The market’s enthusiasm for artificial intelligence (AI) has defined much of 2025 so far. With significant investments in AI infrastructure, a couple of rate cuts, and the U.S. economy continuing to defy slowdown fears, shares of technology companies have rallied significantly. The Nasdaq-100 Technology Index ($NDXT) has surged roughly 18% this year, outpacing the broader market.

Yet Amazon (AMZN) hasn’t joined the party. Despite being one of the largest technology and e-commerce companies, its stock is up only about 0.5% year-to-date, lagging behind most other mega-cap tech names, excluding Tesla (TSLA).

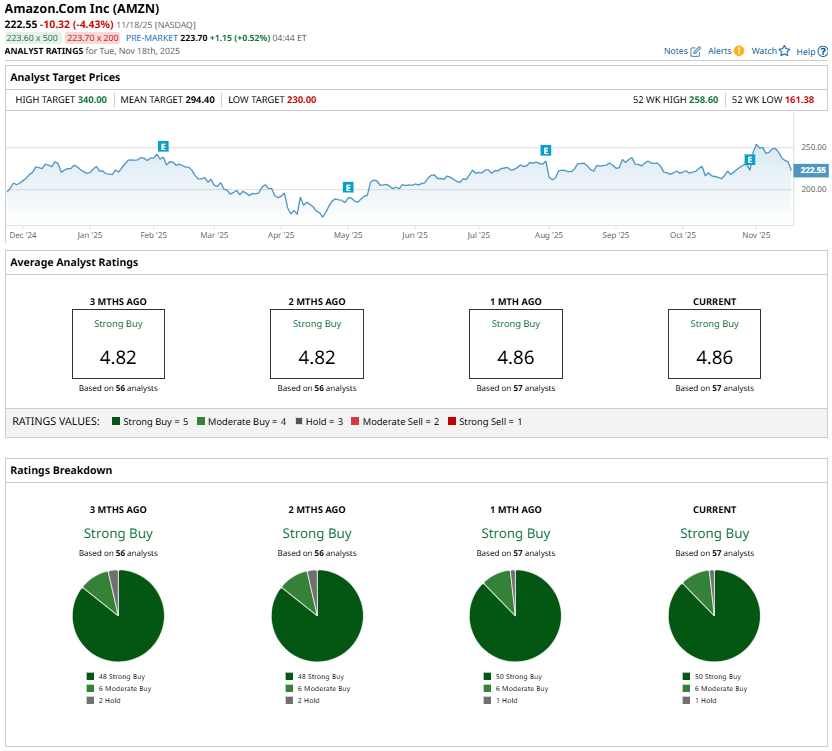

However, Wall Street analysts appear to be optimistic about AMZN’s prospects. Despite muted stock performance, most analysts back Amazon and project meaningful upside from current levels over the next 12 months.

Analysts’ optimism isn’t without reason. Amazon has consistently outpaced expectations, delivering earnings that have repeatedly come in well above consensus estimates, including a substantial 23.4% beat in its most recent quarter. Moreover, it has multiple growth catalysts that could push its share price higher.

Amazon’s operational momentum looks set to continue. Growth in cloud computing, strengthening profitability in its core retail operations, and accelerating demand for AI-driven services are expected to act as powerful tailwinds. Moreover, solid momentum in its high-margin advertising business augurs well for growth. These catalysts could help propel the stock higher.

How High Can Amazon Stock Rise in 12 Months?

Amazon is in a solid growth phase, driven by accelerating momentum in cloud computing, advertising, and its fast-expanding AI infrastructure business. Over the next 12 months, these catalysts could meaningfully lift the company’s revenue, earnings, and potentially its stock price.

The company’s cloud division, Amazon Web Services, remains the centerpiece of this growth story. AWS ended the third quarter with a massive $200 billion backlog, and that figure doesn’t yet reflect a series of new deals closed in October. According to the company, those unannounced agreements alone exceeded the total value of deals signed in the entire third quarter, suggesting that AWS’s pipeline is strengthening faster.

Demand for both core cloud services and AI workloads has been a major driver, translating into a strong quarter. AWS generated $33 billion in revenue, up more than 20% year-over-year, marking a sharp acceleration from 17.5% year-over-year growth in the second quarter. The segment’s operating income also increased, reaching $11.4 billion, reflecting the business’s ability to grow profitably while expanding capacity. To support the next leg of growth, Amazon has been aggressively expanding its data center power infrastructure. Over the past year, it added 3.8 gigawatts of capacity, double what AWS had just two years earlier, and aims to double capacity again by 2027.

Advertising remains another key growth driver. Amazon’s ad revenue climbed to $17.7 billion in the third quarter, marking the third straight quarter of accelerating growth. The company is broadening its reach through deeper integrations with renowned platforms such as Spotify, and continued expansion in live sports streaming on Prime Video is drawing more marketers to Amazon’s ecosystem.

One of the key developments for investors is Amazon’s rapidly scaling AI chip business. The company revealed that its Trainium2 chips, which are custom-built for AI training workloads, have quickly become a multibillion-dollar business, growing 150% from the previous quarter and now fully subscribed. Although currently used by only a handful of major customers, Amazon expects adoption to broaden with the next-generation Trainium3 chips, positioning the company more firmly within the high-growth AI infrastructure market.

Amazon’s retail segment, while more mature, is also delivering solid growth. The company has improved its logistics network by optimizing inventory placement and adopting robotics and automation. These improvements enhance operating efficiency, helping retail contribute more meaningfully to profitability.

Together, these catalysts suggest that Amazon is poised to deliver solid profitable growth over the next 12 months.

Analysts expect this momentum to translate into upside for the stock. The average price target for Amazon is $294.40, implying roughly 32% upside from current levels. Meanwhile, the highest price target is $340 per share, suggesting potential gains of about 53% in a year.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Loop Capital Says Ride the ‘Waves of AI Optimism’ and Buy Google Stock Here

- Is Meta Stock a Buy or a Sell Before Michael Burry Drops His Bombshell on November 25?

- 22 ADRs Hit New 52-Week Lows: Are Any Worth Buying?

- Klarna Stock Plunges Toward Oversold Territory on Post-Earnings Selloff. Should You Buy the Dip?