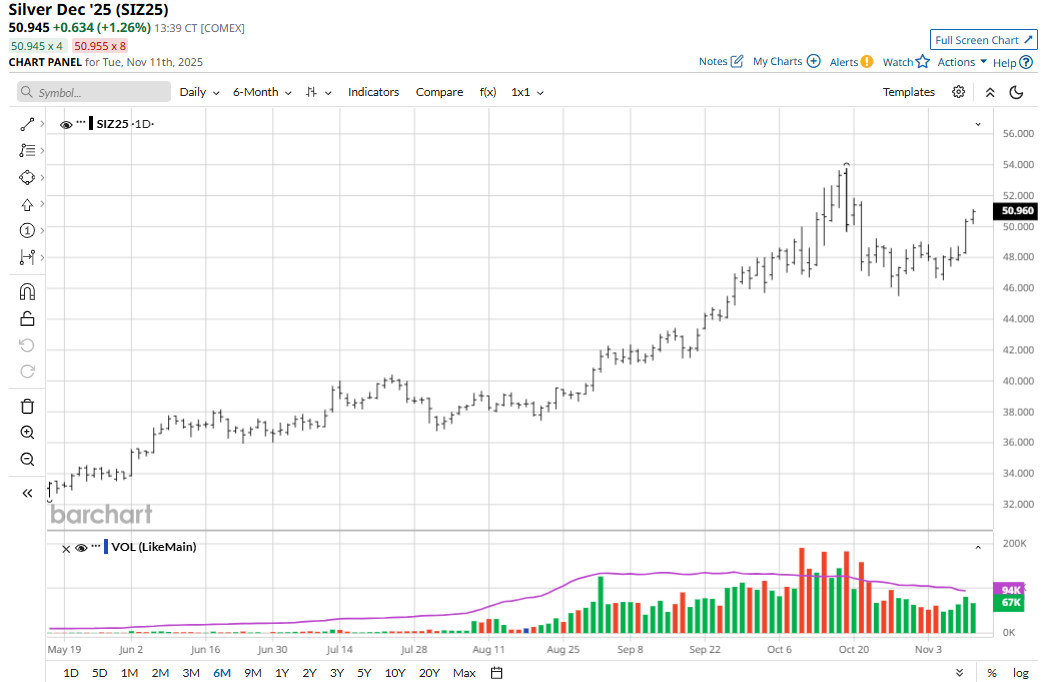

The gold (GCZ25) and silver (SIZ25) markets hit record highs in October and then backed well off those peaks. In late October, the December silver futures contract dropped to a low of $45.51 an ounce, well down from its record high of $53.765 scored on Oct. 17. December gold futures hit a low of $3,901.30 on Oct. 28, after scoring a record high of $4,398.00 on Oct. 20. Near-term technical damage was inflicted on the price downturns, including price uptrends on the daily charts being at least temporarily negated. Those were early clues that gold and silver bulls were exhausted and that near-term market tops could be in place.

I reported to you in mid-October that there was one important element that could well determine the fate of the gold and silver markets’ longer-term bull runs in the months ahead: Silver prices being able to push higher and close back above major psychological resistance at the $50.00 level.

Here’s what I said then:

“Probably the most important factor that I think will determine where gold and silver prices are headed: Silver above $50.00. Reason: Price history over the past 50 years shows that when silver prices reach $50, or get close to it, which has occurred three times now, the first two times saw silver trade above $50 for only a short period of time. Two weeks from now, if silver prices are above $50 an ounce, then the marketplace can start to believe both gold and silver are entering new, longer-term price ranges that will continue well above what price history of the past 50 years has shown. And if silver drops back below $50 in the next couple weeks, history will again repeat itself – and that would suggest gold and silver are due for extended downside price corrections and even bear markets farther down the road, to continue the historical cycle of boom and bust seen in all raw commodity markets.”

So here we are nearly a month later than that Barchart report and silver prices have rebounded smartly and so have gold prices. The way I see it now is that gold and silver bulls have regained power and have proven they can be resilient after significant downside price corrections. More price upside in both precious metals is now likely.

This week’s price gains in gold and silver are due in part to U.S. lawmakers likely having a deal to end the longest U.S. government shutdown in history. A restart of the government would see the release of long-delayed U.S. economic data, which is expected to show a worsening outlook and likely be a catalyst for more Federal Reserve easing of its monetary policy as soon as the December FOMC meeting.

Lower interest U.S. interest rates are bullish for the precious metals, suggesting better global demand for the metals, as well as suggesting the U.S. dollar could depreciate on the foreign exchange market.

Updated Upside Price Targets for Gold and Silver

With silver prices well above $50.00 again, I now see silver’s next major upside target as $60.00. That’s not a stretch and could even come before the end of this year. The silver market now has a downside price benchmark that if breached would suggest a market top is in place: the October low of $45.51, basis December Comex futures.

For gold, the new upside target is $5,000.00 an ounce. It’s my bias that price target could be hit next year. A signal that the bulls don’t have the power to continue their record-setting run would be a close in December Comex futures below solid chart support at the October low of $3,901.30.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart