Seattle-based Starbucks Corporation (SBUX) operates as a roaster, marketer, and retailer of coffee worldwide. Its stores offer coffee, tea, and various food products. With a market cap of $97.1 billion, Starbucks operates through North America, International, and Channel Development segments.

The coffee giant has continued to lag behind the broader market over the past year. SBUX stock has dropped 7.8% in 2025 and 13.6% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 17.2% gains on a YTD basis and 18.1% surge over the past year.

Narrowing the focus, Starbucks has also underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.6% gains on a YTD basis and 19.4% surge over the past year.

It's been over a year since the start of the new CEO Brian Niccol’s Back to Starbucks strategy, and the results of this strategy haven’t been as fruitful as initially expected. Starbucks' comparable sales had observed a consistent decline for several quarters previously. Despite the low base, its comparable sales haven’t observed the anticipated growth. In Q4 2025, the company’s North America comps remained flat year-over-year. However, international comps observed a 3% improvement, driven by 6% increase in comparable transactions, partially offset by 3% decline in average ticket.

Its overall topline increased 5.5% year-over-year to $9.6 billion, beating Street’s expectations. However, due to lower average ticket size in international markets and subdued performance in local markets, Starbucks’ margins got squeezed. Its adjusted EPS for the quarter plummeted 35% year-over-year to $0.52, missing the consensus estimates by 5.5%. SBUX stock prices have been trading in the red for the past two trading sessions in anticipation of poor Q4 performance, which was released after the markets closed yesterday.

In fiscal 2026, ending in September next year, analysts expect Starbucks to deliver a solid double-digit growth in earnings. However, it has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates once over the past four quarters, while missing the projections on three other occasions.

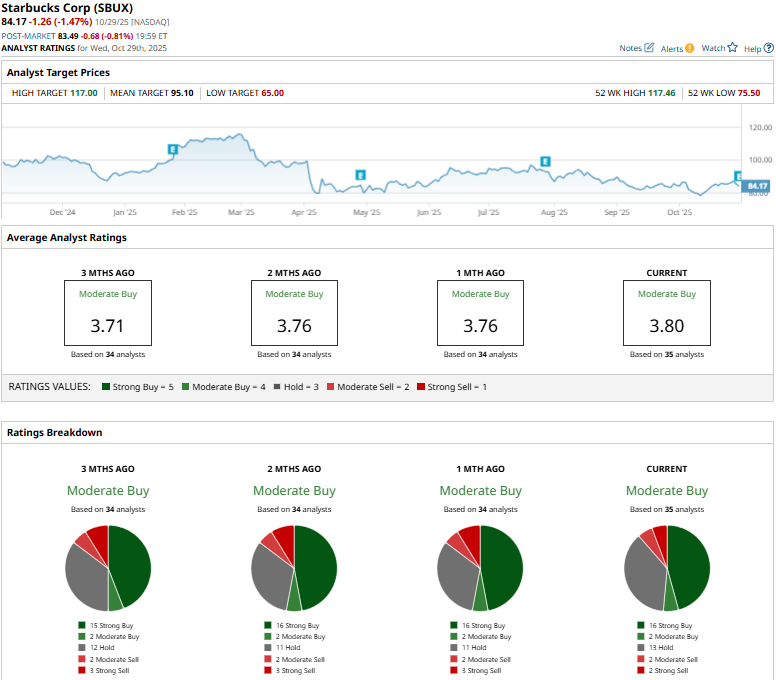

SBUX holds a consensus “Moderate Buy” rating overall. Of the 35 analysts covering the stock, opinions include 16 “Strong Buys,” two “Moderate Buys,” 13 “Holds,” two “Moderate Sells,” and two “Strong Sells.”

This configuration is slightly more bullish than a month ago, when three analysts gave “Strong Sell” ratings.

On Oct. 28, Mizuho analyst Nick Setyan initiated coverage on SBUX with a “Neutral” rating and set a price target of $84.

SBUX’s mean price target of $95.10 implies a 13% premium to current price levels, while its street-high target of $117 suggests a 39% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart