Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at NetApp (NASDAQ: NTAP) and the best and worst performers in the hardware & infrastructure industry.

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

The 9 hardware & infrastructure stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was 2.1% above.

Thankfully, share prices of the companies have been resilient as they are up 9.8% on average since the latest earnings results.

NetApp (NASDAQ: NTAP)

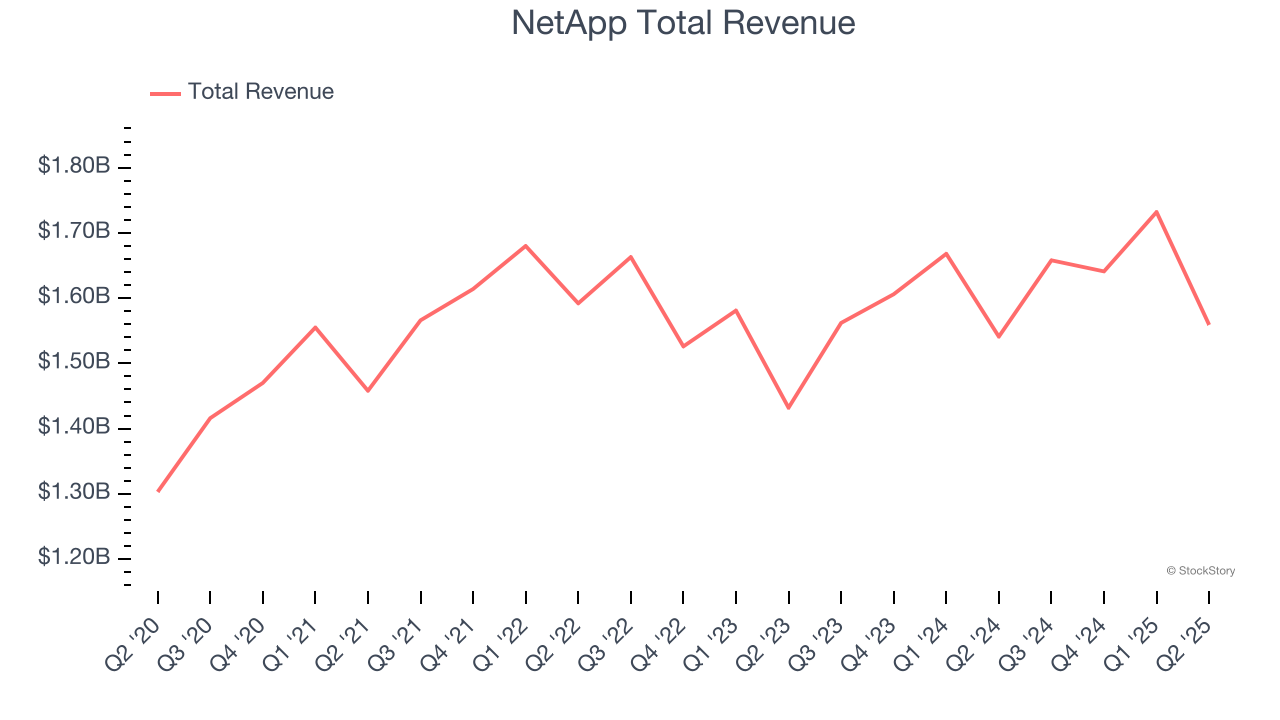

Founded in 1992 as a pioneer in networked storage technology, NetApp (NASDAQ: NTAP) provides data storage and management solutions that help organizations store, protect, and optimize their data across on-premises data centers and public clouds.

NetApp reported revenues of $1.56 billion, up 1.2% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ billings estimates but full-year revenue guidance meeting analysts’ expectations.

Interestingly, the stock is up 4.4% since reporting and currently trades at $117.04.

Is now the time to buy NetApp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Pure Storage (NYSE: PSTG)

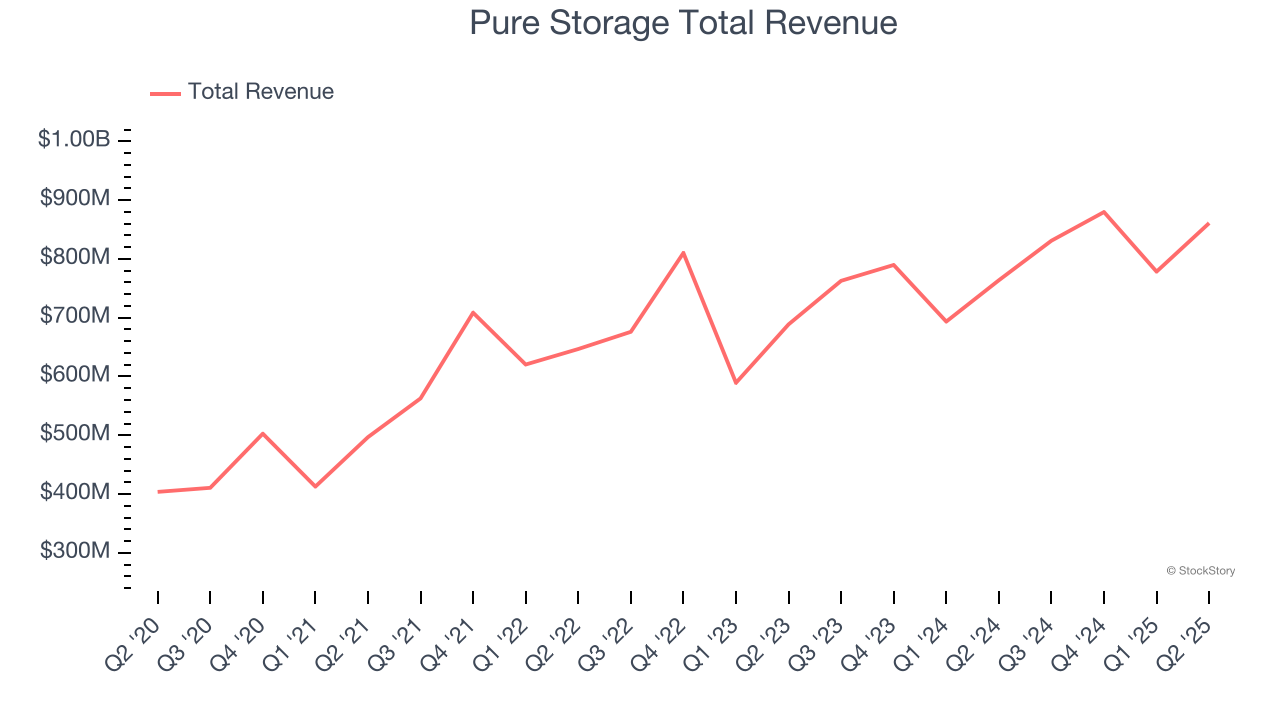

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE: PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

Pure Storage reported revenues of $861 million, up 12.7% year on year, outperforming analysts’ expectations by 1.7%. The business had an exceptional quarter with a solid beat of analysts’ billings estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 54.5% since reporting. It currently trades at $94.09.

Is now the time to buy Pure Storage? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Super Micro (NASDAQ: SMCI)

Founded in Silicon Valley in 1993 and known for its modular "building block" approach to server design, Super Micro Computer (NASDAQ: SMCI) designs and manufactures high-performance, energy-efficient server and storage systems for data centers, cloud computing, AI, and edge computing applications.

Super Micro reported revenues of $5.76 billion, up 7.5% year on year, falling short of analysts’ expectations by 4.2%. It was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Super Micro delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. As expected, the stock is down 15.4% since the results and currently trades at $48.50.

Read our full analysis of Super Micro’s results here.

Diebold Nixdorf (NYSE: DBD)

With roots dating back to 1859 and a presence in over 100 countries, Diebold Nixdorf (NYSE: DBD) provides automated self-service technology, software, and services that help banks and retailers digitize their customer transactions.

Diebold Nixdorf reported revenues of $915.2 million, down 2.6% year on year. This print topped analysts’ expectations by 3.3%. However, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates.

Diebold Nixdorf had the slowest revenue growth among its peers. The stock is up 4.3% since reporting and currently trades at $58.73.

Read our full, actionable report on Diebold Nixdorf here, it’s free for active Edge members.

IonQ (NYSE: IONQ)

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE: IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

IonQ reported revenues of $20.69 million, up 81.8% year on year. This result surpassed analysts’ expectations by 21.5%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ revenue estimates and revenue guidance for next quarter exceeding analysts’ expectations.

IonQ delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 48% since reporting and currently trades at $61.02.

Read our full, actionable report on IonQ here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.