KeyCorp (KEY), headquartered in Cleveland since 1849, stands as one of America’s enduring financial institutions. Through its flagship, KeyBank, it serves consumers, businesses, and institutions across the U.S., offering everything from personal finance and mortgages to capital markets and wealth management. Born from a merger of Ohio and New York legacies in 1994, KeyCorp has steadily expanded through innovation and community-driven banking. Today, with a market capitalization of $19.5 billion, it blends tradition with modern financial strength.

The stock has underperformed the broader market over the past 52 weeks. KEY stock has increased marginally over this time frame, while the broader S&P 500 Index ($SPX) has rallied 17.4%. Moreover, shares of KeyCorp are up 2.2% on a year-to-date (YTD) basis, compared to SPX’s 16% rise.

In addition, KEY stock has lagged behind the Financial Select Sector SPDR Fund’s (XLF) 10.8% return over the past 52 weeks and 8.1% YTD gains.

Despite stable operational results, the KeyCorp stock is performing weakly in 2025 because investor sentiment remains cautious around its banking-sector risks, even though earnings have improved. The company posted strong Q3 results with net interest income up 23.8% and net interest margin rising to 2.75% from 2.17% a year earlier. However, market concerns persist around slower loan growth, elevated funding and deposit costs, and whether KeyCorp can sustain earnings expansion in a challenging macro environment.

For the current fiscal year, ending in December 2025, analysts expect KeyCorp’s EPS to grow 25.9% year-over-year to $1.46. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

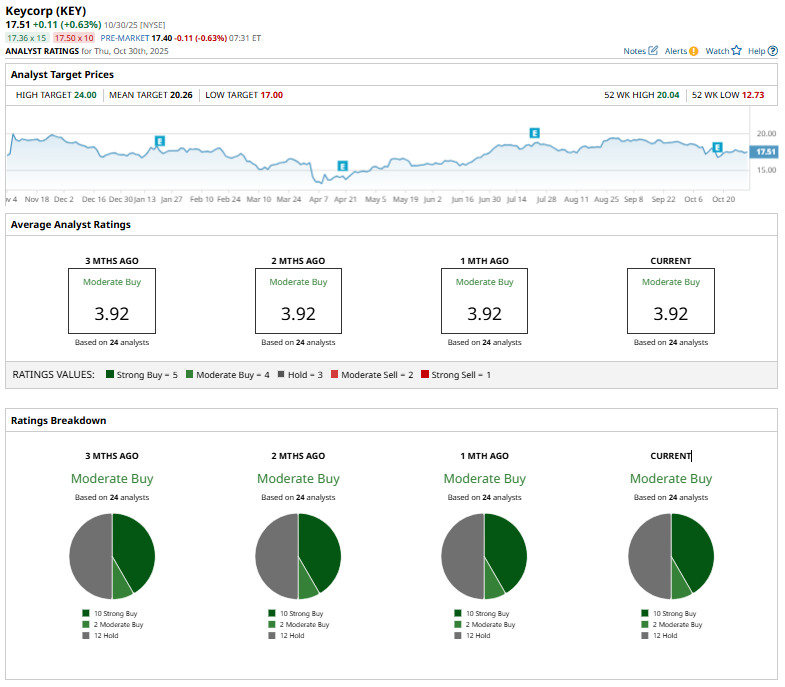

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, two “Moderate Buys,” and 12 “Holds.”

This configuration remained largely consistent over the past three months.

On Oct. 17, DA Davidson lowered its price target on KeyCorp from $22 to $21 while maintaining a “Buy” rating, noting strong Q3 2025 results and higher full-year revenue guidance but suggesting that these positives are already reflected in consensus estimates.

Its mean price target of $20.26 suggests an upside of 15.7%. The Street-high price target of $24 implies a potential upside of 37.1% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Slashed His Fiserv Stock Price Target by 55%. Should You Jump Ship Now?

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?

- A $135 Billion Reason to Buy Microsoft Stock Now

- 3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.