With a year-to-date gain of over 96%, SoFi stock (SOFI) is outperforming the markets by a wide margin this year. The gains appear all the more impressive, considering recent concerns over credit quality for certain financial institutions. Meanwhile, SoFi hasn’t just been a one-year wonder. This is the third consecutive year the fintech giant has outperformed the markets. The stock gained 55% last year, which was preceded by a 116% rise in 2023.

I have generally been bullish on SoFi for the last couple of years, even though I sold the bulk of my position amid the recent rally. In this article, we’ll look at SoFi’s 2026 outlook and examine whether the stock can continue its rally.

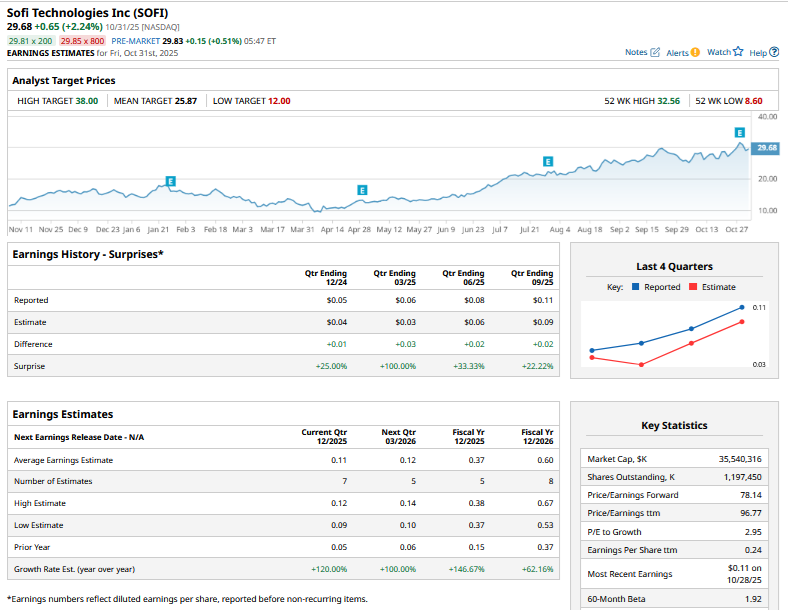

SoFi Stock 2026 Forecast

Here are the seven reasons I remain a long-term bull on SoFi stock

- Growing Member Base: One of the key reasons I invested in SoFi in the first place was its widening ecosystem with a rising member count that keeps swelling with every quarter. In Q3 2025, the Anthony Noto-led company added a record 905,000 members, which was up 35% year-over-year and lifted its total member count to 12.6 billion. The company’s new member count is now approaching a million people every quarter, which is quite astonishing.

- Rising Number of Products on Its Platform: The second key driver of SoFi’s flywheel is the growing product base. The company has added private market funds, co-branded debit cards, options trading, and international payments to its arsenal. It is also set to resume cryptocurrency trading in the current quarter after having previously abandoned that business. SoFi is betting big on blockchain and plans to integrate SoFi Pay with the yet-to-be-launched SoFi USD stablecoin

- Innovation: SoFi is also leveraging artificial intelligence (AI), and during the Q3 earnings call, it talked about the AI-driven Cash Coach, which helps users optimize their cash utilization across different accounts. Next year, it intends to launch what it calls a “more comprehensive SoFi Coach” that would expand the insights to more financial activities.

- Cross-Selling Opportunities: More personalized advisory services would help SoFi increase cross-sell penetration levels among its members. Cross-selling to its now nearly 13 million members is a key component of the SoFi flywheel, and during the third quarter, 40% of its 1.4 million new products were opened by existing members. Its cross-buy rate has increased for four consecutive quarters and reached the highest level since 2022 in the September quarter.

- Diversified Business: SoFi has a very diversified business and is no longer limited to lending. SoFi’s loan platform business, where it originates loans for third parties, is another key driver of the company’s growth. According to SoFi, annually, it is not able to lend to loan applications worth $100 billion. These are customers who don’t meet SoFi’s credit standards, but by originating loans for other lenders, SoFi gets low-risk, high-margin revenues. During Q3, SoFi originated $3.4 billion of loans through its loan platform business, which helped it generate $534 million in non-lending revenues.

- Efficient Lending Practices: Another reason I am bullish on SoFi is the company’s conservative lending practices. At a time when there are concerns over higher delinquencies in personal loans amid the economic stress in lower-income groups, SoFi’s annual charge-off rate in personal loans actually fell by 20 basis points to 2.6% in Q3. In the student loan portfolio, the metric fell by a similar quantum to 0.69%.

- Under Promise and Over Deliver: While a lot of fellow former SPACs have done the opposite, SoFi is a case of under promising and over delivering. The company is quite conservative with its guidance, and in Q3, it yet again raised the 2025 guidance.

Why SoFi Remains a Buy for the Long-Term

On a tactical level, falling interest rates are a positive for SoFi as it would help boost its student loan refinancing business – a segment that was once core for the company as it became the first company to refinance both federal and private student loans in 2012.

SoFi previously issued 2026 earnings per share guidance of $0.55 to $0.80 and expects its GAAP earnings to rise by between 20%-25% thereafter. The company raised its 2025 adjusted EPS guidance to $0.37, and I expect it to raise its 2026 guidance when it releases its next earnings report.

From a valuation perspective, SoFi trades at 37x the top end of its 2026 guidance, which, to be fair, does not look cheap. However, there aren’t many companies in the space that bring the kind of top-line and profitability growth that SoFi brings to the table. Overall, while I expect SoFi to end 2026 higher than current levels, investors should tone down their expectations after the stellar rally in the previous three years.

On the date of publication, Mohit Oberoi had a position in: SOFI . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Is Warning that a Popular AI Data Center Stock Could Plunge More Than 30% from Here

- Rare Earth Mining Stocks Are Taking Over Wall Street. Here’s 1 ETF to Buy to Profit.

- Athletic Apparel Icon Nike (NKE) Offers an Informational Arbitrage Opportunity

- Chevron's Free Cash Flow Rises - An Expected Dividend Hike Could Push CVX 14% Higher