As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at data storage stocks, starting with MongoDB (NASDAQ: MDB).

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

The 5 data storage stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.7% on average since the latest earnings results.

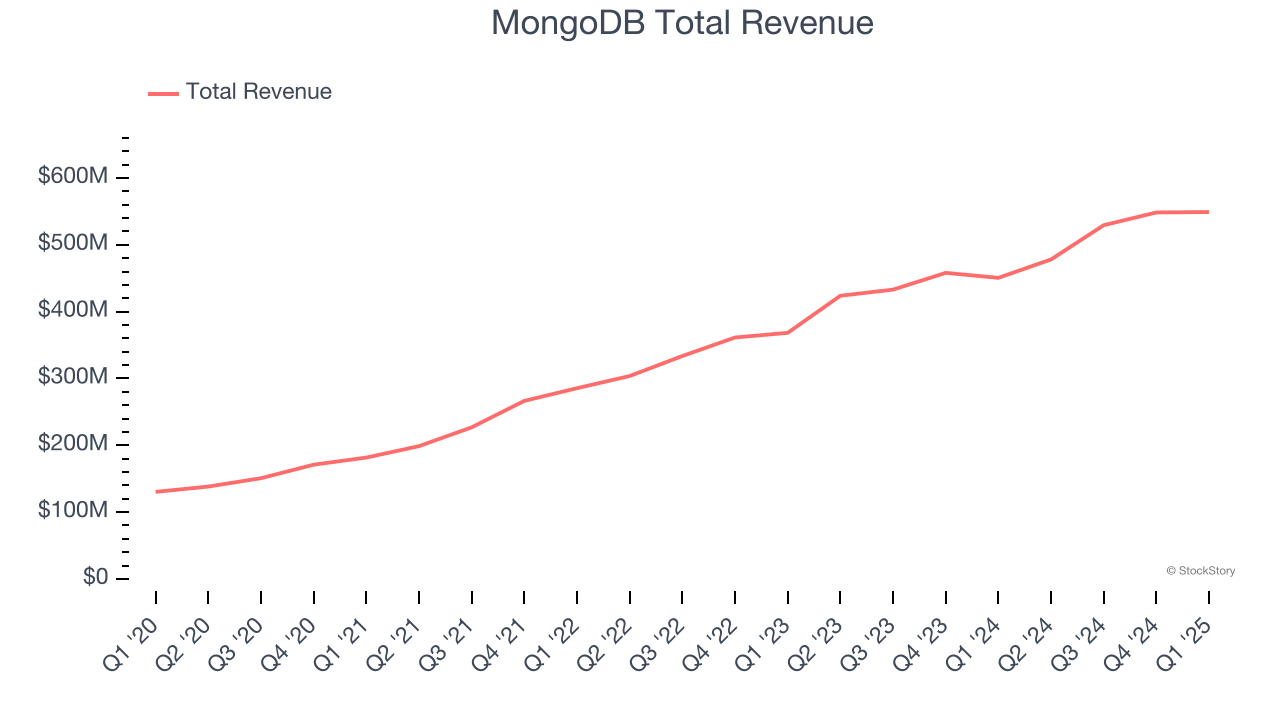

MongoDB (NASDAQ: MDB)

Started in 2007 by the team behind Google’s ad platform, DoubleClick, MongoDB offers database-as-a-service that helps companies store large volumes of semi-structured data.

MongoDB reported revenues of $549 million, up 21.9% year on year. This print exceeded analysts’ expectations by 4.1%. Overall, it was a very strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $201.11.

Is now the time to buy MongoDB? Access our full analysis of the earnings results here, it’s free.

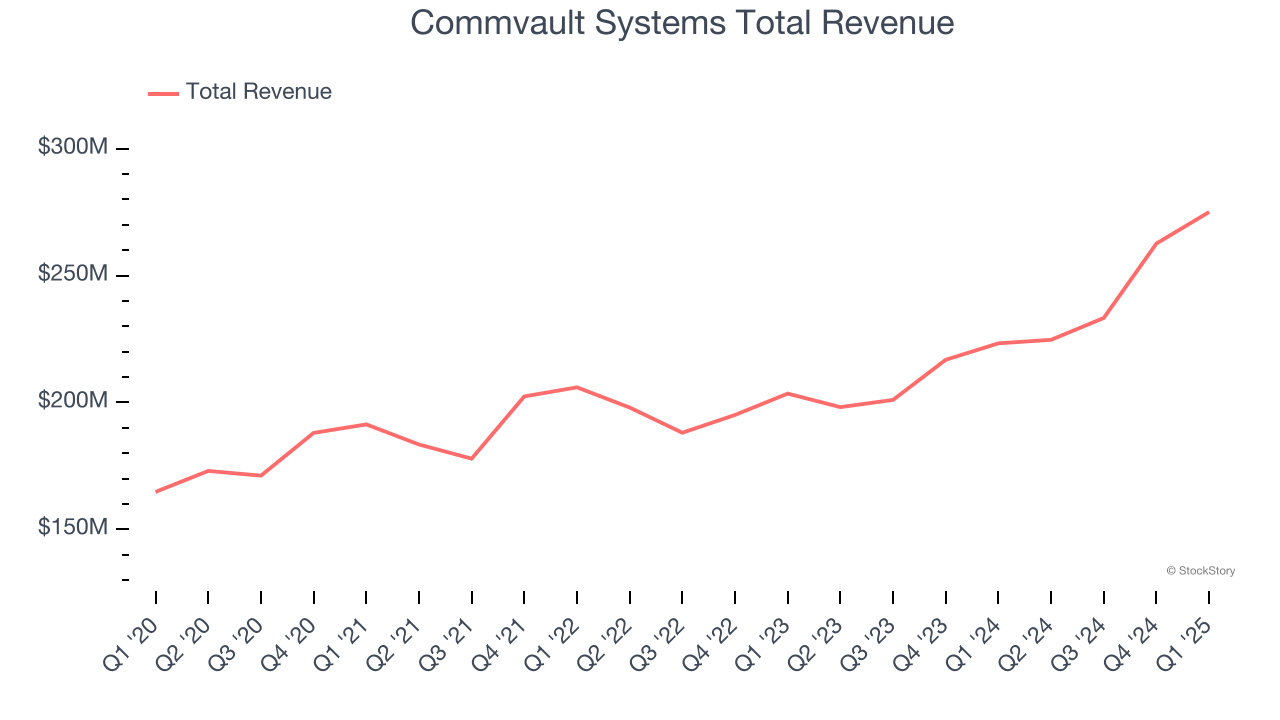

Best Q1: Commvault Systems (NASDAQ: CVLT)

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Commvault Systems reported revenues of $275 million, up 23.2% year on year, outperforming analysts’ expectations by 4.8%. The business had a very strong quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Commvault Systems achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 2.9% since reporting. It currently trades at $170.45.

Is now the time to buy Commvault Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: DigitalOcean (NYSE: DOCN)

Started by brothers Ben and Moisey Uretsky, DigitalOcean (NYSE: DOCN) provides a simple, low-cost platform that allows developers and small and medium-sized businesses to host applications and data in the cloud.

DigitalOcean reported revenues of $210.7 million, up 14.1% year on year, exceeding analysts’ expectations by 1%. Still, it was a mixed quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

DigitalOcean delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 16% since the results and currently trades at $27.52.

Read our full analysis of DigitalOcean’s results here.

Couchbase (NASDAQ: BASE)

Formed in 2011 with the merger of Membase and CouchOne, Couchbase (NASDAQ: BASE) is a database-as-a-service platform that allows enterprises to store large volumes of semi-structured data.

Couchbase reported revenues of $56.52 million, up 10.1% year on year. This result beat analysts’ expectations by 1.7%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

Couchbase had the slowest revenue growth among its peers. The stock is up 33% since reporting and currently trades at $24.69.

Read our full, actionable report on Couchbase here, it’s free.

Snowflake (NYSE: SNOW)

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE: SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Snowflake reported revenues of $1.04 billion, up 25.7% year on year. This number topped analysts’ expectations by 3.4%. Taking a step back, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

Snowflake delivered the fastest revenue growth among its peers. The company added 26 enterprise customers paying more than $1 million annually to reach a total of 606. The stock is up 18.2% since reporting and currently trades at $211.72.

Read our full, actionable report on Snowflake here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.