AeroVironment (AVAV) has been riding on the narrative that it’s likely to be the next Palantir (PLTR). And a strong rally of 60% for the year is backed by positive fundamental developments.

Year-to-date (YTD) returns would have been healthier considering the fact that AVAV stock touched highs of $417 in October 2025. There has, however, been a sharp correction of 40% from the highs. Stretched valuation coupled with an earnings miss for Q2 2026 has triggered the correction.

Having said that, the developments continue to be positive in terms of order intake. It’s likely that the robust growth trajectory will sustain, and the temporary blip seems to be a good accumulation opportunity.

About AeroVironment Stock

AeroVironment identifies itself as a defense technology company with capabilities across air, land, sea, space, and cyber. The company’s business segments include uncrewed aircraft systems, CUAS & precision strikes, space & directed energy, and cyber & mission systems.

For FY 2026, AeroVironment is likely to clock $2 billion in revenue. With sustained tailwinds for the aerospace & defense sector, the growth outlook is robust.

The price action in AVAV stock has therefore been positive, with an upside of 28% in the last six months, even after the recent correction from all-time highs.

Strong Order Backlog

As of November 2025, AeroVironment reported a funded order backlog of $1.1 billion. Further, for the same period, the unfunded order backlog was $3.0 billion. This provides clear revenue and growth visibility.

It’s also worth noting that on Dec. 8, AeroVironment received orders worth $874 million from the U.S. Army Contracting Command. The contract relates to unmanned aerial systems and counter-UAS systems.

The key point is that the order intake has been robust, and with innovation in the forefront, it’s likely that the backlog will continue to swell.

The order intake is also likely to be supported by the broadening of the product portfolio. As an example, AeroVironment acquired BlueHalo earlier this year. This provides the company with an opportunity to explore opportunities in the space-based communication segment.

Robust Growth to Sustain

For Q2 2026, AeroVironment reported robust revenue growth of 151% on a year-on-year (YoY) basis to $472.5 million. Considering the order backlog, AeroVironment has guided for FY 2026 revenue of $1.95 to $2 billion. For the same period, the company expects adjusted EBITDA (mid-range) of $310 million.

On the flip side, AeroVironment reported an operating loss of $30 million for Q2 2026 as compared to an operating profit of $7 million in Q2 2025. However, the losses were primarily due to an increase in SG&A expense (intangible amortization expense and incremental headcount from the acquisition of BlueHalo). Margin expansion is therefore likely in the coming years, coupled with cash flow upside.

An important point to note from a growth perspective is that AeroVironment reported research and development expenses of $69.1 million for the first six months of FY 2026. R&D expense is at 7.5% of the total revenue. With significant investment focused on driving innovation, the healthy growth outlook is reaffirmed.

What Analysts Say About AVAV Stock

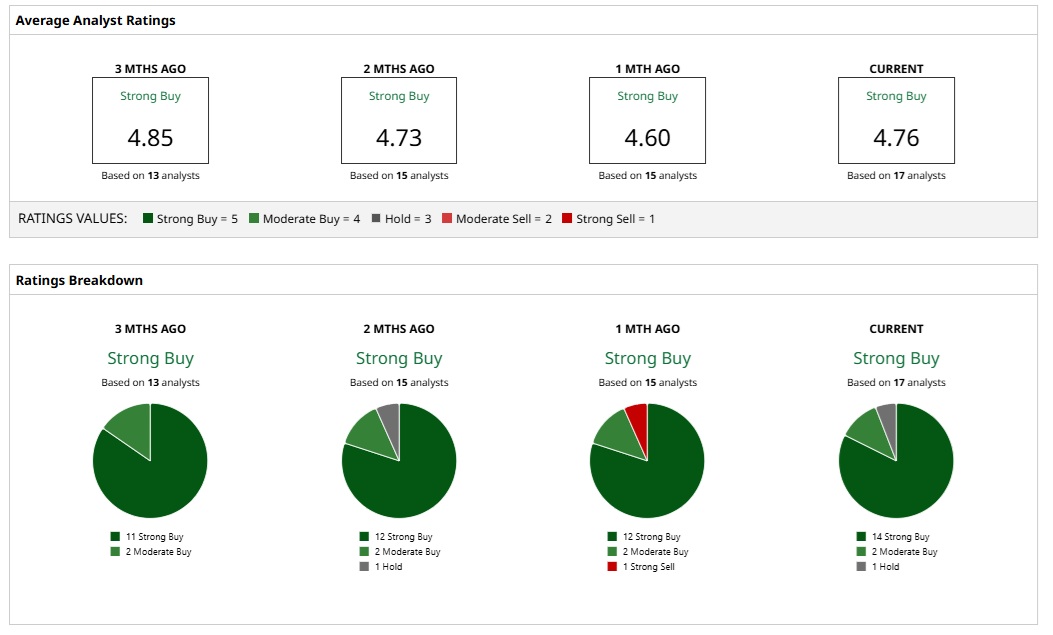

Based on the rating of 17 analysts, AVAV stock is a consensus “Strong Buy.”

While 14 analysts have assigned a “Strong Buy” rating, two and one analysts have a “Moderate Buy” and “Hold” rating, respectively.

Based on these ratings, the analysts have a mean price target of $392.60. This would imply an upside potential of 61.7%. Further, considering the most bullish price target of $486, the upside potential is 98%.

Last month, Piper Sandler assigned an “Overweight” rating for AVAV stock. The key factor for this rating was the evolution of AeroVironment from a drone-technology company to a diversified defense platform that sets the stage for “multi-year, outsized growth.”

An important point to note is that a forward price-earnings ratio of 78 might seem stretched. However, considering the order backlog and growth visibility, AVAV looks attractive after the earnings miss triggered correction.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart