IREN’s (IREN) bull run came to a halt in October, and the stock has been volatile since. Even though the stock still has potential, Wall Street opinions can often spook investors. Something similar is happening with IREN stock right now as H.C. Wainwright downgraded the stock to “Sell.” The firm’s analyst, Mike Colonnese, raised the target price from $36 to $45, which would still be a roughly 30% drop from current levels, but took away the previous “Buy” rating and issued a “Sell” in its place.

The downgrade suggests investors have started to factor in the valuation risk. Since Bitcoin (BTCUSD) is a part of the company’s business, the crypto-associated risk was already there. However, it now seems that, based on the AI infrastructure potential, the stock may also have run its course.

Investors would need to carefully assess their options with stocks like IREN. On the surface, per-megawatt (MW) calculations seem very attractive. However, they often do not include upfront revenue and involve heavy investments and wait times. Only if the company can monetize its data center infrastructure can it fulfill the high expectations analysts have assigned.

About IREN Stock

IREN is a vertically integrated data center and Bitcoin miner. It establishes its infrastructure in areas where renewable energy and high-speed fiber connectivity are easily available. The company is based in Sydney, Australia.

IREN has delivered 583% returns in 2025, touching an all-time high of $75.73 today. It has comprehensively outpaced the benchmark Nasdaq Composite’s ($NASX) year-to-date (YTD) returns of 24% by almost 24x. Looking at the performance during the last three years, the stock currently trades over 60x higher than the three-year low it touched back in December 2022. An aggressive pivot from Bitcoin mining towards AI cloud and high-performance computing (HPC) services fueled much of the investor appetite, and it kept providing support to IREN shares.

Recent weeks captivated a lot of attention, given the stock’s downgrading by some analysts on the fears of being extremely overvalued. There have also been talks of insider selling, which sparked a bit of a negative sentiment.

It is not surprising to see many investors and analysts dubbing IREN as an overheated scrip. At current levels, the stock trades at a trailing twelve-month GAAP price-to-earnings (P/E) ratio of 155x, which is 356% above the sector median. IREN also trades at a trailing twelve-month price-to-sales (P/S) ratio of 26x, compared to a sector median of 3.6x. Given the company’s recent $875 million convertible debt offering, it is important to look at valuation metrics that take account of broader capital structure too. Hence, IREN’s trailing twelve-month EV/sales and EV/EBITDA multiples stand at 33.8x and 84.1x, respectively. These compare with sector medians of 3.8x and 19.3x, respectively, clearly indicating overvaluation.

IREN Outperforms Revenue and Earnings Consensus

IREN announced the 2025 annual results on Aug. 28, beating the revenue and profit estimates for the final quarter. Fourth-quarter revenues of $188.9 million beat the consensus forecasts marginally by $1.4 million, bringing the total revenue proceeds for 2025 to $501 million. This was 168% higher than the 2024 topline figures of $187 million. During the final quarter, the company recorded adjusted EBITDA of roughly $122 million, comfortably beating the consensus estimates of $111 million. However, much of this is attributed to the unrealized gains of $148 million on financial instruments. Hence, it was a critical factor in registering a GAAP earnings per share (EPS) of $0.66, which was 230% higher than market forecasts.

For 2026, the management has provided optimistic guidance, estimating total revenues exceeding $927 million for the year. This will be backed by a healthy run rate revenue from AI cloud operations, which are expected to cross the $500 million mark during the first quarter. As per market consensus, first-quarter revenues will be slightly above $230 million, leading to $0.13 in GAAP EPS.

What Are Analysts Saying About IREN Stock?

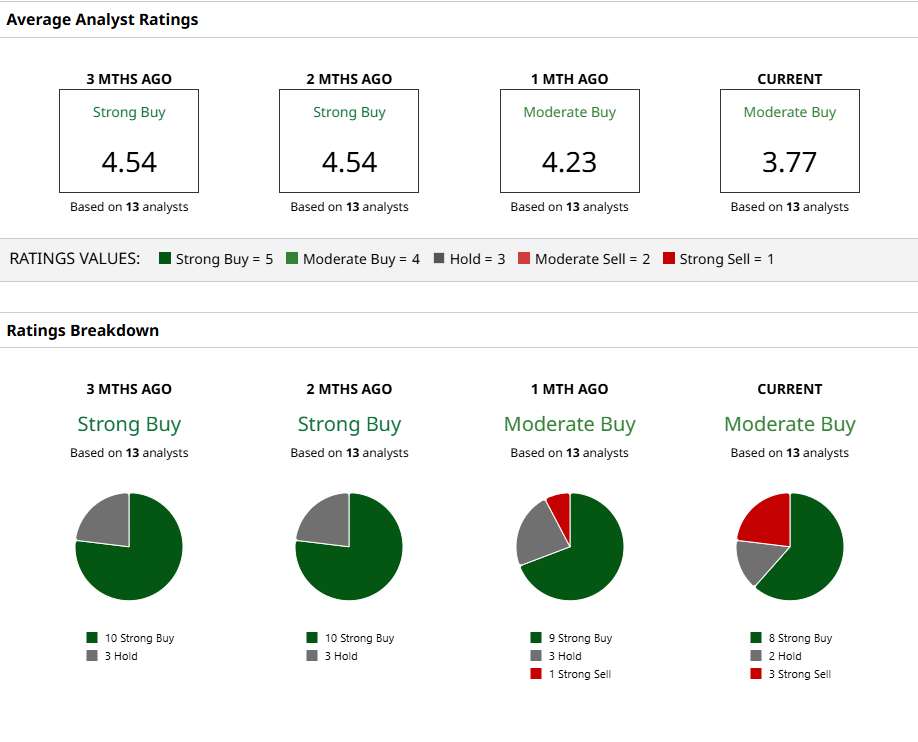

Despite recent pessimism, there is a strong bias towards bullish sentiment for IREN. Of the 13 analysts that cover the stock, eight still have a “Strong Buy” rating. In fact, the stock is trading just above its mean target price of $65.30, while the highest target price of $100 still offers 50% upside from current levels.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart