Oracle (ORCL) stock has taken a sharp turn after an impressive run, sliding more than 36% from its peak of $345.72. The pullback reflects growing unease among investors as the company doubles down on its transformation from a traditional enterprise software provider into a key player in the artificial intelligence (AI) infrastructure space.

The company has been pouring billions into expanding its cloud infrastructure to meet soaring demand. However, this aggressive expansion is what has some investors on edge. The question lingering over the stock is whether these massive upfront costs will ultimately produce the sustained profits the company is counting on.

The broader environment has also added pressure. Across big tech, investors are starting to question whether the billions being invested in AI development will deliver the returns many companies have promised. Oracle’s significant debt load intensifies those concerns. As capital expenditures rise, free cash flow could stay tight, and profit margins may continue to be squeezed in the near term. Management has already signaled that both cloud-related spending and software expenses will continue to rise through fiscal 2026 as the company increases capacity in existing data centers and builds new ones to meet growing customer demand.

Against this backdrop, does the recent decline in ORCL present an opportunity to buy into a long-term growth story at a discount, or will the stock experience further volatility ahead as the company navigates this capital-intensive transformation?

What’s Ahead for Oracle?

Oracle’s long-term bet on AI may be facing a shift in sentiment. Still, the underlying demand for AI infrastructure suggests the company’s strategy is far from running out of steam. In fact, the scale of Oracle’s future commitments indicates that the company is preparing for substantial growth.

As of Aug. 31, 2025, the company reported remaining performance obligations (RPO) of $455.3 billion. This represents a significant opportunity that management expects to convert into revenue steadily over the coming years. Approximately one-tenth of that total is expected to be recognized within the next 12 months, with meaningful contributions continuing well into the next decade.

Driving momentum is Oracle’s cloud division. In the first quarter, cloud revenue climbed to $7.2 billion, up 27% from the prior year, while cloud infrastructure revenue surged 54% to $3.3 billion. Demand for Oracle Cloud Infrastructure (OCI) remains exceptionally strong, outpacing available capacity and rising 57% year over year. With several multibillion-dollar contracts in the pipeline, Oracle expects its backlog to move past the half-trillion-dollar mark, highlighting the strong demand for its cloud and AI-ready platforms.

The company’s database business is also delivering growth. Annualized revenue reached nearly $2.8 billion, marking 32% year-over-year growth. The Autonomous Database expanded 43%, but the biggest surprise came from multi-cloud database services, which skyrocketed 1,529%. Deeper integrations with Amazon Web Services, Microsoft Azure, and Google Cloud have positioned Oracle as a key player to capitalize on the shift toward flexible, cross-cloud architectures.

Management is leaning into that momentum with a bullish outlook. Oracle expects OCI revenue to increase by 77% this fiscal year to approximately $18 billion, with continued rapid growth in the year ahead as AI workloads intensify. The company already operates 34 multi-cloud data centers, with an additional 37 planned for deployment. This aggressive buildout strengthens Oracle’s positioning in the fast-growing hybrid and multi-cloud market, giving the company a broader platform to capture enterprise demand.

Is Oracle Stock a Buy, Sell, Or Hold?

Oracle is entering a strong growth phase, backed by soaring demand for AI and cloud infrastructure. While this momentum is encouraging, its free cash flow could remain under pressure in the short term as the company invests heavily in data-center buildouts and cloud capacity. However, note that this isn’t necessarily a red flag, and it means the benefits may take time to fully show up in cash flow metrics.

Valuation is the key consideration today. Oracle stock trades at a forward price-earnings (P/E) multiple of 41.2x, which is rich compared to its expected earnings growth of 23.4% in fiscal 2026 and 17.7% in fiscal 2027, according to analyst estimates. Much of the optimism surrounding AI and cloud adoption is already priced into the stock.

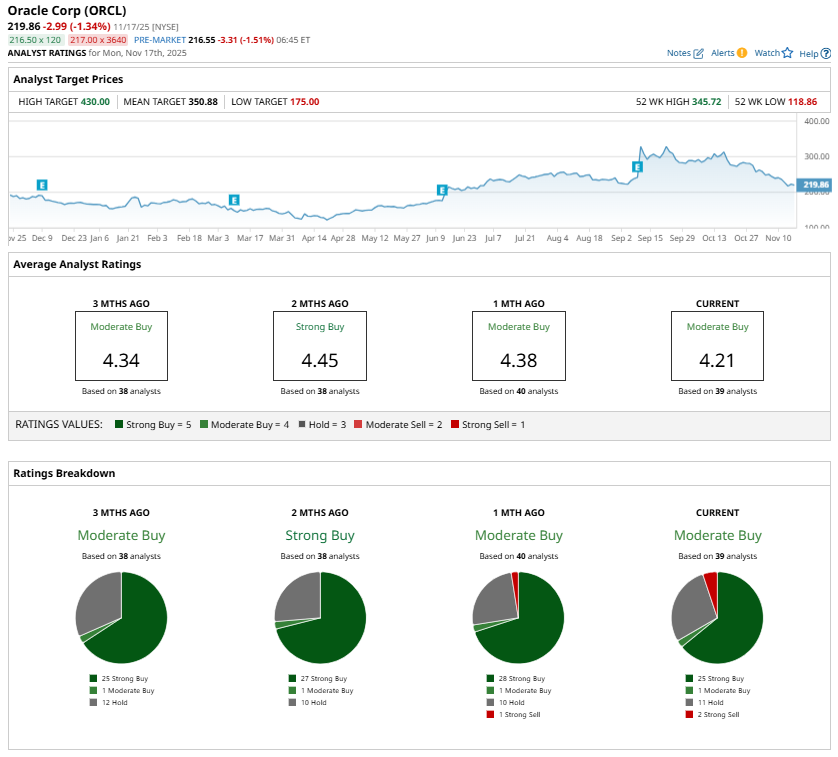

Wall Street analysts currently rate Oracle stock a “Moderate Buy,” indicating that the company is likely to continue benefiting from AI tailwinds. However, Oracle’s valuation remains elevated, leaving little margin for error if growth slows or AI adoption takes longer than expected.

For long-term investors, the recent pullback in ORCL shares may present an attractive entry point. Meanwhile, short-term investors should approach with caution. Market enthusiasm for AI has cooled slightly, and Oracle stock may remain volatile until the company achieves material gains from its AI initiatives and signs additional AI deals.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart