Technology stocks have continued to dominate headlines. Recently, Nvidia (NVDA) topped $5 trillion in market capitalization. This has been followed by a stellar set of Q3 2025 numbers from Alphabet (GOOG) (GOOGL) and the stock is already higher by 48% for the year.

An interesting point about Q3 is that healthy growth was witnessed across segments. This includes Google Search, YouTube ads, Google subscriptions, and cloud.

While GOOG stock has been in an uptrend, it’s likely that the positive momentum will sustain as Alphabet makes big investments for growth acceleration.

About Alphabet Stock

Alphabet is a provider of a wide range of products and platforms globally. This includes Google Search, advertising, Chrome, cloud, YouTube, and Android. With a market valuation of $3.3 trillion, Alphabet is among the tech giants that have created immense value over the years.

With AI-driven growth being the central theme, Alphabet stock has been in focus. Driven by innovation and big investments, the company has delivered stellar Q3 2025 numbers.

It’s therefore not surprising that GOOG stock has surged higher by 71% in the last six months. Further, with an optimistic growth outlook, there are reasons to remain bullish.

Strong Q3 Results

Alphabet posted strong Q3 2025 results, with quarterly revenue surpassing $100 billion for the first time. While revenue increased by 16% on a year-on-year (YoY) basis, diluted EPS swelled by 35% to $2.87.

Among the highlights, Google Cloud revenue increased by 34% to $15.2 billion. This was driven by growth in Google Cloud Platforms, AI infrastructure, and generative AI solutions.

It’s also worth noting that Google Cloud ended the quarter with a $155 billion backlog. This is likely to ensure that segment growth remains robust. Alphabet ended the quarter with 300 million paid subscribers, primarily for Google One and YouTube Premium. Further, the Gemini app has more than 650 million monthly active users.

Another important point to note is that for Q3, the company’s capital expenditure surged to $23.9 billion. On a YoY basis, the capex increased by 83%. With annual capex targeted in the range of $91 to $93 billion, growth is likely to be supported across business segments.

Even with significant investments, the company has reported trailing-twelve-month FCF of $73.6 billion. Additionally, Alphabet reported a cash buffer of $98.5 billion as of Q3 2025. Financial flexibility therefore remains high for innovation-driven growth. Amidst intense competition, significant investment in AI is likely to give Alphabet an edge.

What Analysts Say About GOOG Stock

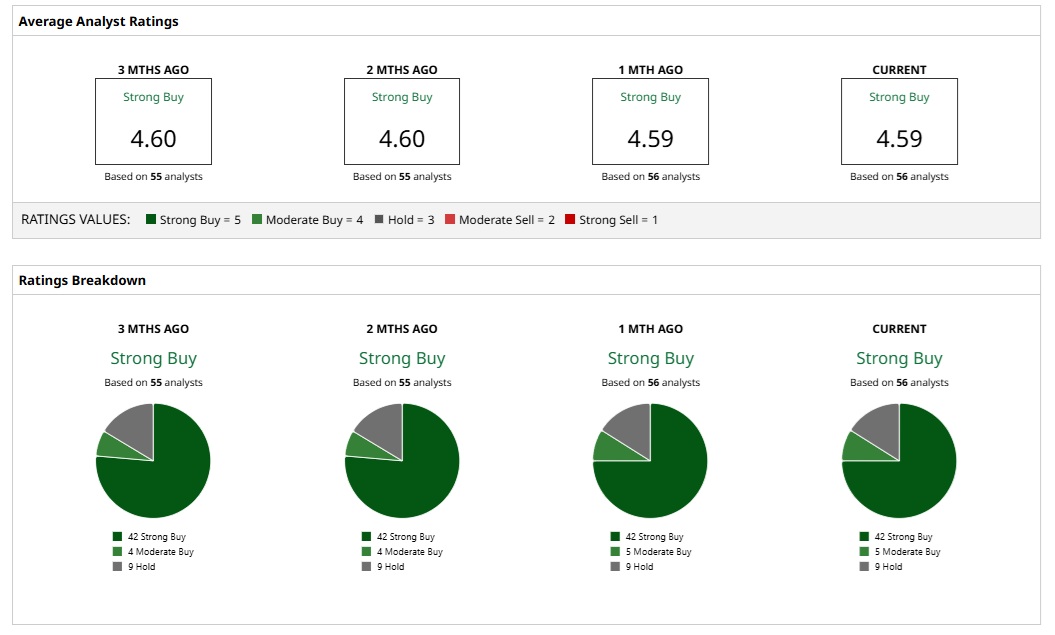

Analysts have an overwhelmingly positive outlook on GOOG stock. Based on the ratings of 56 analysts, the stock is a “Strong Buy.”

While 42 analysts have assigned a “Strong Buy” rating, five and nine analysts have a “Moderate Buy” and “Hold” rating, respectively. Overall, the mean price target for GOOG stock is $298.38. This is 5% lower than the current price of $283.56. However, the most bullish price target of $350 implies an upside potential of 24%. At the same time, the Q3 results will translate into a re-rating of GOOG stock and potentially additional higher price targets.

It’s worth noting that Evercore ISI has reiterated its “Outperform” rating for the stock with a price target of $325. Similarly, Barclays also has an “Outperform” rating with a price target of $315. The overall sentiment therefore looks optimistic, and the positive price action is backed by strong fundamental development.

From a valuation perspective, GOOG stock trades at a forward price-earnings ratio of 27. Valuations do not look stretched considering the point that analysts expect earnings growth for FY 2025 at 25%. Further, AI tailwinds are likely to last beyond the current year and will support strong earnings growth.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart