On Nov. 18, American mining company USA Rare Earth (USAR) completed the acquisition of Less Common Metals (LCM), a scaled-up ex-China rare-earth metal and alloy manufacturer. This purchase largely aligned with USAR’s strategy of creating a fully integrated, end-to-end rare-earth supply chain.

A few days later, USAR announced that LCM has established a strategic partnership with chemical company Solvay to supply rare-earth metals to Permag, a leading magnetic equipment manufacturer.

Rare-earth metals have come under the spotlight as U.S.-China trade relations enter a delicate phase. A trade truce between the countries has led to a selloff in domestic rare-earth stocks. However, this sense of security might not last long, as China continues to sharpen its strategies.

For example, Beijing’s Validated End-User (VEU) system allows rare earth materials to flow exclusively to approved American companies focused solely on civilian use, while explicitly preventing the U.S. military and its extensive network of contractors from accessing these resources. The VEU strategy underscores the U.S. government’s investment. in the domestic rare-earth sector, positioning USAR as a critical source of rare-earth metals.

Against this backdrop, we take a closer look at USA Rare Earth.

About USA Rare Earth Stock

Headquartered in Stillwater, Oklahoma, USA Rare Earth is building a fully integrated domestic supply chain for rare earth elements and neodymium magnets and targeting markets in defense, automotive, and technology. It operates the unique Round Top deposit in West Texas, a source of 15 of the 17 rare earth elements essential to high-tech industries and green energy.

The Stillwater facility, designed for commercial-scale magnet manufacturing, aims to serve diverse sectors with innovative materials and will collaborate with local research institutions to advance magnet technology and industrial expertise. The company has a market capitalization of $1.6 billion.

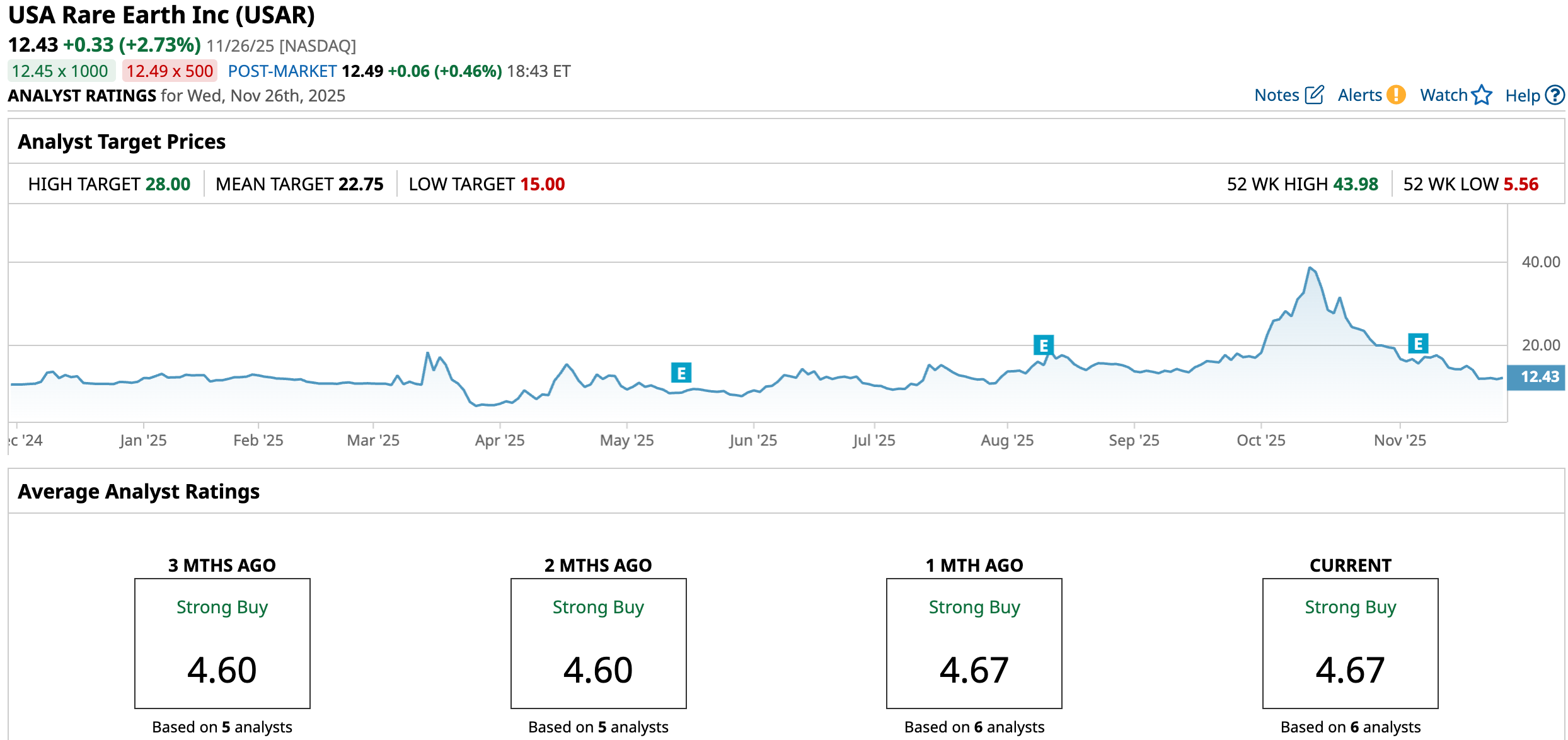

Over the past 52 weeks, USAR’s stock has gained 15.36%, driven by solid investor interest in rare-earth minerals critically needed for electric vehicles (EVs), renewable energy, and defense technologies. However, over the past month, the stock has plunged 47.26%, primarily due to a drop in share prices following its third-quarter results. USAR’s stock had reached a 52-week high of $43.98 on Oct. 13, but is down 72.17% from that level.

USA Rare Earth’s Third-Quarter Results Showed Operational Progress

On Nov. 6, USAR announced its third-quarter results for fiscal 2025. The company highlighted its operational strides, which included the identification of a flow sheet for the Round Top development process, with a pre-feasibility study expected to be completed in the second half of next year. The magnet facility at Stillwater remains on track for commissioning for commercial production in the first quarter of 2026.

In addition, USAR signed a memorandum of understanding (MOU) with Enduro Pipeline Services to deliver U.S.-made neo magnets in early 2026. Also, it entered into a joint development agreement with ePropelled to establish a supply-and-purchase partnership for sintered neodymium magnets.

On the Nov. 6 Earnings call, USAR’s new CEO Barbara Humpton also underscored USAR’s mission to build “a fully integrated U.S.-based rare earth material and magnet platform that supports national priorities.”

On the other hand, USAR reported an adjusted loss per share of $0.25 in Q3 2025, which was a giant leap from the small $0.03 loss per share it had reported in Q3 2024. And, the figure missed the loss per share of $0.06 that Wall Street analysts had expected. Net cash used in operating activities grew 135.5% year-over-year (YOY) to $2.85 million. Contrarily, USAR ended the quarter with $257.61 million in cash and no significant debt.

Wall Street analysts have a mixed view on USAR’s bottom line trajectory. For the current quarter, the company’s loss per share is expected to deepen by 100% YOY to $0.06. For fiscal 2025, loss per share is expected to increase by 100.07% to $0.65. However, it is expected to be followed by a 36.9% improvement, resulting in a loss per share of $0.41 in the subsequent fiscal year.

What Do Analysts Think About USA Rare Earth Stock?

Wall Street analysts are currently bullish on USAR’s stock. This month, analyst George Gianarikas from Canaccord Genuity reaffirmed a “Buy” rating on USAR’s stock, while raising the price target from $22 to $23.

Last month, analysts at William Blair initiated coverage on USAR’s stock with an “Outperform” rating. Those analysts, including Neal Dingmann and Bert Donnes, believe that the company’s development of its Texas mine and the start of production at its neo magnet manufacturing site in Oklahoma should benefit the company.

Wall Street analysts are favoring USAR’s stock, awarding it a consensus “Strong Buy” rating overall. Of the six analysts rating the stock, a majority of five analysts have rated it a “Strong Buy” and only one analyst is playing it safe with a “Hold” rating. The consensus price target of $22.75 represents an 83% upside from current levels. Moreover, the Street-high price target of $28 indicates a 125.3% upside.

Key Takeaways

As the U.S. and China continue their tech and defense race, rare-earth metals and the companies that mine them might stand to benefit. USAR’s strategy of building a robust domestic mining supply chain for these metals could lead to lucrative future contracts. Therefore, post the LCM acquisition, the company might be a solid buy now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart