Nvidia (NVDA) stock is slipping further on Nov. 25 following reports that Meta Platforms (META) is considering switching to Google’s (GOOGL) tensor processing units (TPUs) to power its AI data centers.

META has historically relied almost exclusively on NVDA chips to power its artificial intelligence infrastructure. However, it’s now considering a pivot to GOOGL by early 2027, the reports added.

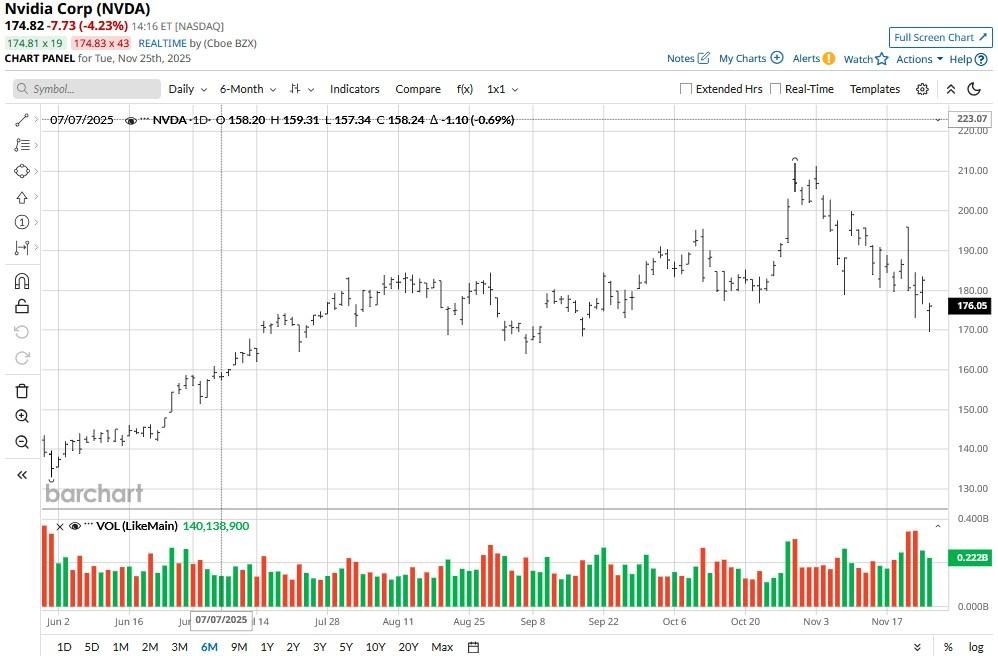

Following today’s decline, Nvidia shares are down about 18% versus their year-to-date high set in late October.

Why Is This News Concerning for Nvidia Stock?

Meta Platforms’ potential pivot to Google’s custom chips signals rising competition in AI hardware.

Nvidia has been the dominant supplier of GPUs for large-scale artificial intelligence training – but losing Meta’s business by 2027 could prove a major blow to its top-line growth.

And who’s to say that others like Microsoft (MSFT) won’t follow suit?

What The Information report essentially reminds us is that Nvidia’s exceptional growth could come under intense scrutiny if hyperscalers started diversifying their supply chains away from its chips.

Such a structural shift could erode the multinational’s pricing power and market share, making it increasingly harder for NVDA stock to replicate its outperformance in the years to come.

Does It Warrant Unloading NVDA Shares?

Former hedge fund manager Jim Cramer still recommends long-term investors to initiate or expand their positions in Nvidia stock on its recent pullback.

According to him, the market’s reaction to the Meta news overlooks Nvidia’s strong fundamentals, particularly the visibility into a whopping $500 billion worth of demand.

In a recent segment of CNBC, Cramer said “the demand is insatiable” for Nvidia’s Blackwell chips and its next-gen Vera Rubin platform, which he believes will drive NVDA shares to record levels in 2026.

TD Cowen analysts also reiterated their “Buy” rating on the AI stock today with a price objective of $235 indicating potential upside of a little under 40% from here.

Wall Street Sees Massive Upside in Nvidia

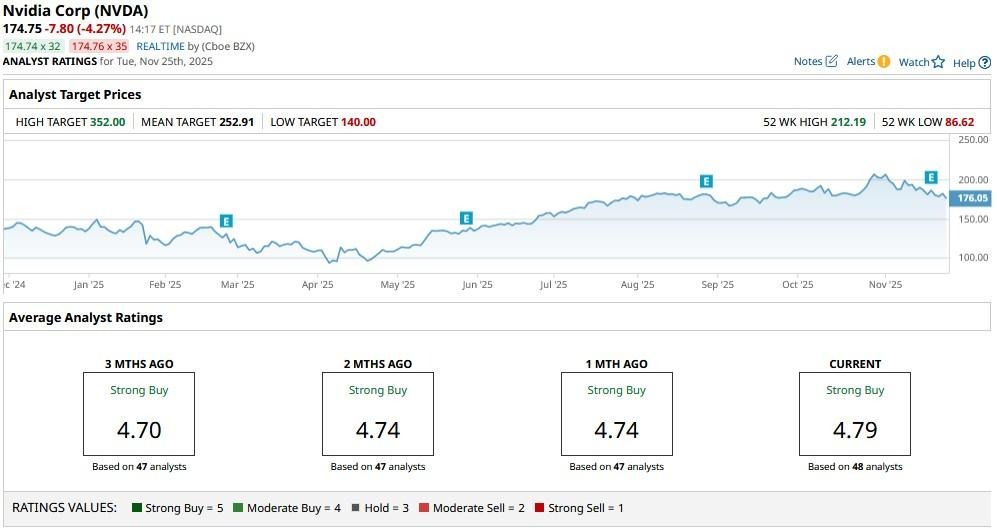

Other Wall Street firms continue to recommend sticking with NVDA stock for the next 12 months as well.

The consensus rating on Nvidia shares remains at “Strong Buy” with the mean target of about $253 indicating nearly 50% upside from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Massive Dip in Novo Nordisk Stock?

- Apple Layoffs November 2025: Should You Buy, Sell, or Hold AAPL Stock Amid ‘Rare’ Job Cuts?

- This Stock Is Down 44% in 2025 but Legendary Bridgewater Associates Just Bought Nearly 1 Million Shares

- Down 66% From Its All-Time High, Should You Buy the Dip in Bullish Stock? Cathie Wood Is.