Life sciences company Bio-Techne (NASDAQ: TECH) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 3.5% year on year to $317 million. Its non-GAAP profit of $0.53 per share was 6.1% above analysts’ consensus estimates.

Is now the time to buy Bio-Techne? Find out by accessing our full research report, it’s free.

Bio-Techne (TECH) Q2 CY2025 Highlights:

- Revenue: $317 million vs analyst estimates of $314.7 million (3.5% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.53 vs analyst estimates of $0.50 (6.1% beat)

- Adjusted EBITDA: $115.6 million vs analyst estimates of $110.2 million (36.5% margin, 4.9% beat)

- Operating Margin: -7.5%, down from 15% in the same quarter last year

- Free Cash Flow Margin: 29.4%, up from 18.8% in the same quarter last year

- Organic Revenue rose 3% year on year (0.7% in the same quarter last year)

- Market Capitalization: $8.57 billion

"Bio-Techne delivered a solid fourth quarter that was in-line with our expectations, despite ongoing market uncertainty," said Kim Kelderman, President and Chief Executive Officer of Bio-Techne.

Company Overview

With a catalog of hundreds of thousands of specialized biological products used in laboratories worldwide, Bio-Techne (NASDAQ: TECH) develops and manufactures specialized reagents, instruments, and services that help researchers study biological processes and enable diagnostic testing and cell therapy development.

Revenue Growth

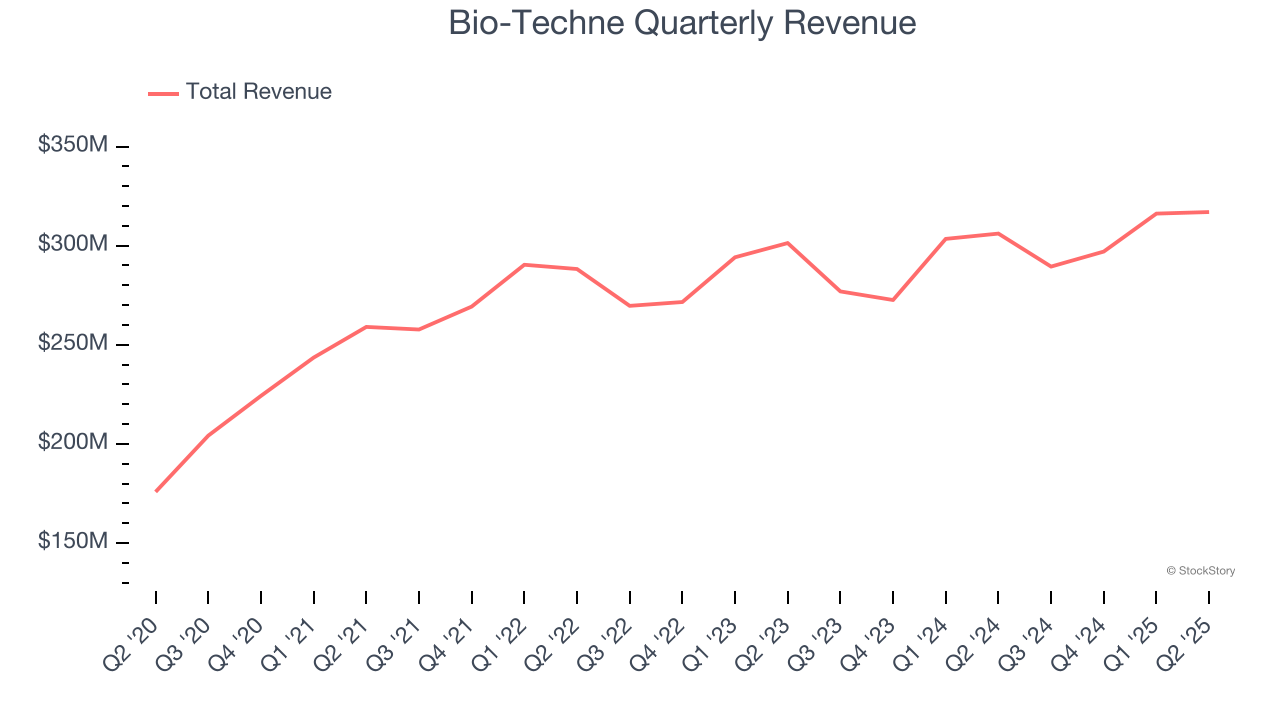

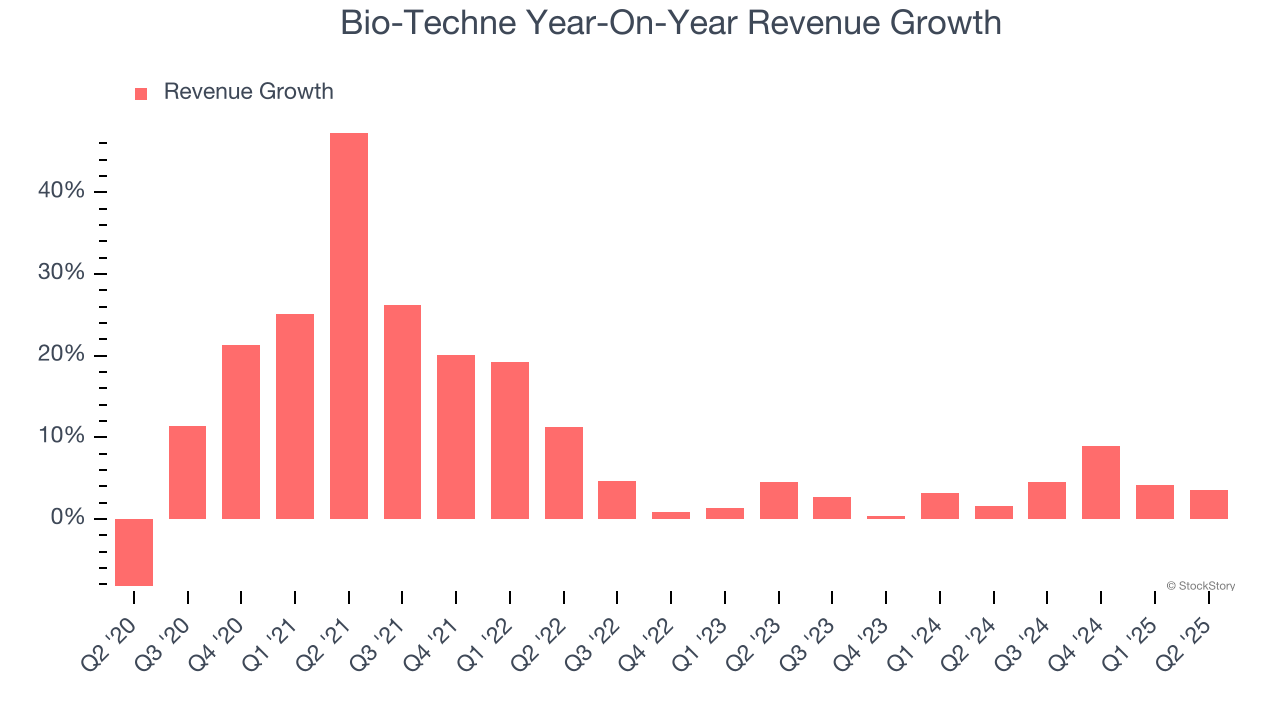

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Bio-Techne’s 10.5% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Bio-Techne’s recent performance shows its demand has slowed as its annualized revenue growth of 3.6% over the last two years was below its five-year trend.

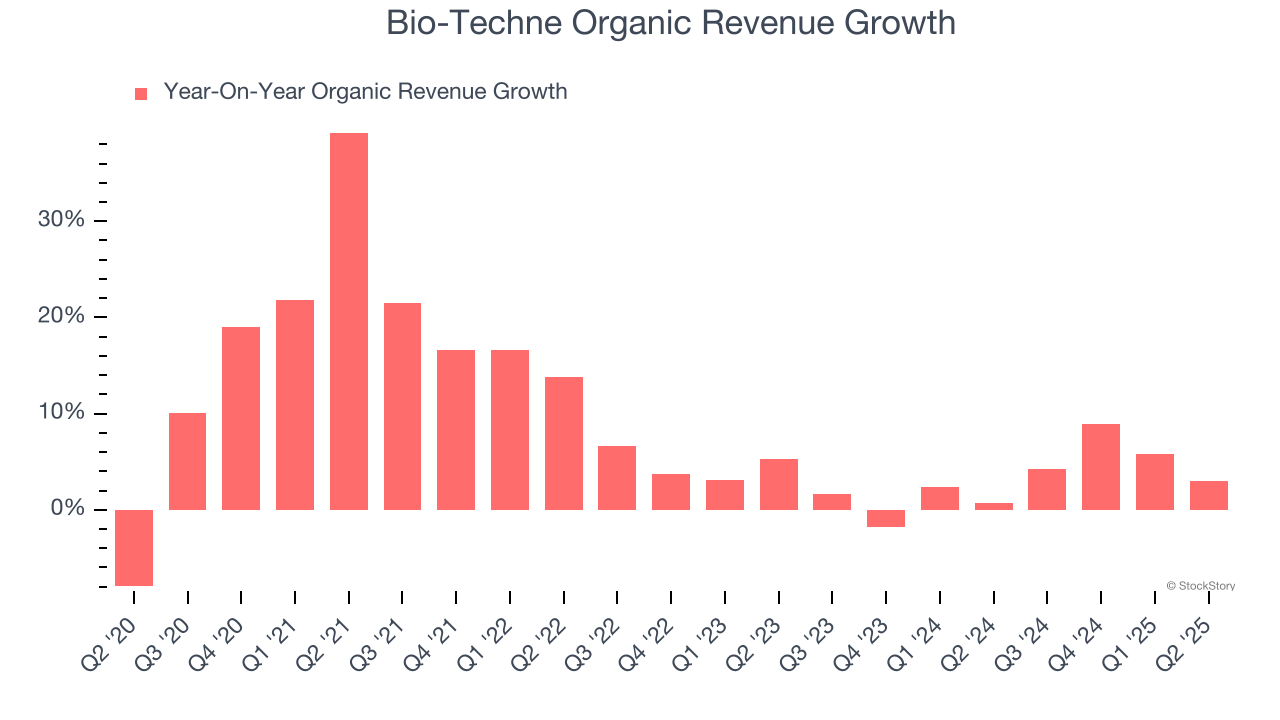

Bio-Techne also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Bio-Techne’s organic revenue averaged 3.1% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Bio-Techne reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

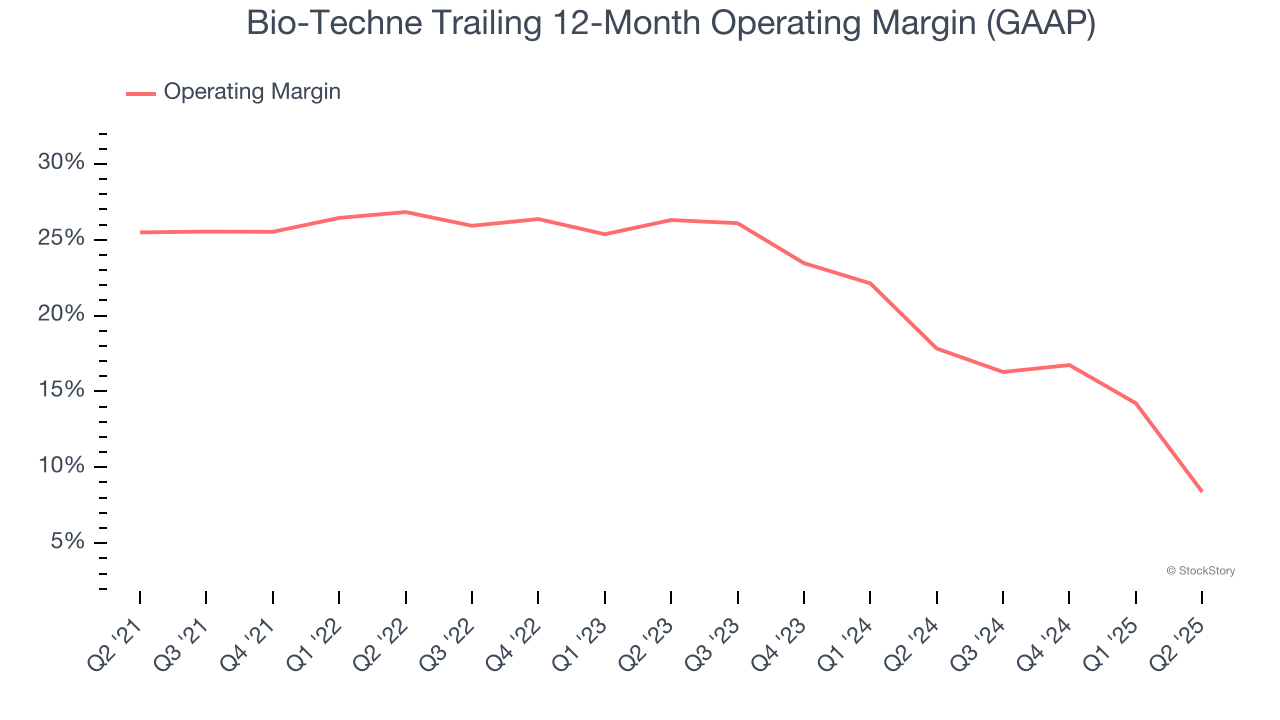

Bio-Techne has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 20.6%.

Analyzing the trend in its profitability, Bio-Techne’s operating margin decreased by 17.1 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 17.9 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Bio-Techne generated an operating margin profit margin of negative 7.5%, down 22.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

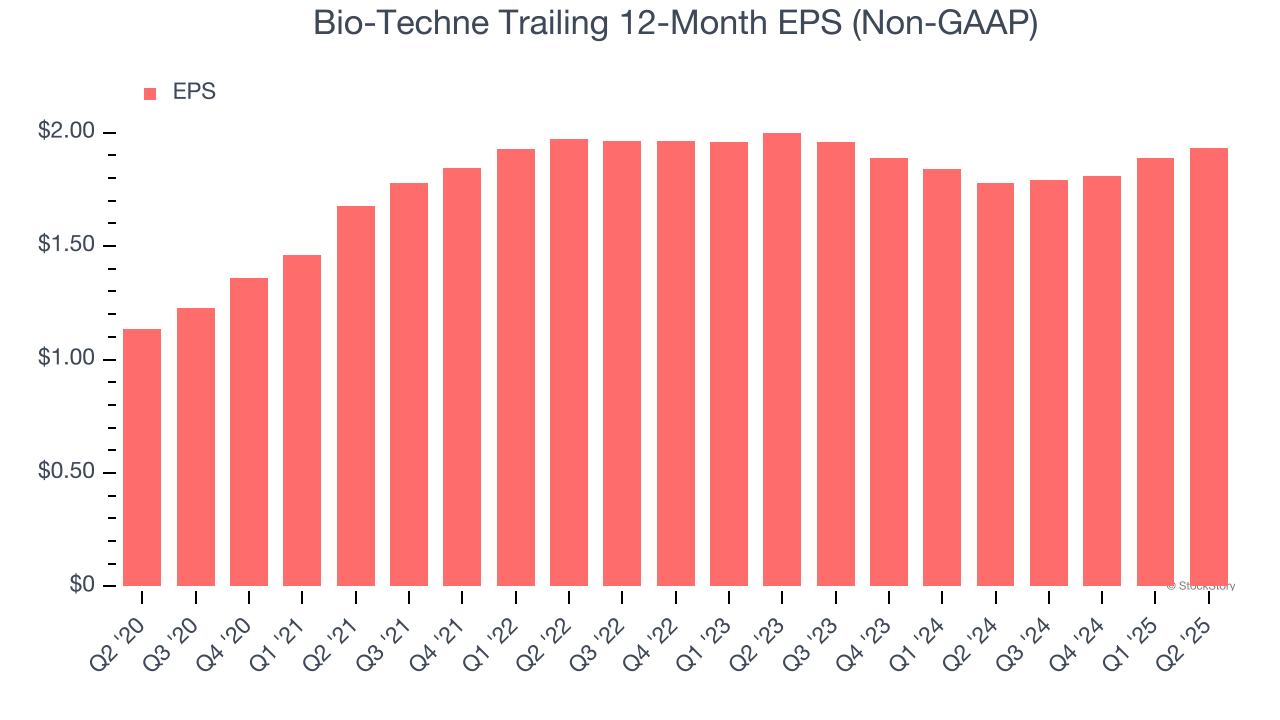

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Bio-Techne’s remarkable 11.2% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Bio-Techne reported adjusted EPS at $0.53, up from $0.49 in the same quarter last year. This print beat analysts’ estimates by 6.1%. Over the next 12 months, Wall Street expects Bio-Techne’s full-year EPS of $1.93 to grow 7.1%.

Key Takeaways from Bio-Techne’s Q2 Results

It was good to see Bio-Techne narrowly top analysts’ organic revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 2.2% to $53.40 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.