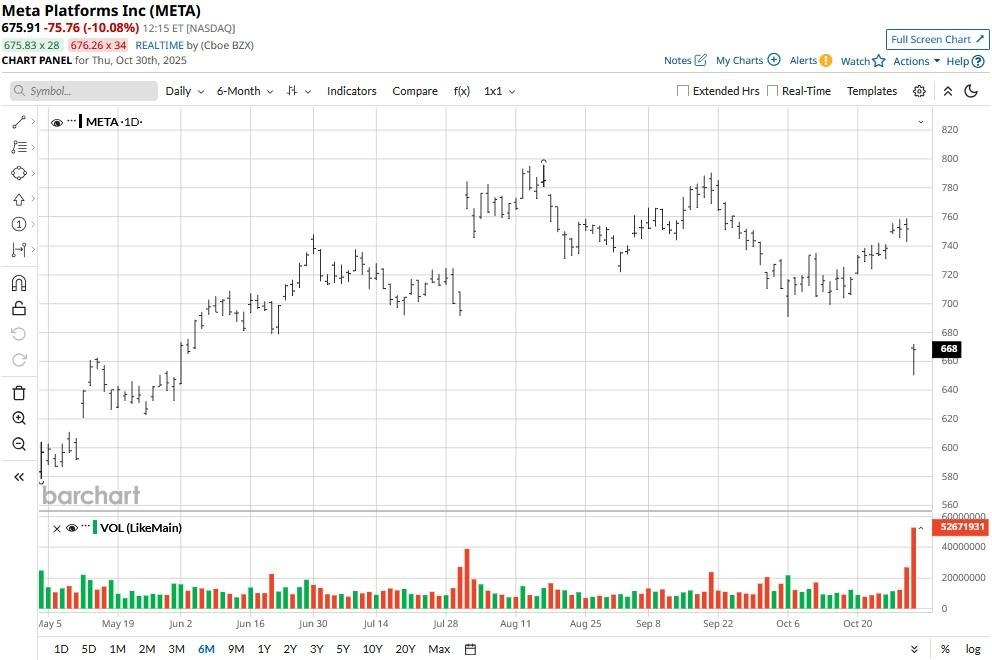

Meta Platforms (META) shares are down nearly 10% this morning even though the tech behemoth came in ahead of Street estimates for its third quarter.

The price action primarily reflects growing concern over the company’s aggressive spending plans tied to its artificial intelligence (AI) ambitions.

Meta now expects its capital expenditures to fall between $70 billion and $72 billion, up from its previous outlook for $66 billion to $72 billion.

Despite the post-earnings decline, META stock is up some 14% versus the start of this year.

Oppenheimer Downgrades Meta Stock and Removes Price Target

Meta shares are tumbling today also because Susan Li, the company’s CFO, confirmed capital expenditures will only increase and “be notably larger in 2026.”

The social media giant continues to double down on AI infrastructure, even though visibility into monetization is still murky at best, and that’s starting to concern Wall Street analysts.

According to Oppenheimer, “significant investment in Superintelligence despite unknown revenue opportunity mirrors 2021-2022 metaverse spending.”

On Thursday, the investment firm downgraded META stock to “Perform” and removed its prior price target of $696.

META Shares May Face Cash Crunch Within the Next 2 Years

In their research note, Oppenheimer analysts argued limited visibility into 2027 earnings makes it increasingly difficult to justify Meta’s stretched valuation multiples.

The investment firm also dubbed Alphabet (GOOGL) a better pick heading into the next year as it offers a more predictable earnings profile.

Others including Arete’s senior analyst Rocco Strauss have an even less-forgiving view on META shares. In a recent CNBC interview, Strauss warned the multinational may “run out of cash and tap net debt territory” by 2027.

Amid these concerns, the AI stock’s 0.32% dividend yield may not be enough to sufficiently entice investors into sticking with it for the long term.

Wall Street Continues to Recommend Owning Meta Platforms

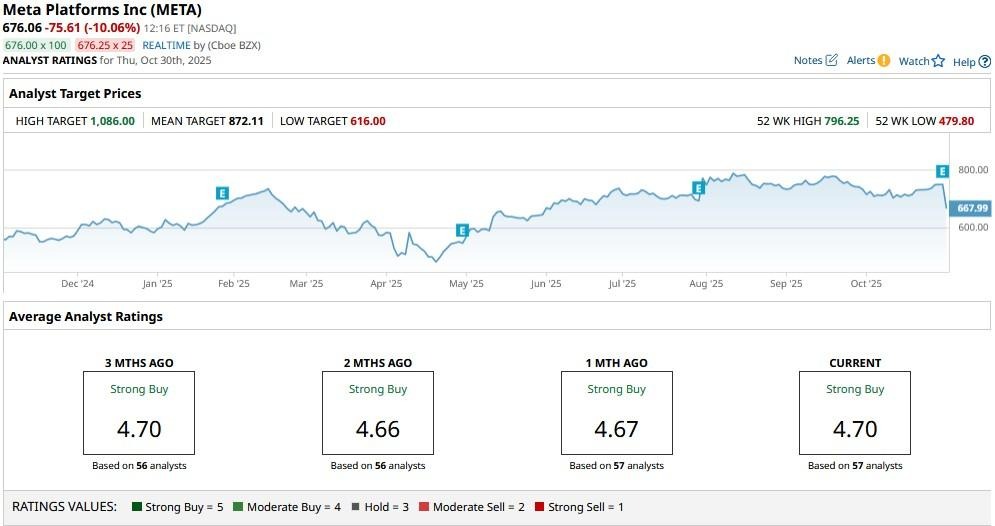

Despite spending concerns, Oppenheimer and Arete are still the contrarian calls on Meta shares.

According to Barchart, the consensus rating on META stock remains at “Strong Buy” with the mean target of roughly $872 indicating potential upside of about 35% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart