The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how NV5 Global (NASDAQ: NVEE) and the rest of the government & technical consulting stocks fared in Q1.

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

The 7 government & technical consulting stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 0.7%.

In light of this news, share prices of the companies have held steady as they are up 2.6% on average since the latest earnings results.

NV5 Global (NASDAQ: NVEE)

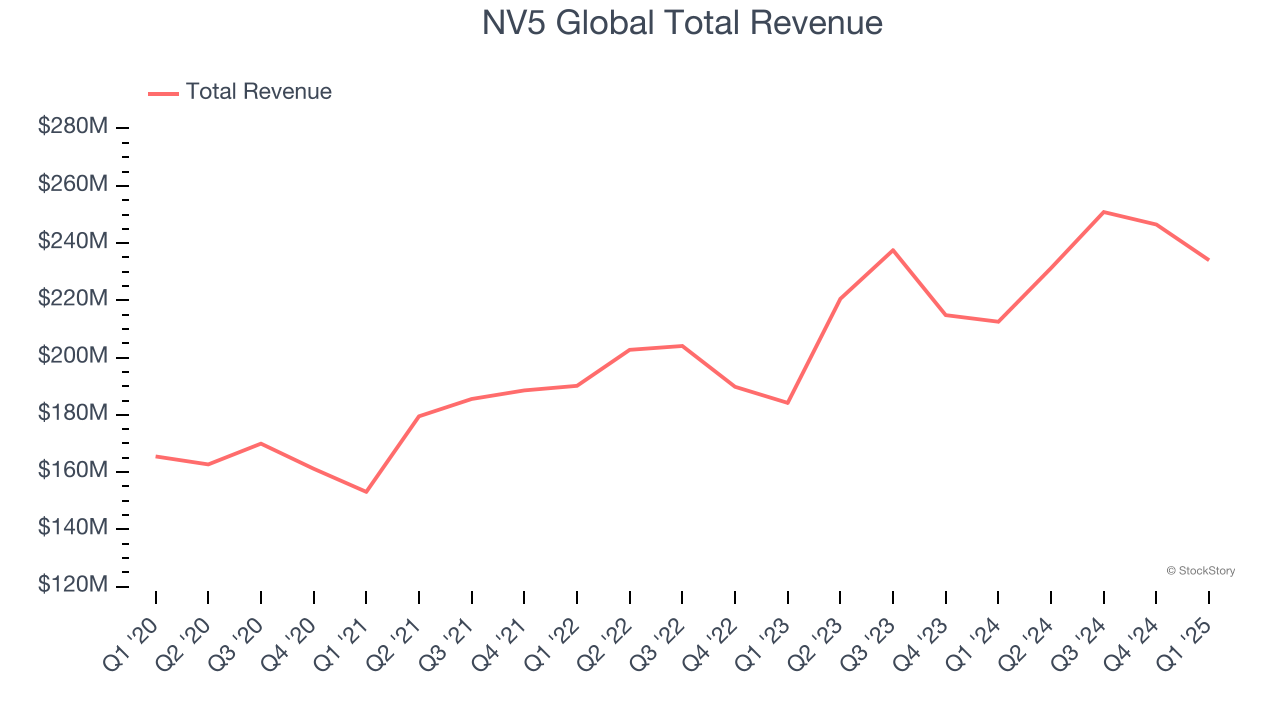

Operating from over 100 locations across the U.S. and internationally, NV5 Global (NASDAQ: NVEE) provides engineering, environmental, geospatial, and technical consulting services to public and private sector clients for infrastructure and building projects.

NV5 Global reported revenues of $234 million, up 10.1% year on year. This print exceeded analysts’ expectations by 2.4%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ full-year EPS guidance estimates but a significant miss of analysts’ EPS estimates.

The three acquisitions that we completed in the first quarter had minimal impact on our financial results for the quarter, but they position us for expansion in key geographies and accelerated organic growth. As a result of our strong first quarter performance, backlog, and pipeline of opportunities, we are reaffirming full-year 2025 guidance for revenue and earnings per share," said Ben Heraud, CEO of NV5.

NV5 Global achieved the fastest revenue growth and highest full-year guidance raise of the whole group. The stock is up 21.1% since reporting and currently trades at $22.28.

Read our full report on NV5 Global here, it’s free.

Best Q1: Maximus (NYSE: MMS)

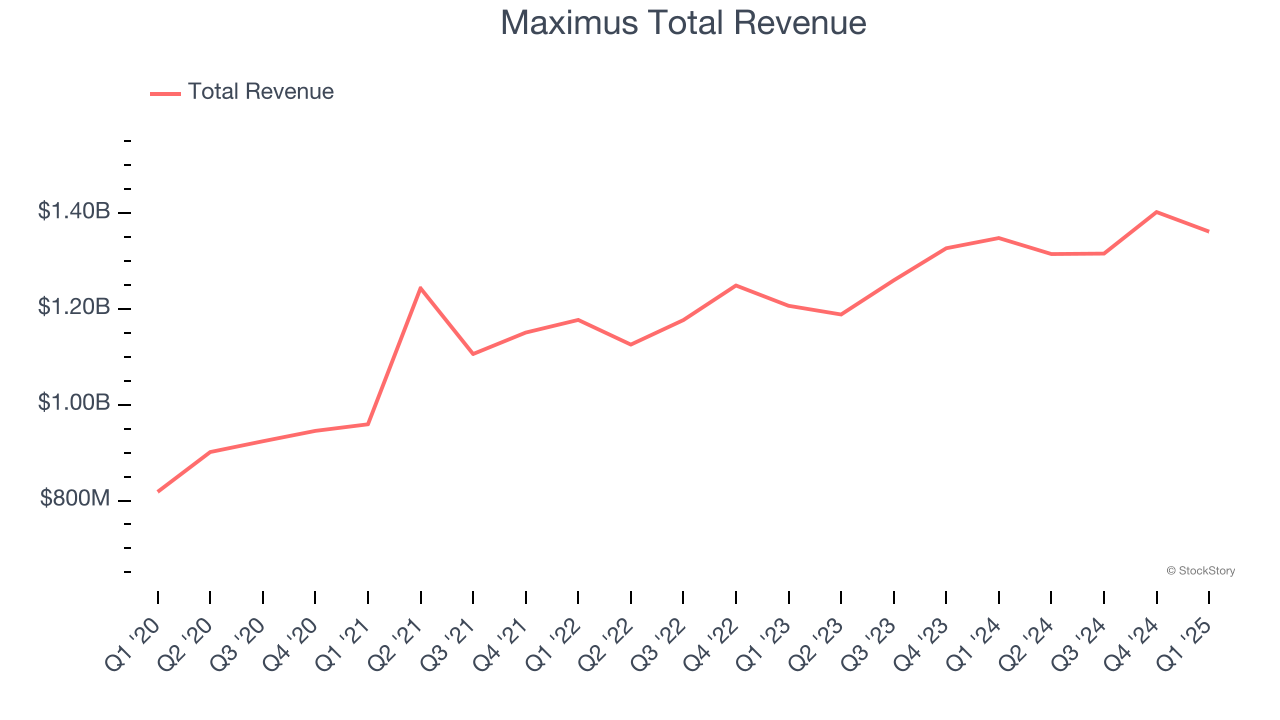

With nearly 50 years of experience translating public policy into operational programs that serve millions of citizens, Maximus (NYSE: MMS) provides operational services, clinical assessments, and technology solutions to government agencies in the U.S. and internationally.

Maximus reported revenues of $1.36 billion, flat year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

Maximus pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7.3% since reporting. It currently trades at $72.10.

Is now the time to buy Maximus? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Booz Allen Hamilton (NYSE: BAH)

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE: BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

Booz Allen Hamilton reported revenues of $2.97 billion, up 7.3% year on year, falling short of analysts’ expectations by 1.8%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Booz Allen Hamilton delivered the weakest full-year guidance update in the group. As expected, the stock is down 18.1% since the results and currently trades at $105.72.

Read our full analysis of Booz Allen Hamilton’s results here.

Amentum (NYSE: AMTM)

With operations spanning approximately 80 countries and a workforce of specialized engineers and technical experts, Amentum Holdings (NYSE: AMTM) provides advanced engineering and technology solutions to U.S. government agencies, allied governments, and commercial enterprises across defense, energy, and space sectors.

Amentum reported revenues of $3.49 billion, flat year on year. This number topped analysts’ expectations by 2%. However, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and full-year revenue guidance meeting analysts’ expectations.

The stock is down 7.9% since reporting and currently trades at $20.38.

Read our full, actionable report on Amentum here, it’s free.

Jacobs Solutions (NYSE: J)

With a workforce of approximately 45,000 professionals tackling complex challenges from water scarcity to cybersecurity, Jacobs Solutions (NYSE: J) provides engineering, consulting, and technical services focused on infrastructure, sustainability, and advanced technology solutions.

Jacobs Solutions reported revenues of $2.91 billion, up 2.2% year on year. This print missed analysts’ expectations by 3.5%. All in all, it was a slower quarter for the company.

Jacobs Solutions had the weakest performance against analyst estimates among its peers. The stock is down 3.7% since reporting and currently trades at $122.03.

Read our full, actionable report on Jacobs Solutions here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.