With a market cap of $489.1 billion, Exxon Mobil Corporation (XOM) is one of the world’s largest integrated energy companies, with leading upstream oil and gas assets, the largest global refining operations, and substantial chemical businesses. Known for disciplined capital allocation and industry-leading returns, the company maintains a strong dividend record and credit profile.

Companies valued at $200 billion or more are generally considered “mega-cap” stocks, and Exxon Mobil fits this criterion perfectly. Its operations span traditional energy, petrochemicals, and emerging lower-emission opportunities, positioning it as a bellwether in the sector.

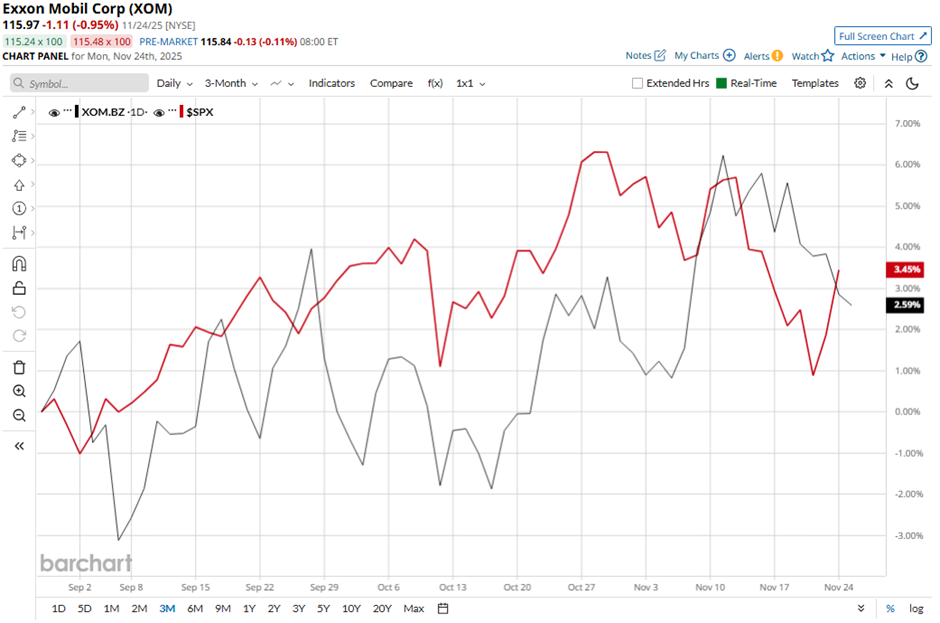

However, shares of the Spring, Texas-based company have fallen 4.9% from its 52-week high of $121.88. Over the past three months, XOM stock has risen 4.2%, which slightly outpaced the broader S&P 500 Index’s ($SPX) return of 4.1% during the same period.

In the longer term, XOM stock has gained 7.8% on a YTD basis, lagging behind the SPX’s 13.5% increase. Moreover, shares of the oil and natural gas company have dipped 4.8% over the past 52 weeks, compared to the 11.2% gain of the SPX over the same time frame.

The stock has been trading above its 50-day and 200-day moving averages since late August.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.88, shares of XOM fell marginally on Oct. 31 as the company reported revenue of $85.29 billion, below forecasts. Investors also focused on weakness in key segments, including a $1.4 billion year-over-year decline in Chemical Products earnings and lower base volumes, which overshadowed the positive production and cash-flow headlines.

In comparison with its rival, Chevron Corporation (CVX) stock has lagged behind XOM stock. CVX stock has soared 3.4% on a YTD basis and declined 7.8% over the past 52 weeks.

Despite the stock’s underperformance relative to the SPX over the past year, analysts are moderately optimistic about its prospects. XOM stock has a consensus rating of “Moderate Buy” from the 26 analysts covering the stock, and the mean price target of $128.96 is a premium of 11.2% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart