Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Atkore (NYSE: ATKR) and its peers.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 13 electrical systems stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was 2.4% below.

Thankfully, share prices of the companies have been resilient as they are up 6.2% on average since the latest earnings results.

Atkore (NYSE: ATKR)

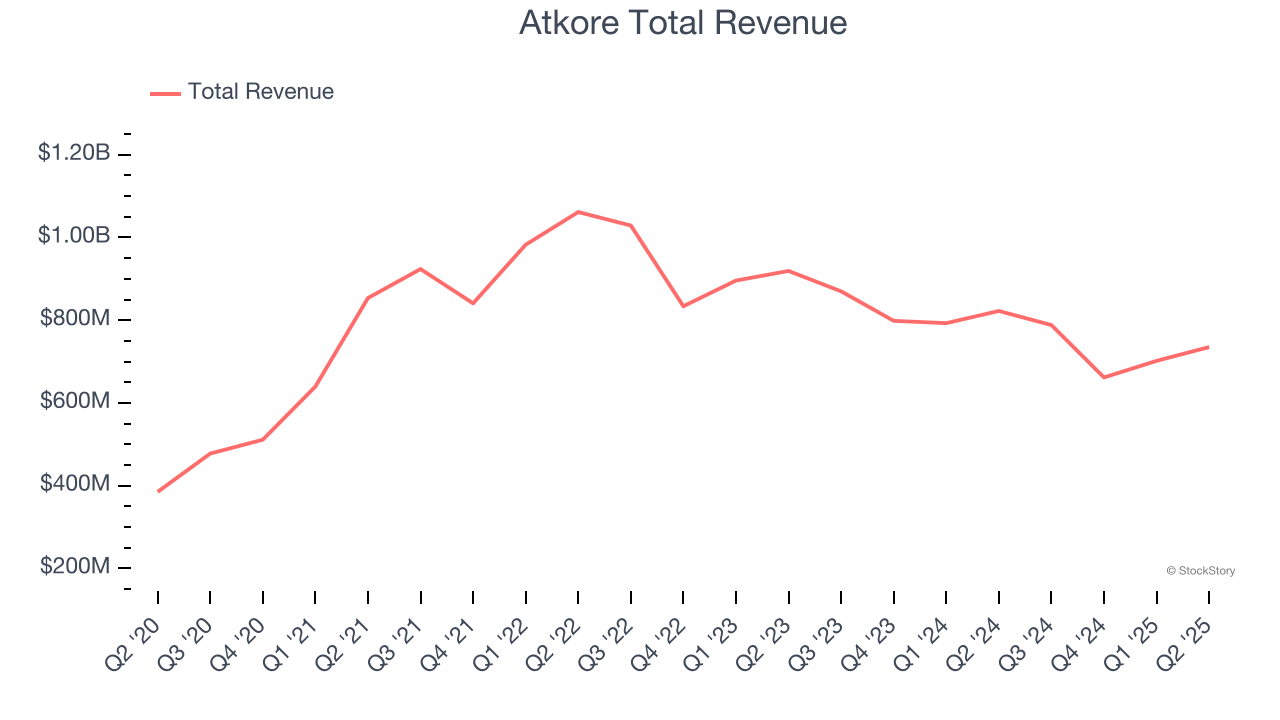

Protecting the things that power our world, Atkore (NYSE: ATKR) designs and manufactures electrical safety products.

Atkore reported revenues of $735 million, down 10.6% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates and full-year EBITDA guidance slightly missing analysts’ expectations.

“Atkore delivered another strong quarter of financial results, achieving Net Sales, Adjusted EBITDA and Adjusted EPS towards the top end of the ranges we presented during our last earnings call in May,” commented Bill Waltz, Atkore’s President and Chief Executive Officer.

Unsurprisingly, the stock is down 23.6% since reporting and currently trades at $58.50.

Read our full report on Atkore here, it’s free.

Best Q2: LSI (NASDAQ: LYTS)

Enhancing commercial environments, LSI (NASDAQ: LYTS) provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $155.1 million, up 20.2% year on year, outperforming analysts’ expectations by 11.6%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 17.8% since reporting. It currently trades at $22.74.

Is now the time to buy LSI? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Whirlpool (NYSE: WHR)

Credited with introducing the first automatic washing machine, Whirlpool (NYSE: WHR) is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $3.77 billion, down 5.4% year on year, falling short of analysts’ expectations by 3%. It was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 3.5% since the results and currently trades at $94.43.

Read our full analysis of Whirlpool’s results here.

Sanmina (NASDAQ: SANM)

Founded in 1980, Sanmina (NASDAQ: SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

Sanmina reported revenues of $2.04 billion, up 10.9% year on year. This result beat analysts’ expectations by 3.1%. Aside from that, it was a mixed quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EBITDA estimates.

The stock is up 19% since reporting and currently trades at $117.01.

Read our full, actionable report on Sanmina here, it’s free.

Verra Mobility (NASDAQ: VRRM)

Aiming to wrap technology and data around a historically manual and paper-based industry, Verra Mobility (NYSE: VRRM) is a leading provider of smart mobility technology to address tolls and violations, title and registration services, as well as safety and traffic enforcement.

Verra Mobility reported revenues of $236 million, up 6.1% year on year. This number surpassed analysts’ expectations by 1.3%. Zooming out, it was a mixed quarter as it also logged a decent beat of analysts’ EBITDA estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 2% since reporting and currently trades at $24.42.

Read our full, actionable report on Verra Mobility here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.