What a brutal six months it’s been for Chart. The stock has dropped 21.4% and now trades at $171.63, rattling many shareholders. This might have investors contemplating their next move.

Given the weaker price action, is now a good time to buy GTLS? Find out in our full research report, it’s free.

Why Is Chart a Good Business?

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE: GTLS) provides equipment to store and transport gasses.

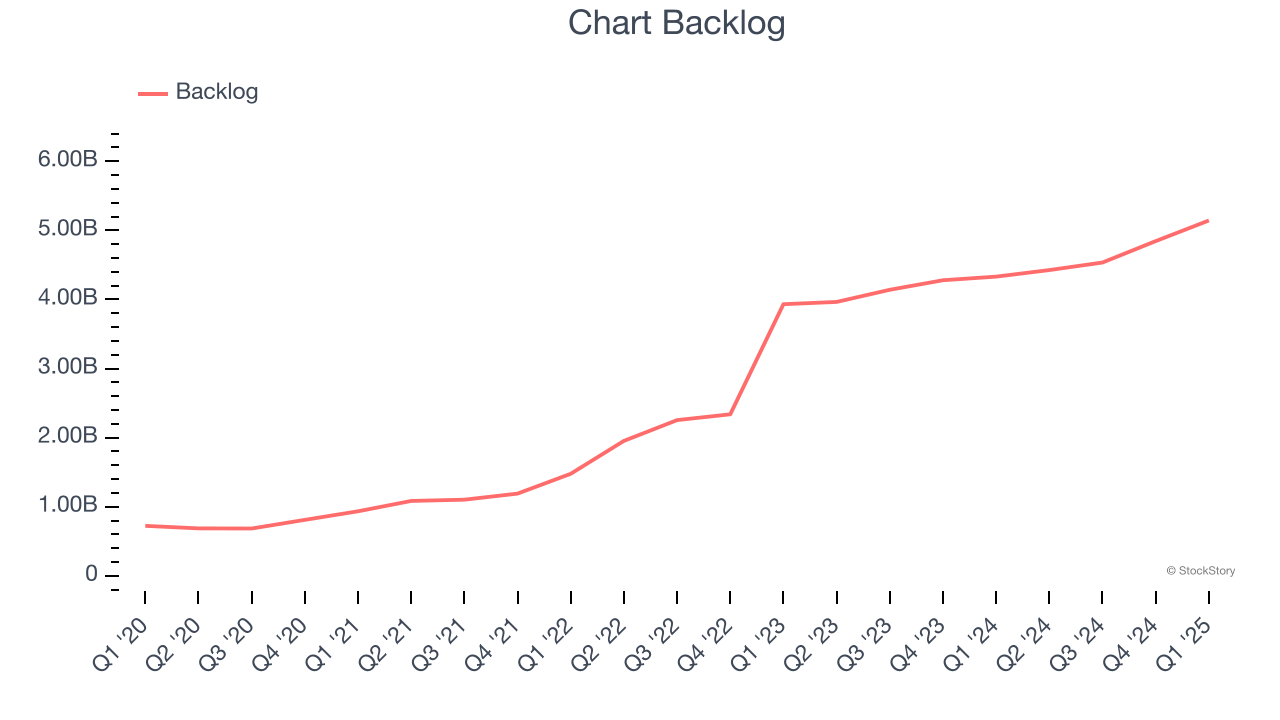

1. Surging Backlog Locks In Future Sales

We can better understand Gas and Liquid Handling companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Chart’s future revenue streams.

Chart’s backlog punched in at $5.14 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 41.6%. This performance was fantastic and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Chart for the long term, enhancing the business’s predictability.

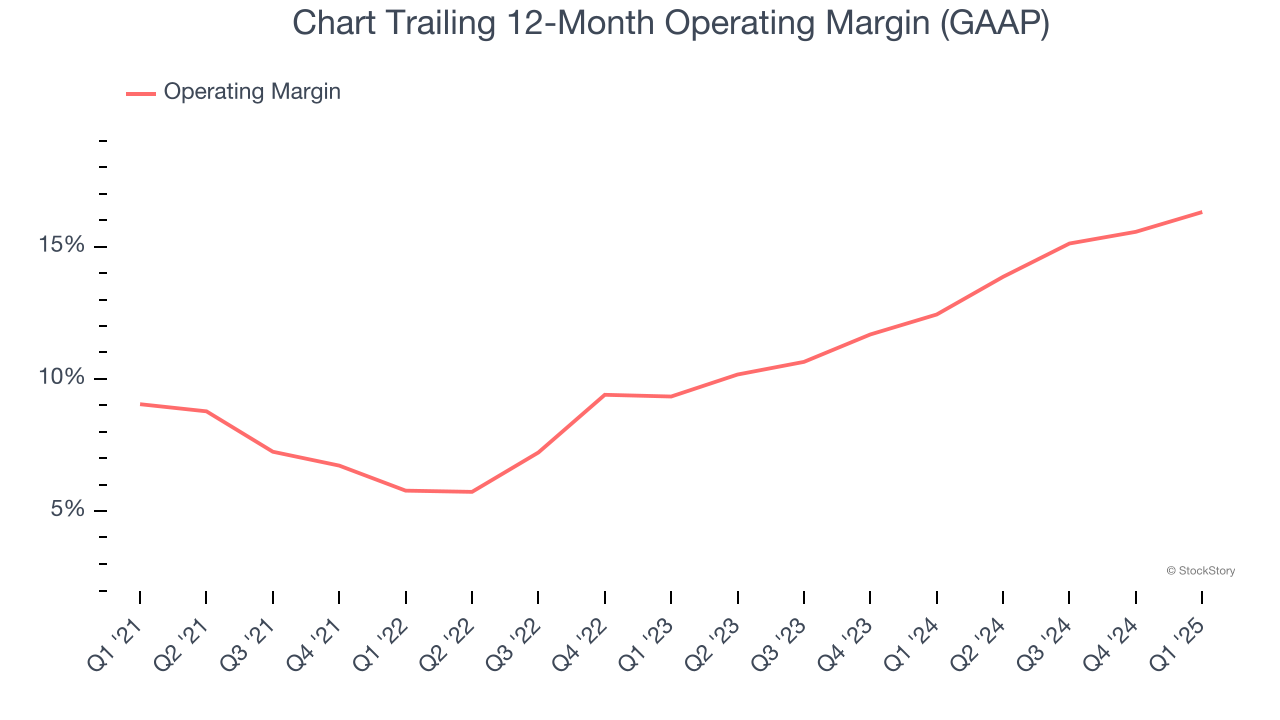

2. Operating Margin Rising, Profits Up

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Chart’s operating margin rose by 7.3 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 16.3%.

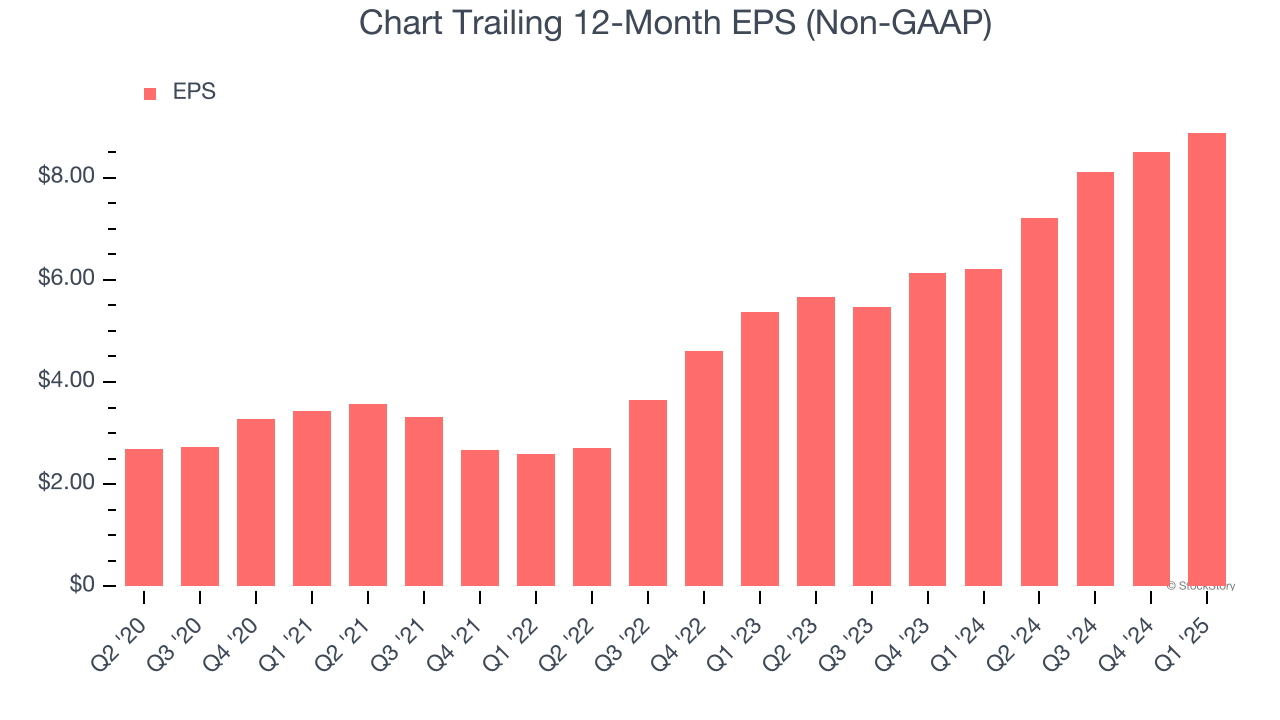

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Chart’s astounding 26.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Final Judgment

These are just a few reasons why we think Chart is a high-quality business. After the recent drawdown, the stock trades at 13.2× forward P/E (or $171.63 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.