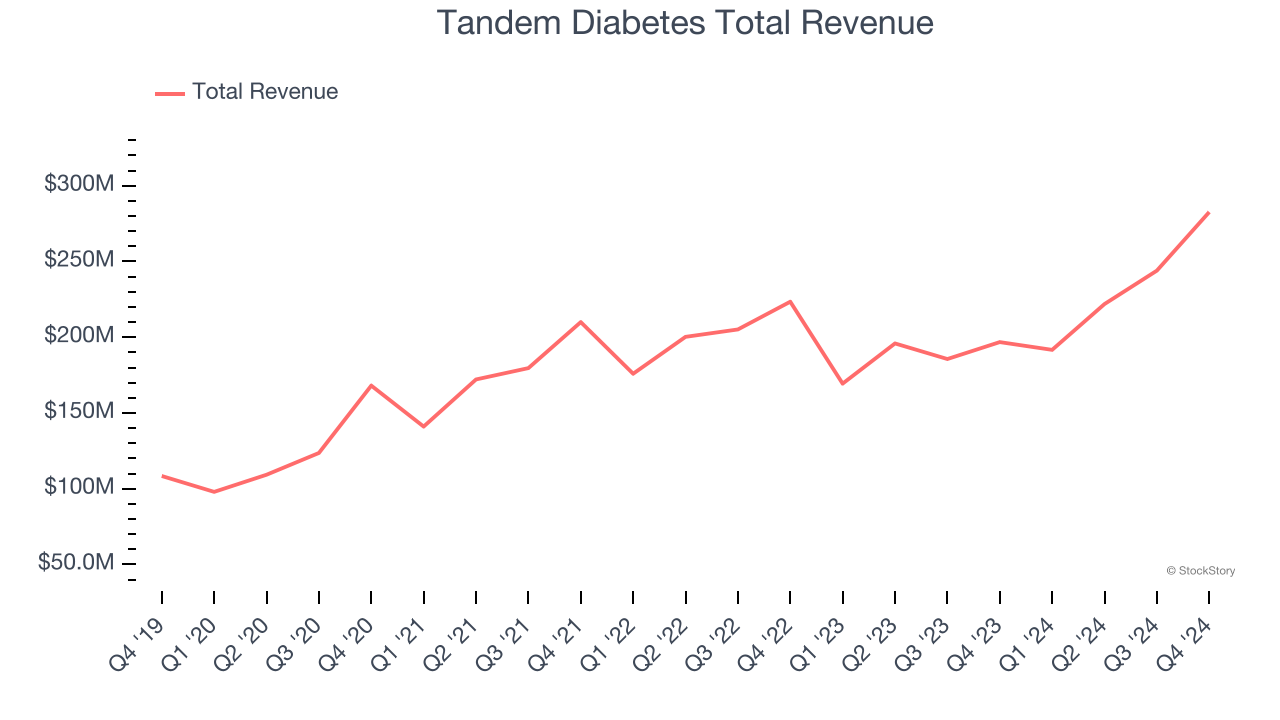

Tandem Diabetes (NASDAQ: TNDM)

With technology that automatically adjusts insulin delivery based on continuous glucose monitoring data, Tandem Diabetes Care (NASDAQ: TNDM) develops and manufactures automated insulin delivery systems that help people with diabetes manage their blood glucose levels.

Tandem Diabetes reported revenues of $282.6 million, up 43.6% year on year. This print exceeded analysts’ expectations by 0.6%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ sales volume estimates.

“2024 was a pivotal year for Tandem, as we returned to strong sales growth both in and outside of the United States, while delivering industry-leading customer satisfaction,” said John Sheridan, president and chief executive officer.

Unsurprisingly, the stock is down 49.5% since reporting and currently trades at $16.97.

Read our full report on Tandem Diabetes here, it’s free.

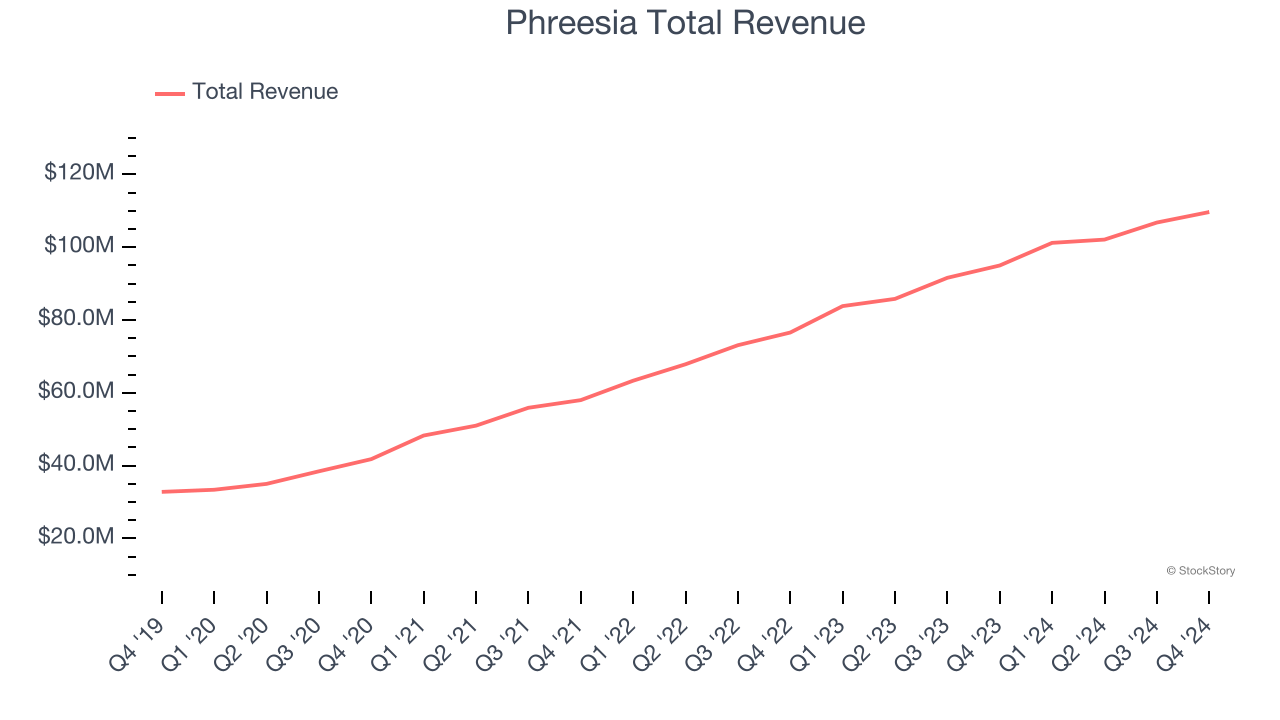

Best Q4: Phreesia (NYSE: PHR)

Founded in 2005 to streamline the traditionally paper-heavy patient check-in process, Phreesia (NYSE: PHR) provides software solutions that automate patient intake, registration, and payment processes for healthcare organizations while improving patient engagement in their care.

Phreesia reported revenues of $109.7 million, up 15.4% year on year, outperforming analysts’ expectations by 0.7%. The business had a strong quarter with a solid beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

The market seems content with the results as the stock is up 1.3% since reporting. It currently trades at $24.19.

Is now the time to buy Phreesia? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Evolent Health (NYSE: EVH)

Founded in 2011 to transform how healthcare is delivered to patients with complex needs, Evolent Health (NYSE: EVH) provides specialty care management services and technology solutions that help health plans and providers deliver better care for patients with complex conditions.

Evolent Health reported revenues of $646.5 million, up 16.3% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Evolent Health delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 7.2% since the results and currently trades at $9.96.

Read our full analysis of Evolent Health’s results here.

Premier (NASDAQ: PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $240.3 million, down 14.2% year on year. This number was in line with analysts’ expectations. However, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

Premier had the slowest revenue growth among its peers. The stock is down 15.2% since reporting and currently trades at $19.01.

Read our full, actionable report on Premier here, it’s free.

Omnicell (NASDAQ: OMCL)

Driven by the vision of an "Autonomous Pharmacy" with zero medication errors, Omnicell (NASDAQ: OMCL) provides medication management automation and adherence tools that help healthcare systems and pharmacies reduce errors and improve efficiency.

Omnicell reported revenues of $306.9 million, up 18.6% year on year. This result beat analysts’ expectations by 2.2%. Taking a step back, it was a slower quarter as it recorded revenue guidance for next quarter missing analysts’ expectations.

The stock is down 29% since reporting and currently trades at $31.52.

Read our full, actionable report on Omnicell here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.