Certainly, divergent views continue to build in the world of technology investors and the analysts that cover this sector.

Some clearly believe that spending has gotten out of control. Whether we look at past spending cycles around other innovative technologies like crypto or the metaverse, today investors are starting to demand profitability for companies that are ultimately doing the buying of key infrastructure to support their AI goals.

For Nvidia (NVDA), the world’s largest maker of high-performance chips, and the world’s first $5 trillion company valued on the back of extremely robust spending trends within the AI ecosystem, a potential slowdown in orders is a big concern. While Nvidia’s valuation has come down considerably thanks to this recent dip in market sentiment, some analysts believe the company’s recent blowout earnings report could be a signal to go against the crowd right now.

“Bears have missed every transformational tech name the last few decades worried about valuation and will mis these next few years of the tech bull market while hibernating in their caves. As someone like myself that spends so much time globally seeing the AI Revolution play out and gauging demand in the Asia supply chain, we believe this is still the Top of the 3rd inning in the AI Field of Dreams game being played,” Ives wrote.

Let’s examine Wedbush analyst Dan Ives, who is once again stepping up to the plate with a very bullish thesis around Nvidia and the overall AI trade right now.

Plenty of Positives Around Nvidia’s Earnings Report

When looking at Nvidia’s underlying fundamentals, it is clear that the company’s recent earnings report would have – in any other market other than today’s – led to rapid price appreciation for shareholders.

During the company’s most recent quarter, Nvidia brought in $57 billion in revenue and earnings per share of $1.30, both well above analyst expectations. Notable strength from Nvidia’s core data center segment, as well as outperformance in compute and networking, drove these record results.

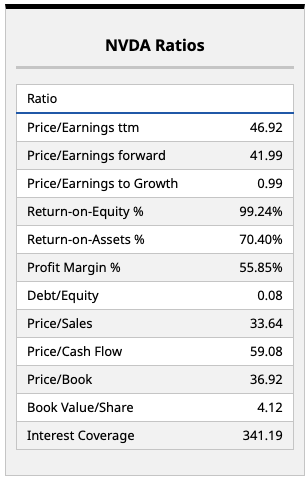

At a current forward multiple of 42 times earnings, Nvidia definitely isn’t a cheap stock. But, this is the company’s most attractive multiple in some time, suggesting the company is fulfilling most investors hopes, as well as growing into its valuation over time.

This past quarter, Nvidia also noted solid demand for Blackwell. Dan Ives thinks this should continue. He views the so-called AI supercycle as still in its infancy, maybe in the third inning of a possibly long-term rally. And with recent deals supporting the idea that Nvidia’s backlog could grow significantly into the future, analysts like Dan Ives have much to consider.

So, Why Is Nvidia Stock Heading in the Wrong Direction?

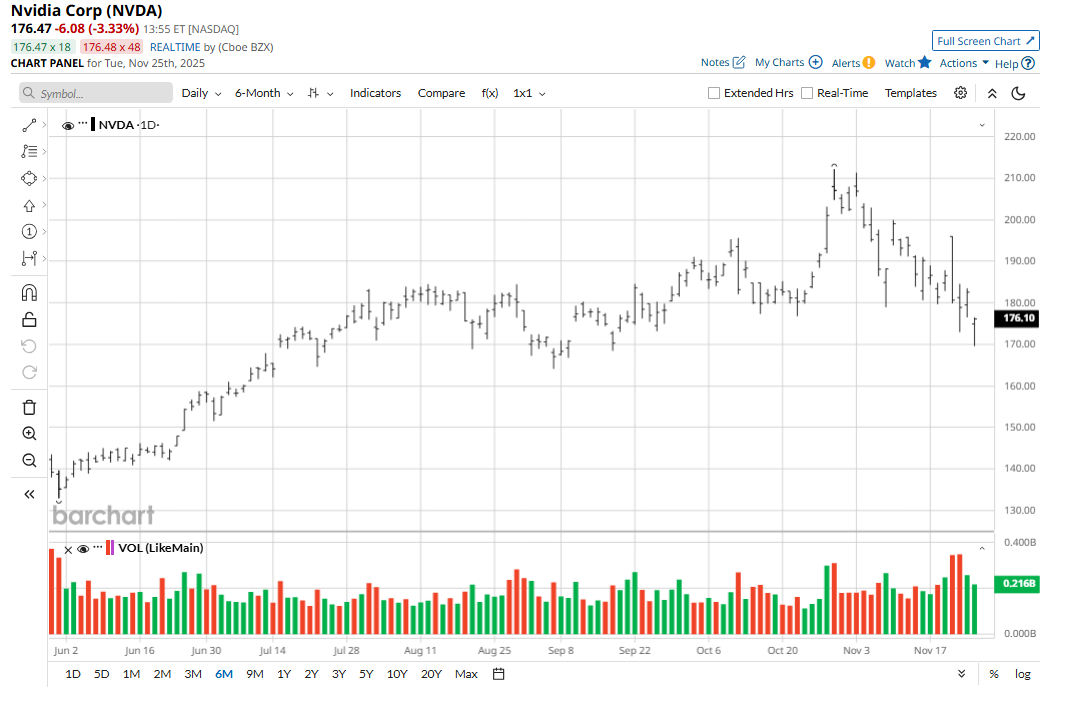

Following Nvidia’s recent earnings, the company’s share price turned an initial pre-market surge into a loss for the day, with a double-digit percentage move intraday driving this downside.

Indeed, it was one of the most incredible reversal rallies, an indication that investors are growing more divisive on some of the biggest and most important names in the market.

Ultimately, investors will have to see Nvidia’s performance in the weeks ahead. Even so, I’m personally braced for a more volatile 2026, given that the balance of risks appears to be favoring caution among those who have very large gains from staying invested in companies like Nvidia, and therefore enticed to take some profits.

What Do Other Analysts Think?

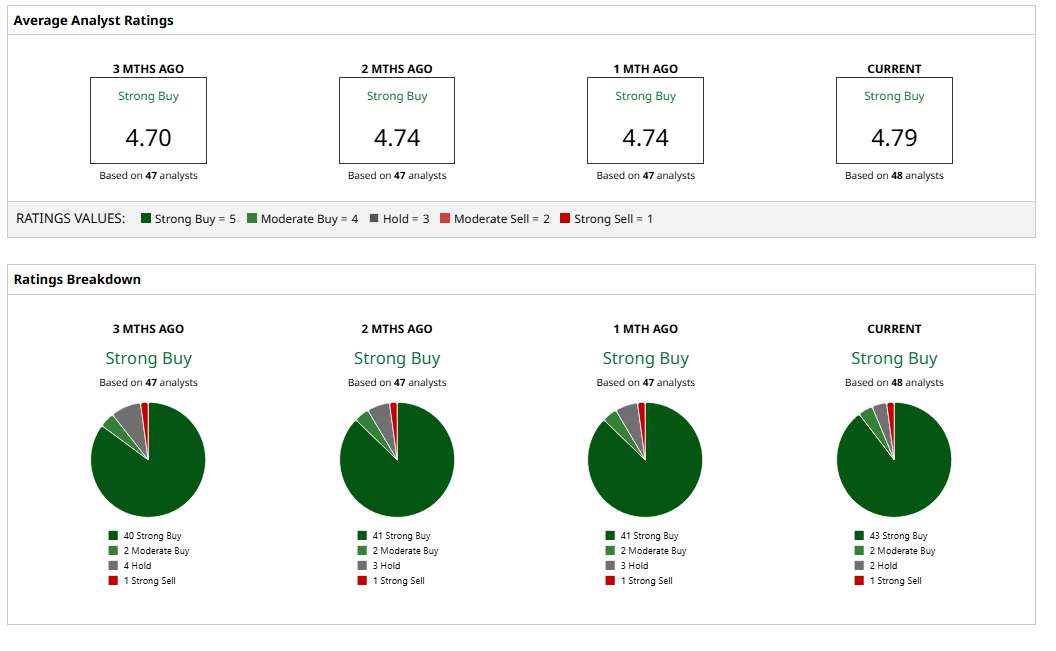

While Dan Ives is perhaps one of the most well-known and boisterous voices on Wall Street, Nvidia’s importance to the market means that nearly every outfit on the Street covers this name.

Currently, the 47 analysts covering Nvidia have a consensus price target of $252.91, implying upside potential of 43%.

Given some of the moves we’ve seen in recent years from Nvidia and other AI beneficiaries, that’s a reasonable implied move. With Nvidia recently breaking through the $200 level, and initially signaling that a move back above this level was likely following its recent earnings, this dip will be one watch.

If Nvidia moves back above the $183 level next week and begins consolidating from here, maybe Dan Ives will turn out to be right.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Microsoft Partners Up with Nvidia and Anthropic, Should You Buy, Sell, or Hold MSFT Stock?

- Nvidia Stock Is Selling Off on Google-Meta Deal. Should You Buy the NVDA Dip Today?

- Nvidia Just ‘Dropped the Mic’ But Its Stock Dropped Too. How Should You Play NVDA Here?

- Get Out of Your Cave and Out onto the Field, Says Wedbush. The AI Game for NVDA Stock Is Still a ‘Field of Dreams.’