Core Scientific (CORZ) builds and operates data center infrastructure for crypto mining but has been pivoting sharply to artificial intelligence (AI) operations. This has coincided with a windfall for the company in the stock market, as companies like CoreWeave (CRWV) had previously expressed interest in acquiring the company.

Core Scientific terminated this merger agreement on Oct. 30.

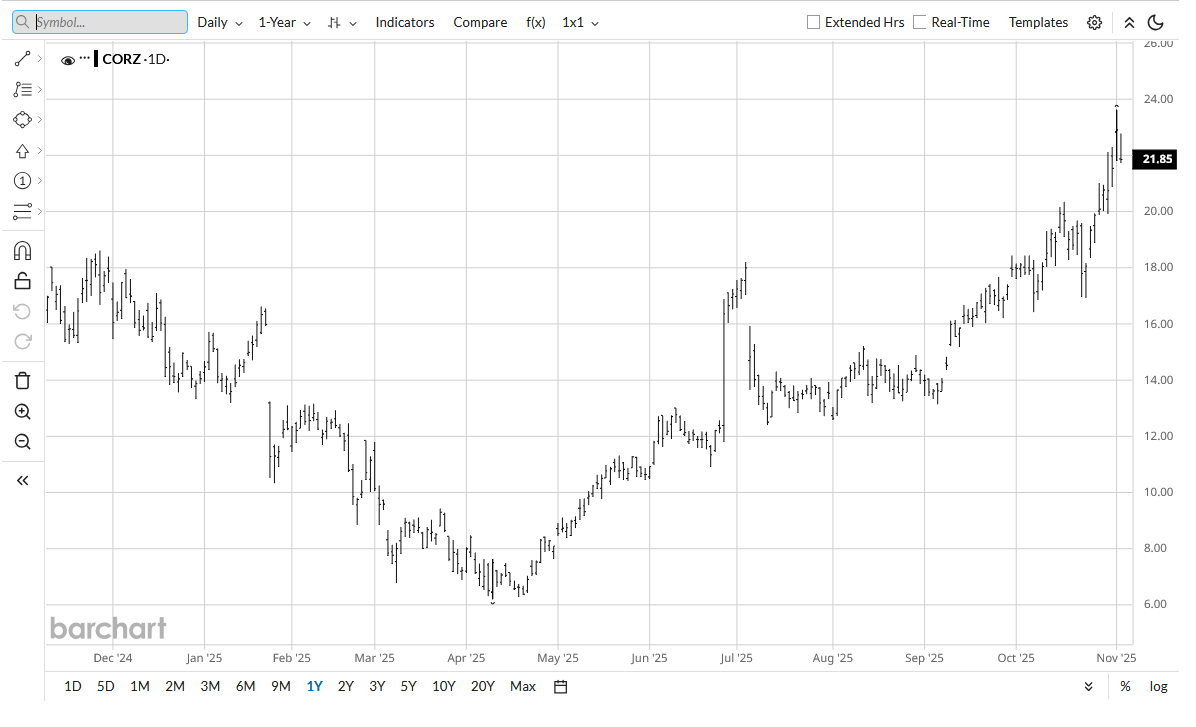

CoreWeave offered $9 billion for the company, but shareholders see much more value if they wait. It's easy to see why, considering CORZ stock is up 152% in the past six months. Despite a small hiccup this morning, the stock is down nearly 5%; the rally still seems strong.

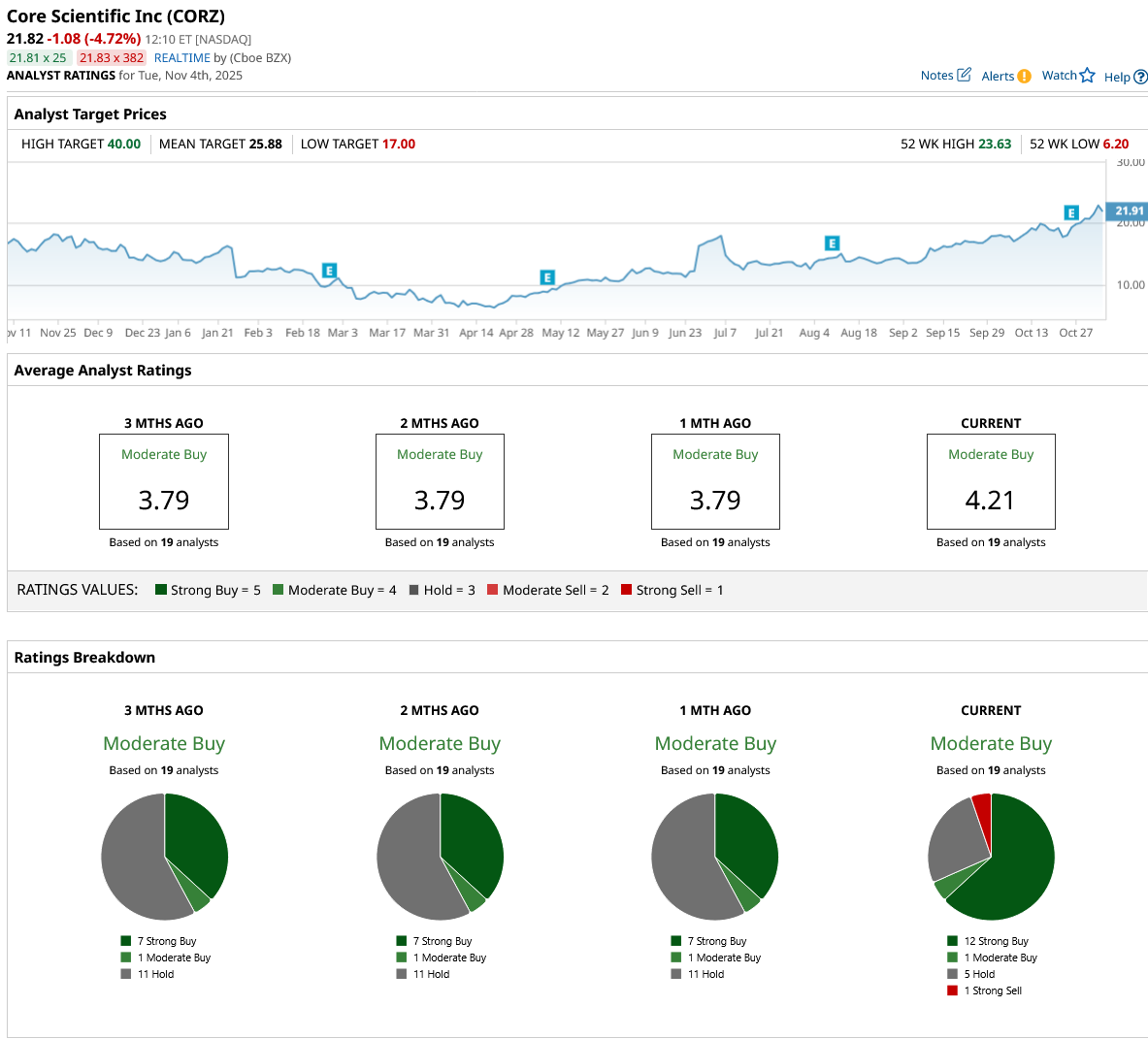

Analysts are also joining in, with highly ambitious price targets for CORZ stock.

Analysts Boost Price Targets for CORZ

A slew of analysts have been lining up to increase their price targets on the stock. Last week, Cantor Fitzgerald raised its price target on CORZ to $26, with Macquarie hiking its target to $34. B. Riley increased its price target to $30 from $17 the week prior.

Bernstein raised its price target this week from $17 to $24, and Roth Capital set a new Street high price target of $40.

Core Scientific's shareholders have made a prudent decision by forgoing the upside they would've gained from the CoreWeave acquisition. CORZ still has a market capitalization of $7.1 billion, below what CoreWeave offered. However, this refusal is being viewed as a sign of shareholder confidence and is resulting in a windfall.

The Potential Ahead for Core Scientific

Core Scientific has turned into a major beneficiary of the AI buildout. More contracts are likely to be signed as hyperscalers increase their data center-related expenditures.

Core Scientific retains an active contract from CoreWeave worth $8.7 billion in total revenue potential over the next 12 years. A $1.2 billion contract expansion was announced in February of this year. This is now one of the largest AI data center deals in the space, and more deals are likely as hyperscalers dispense hundreds of billions into the buildout effort.

Analysts expect positive EPS starting in 2026, with revenue growth of 113% to $801.2 million.

Should You Buy CORZ Stock Here?

The outlook looks increasingly rosy for Core Scientific. It has a large capacity and can land more multi-billion-dollar partnerships in the future. And simultaneously, the current contracted capacity plus the ongoing buildout is enough for shareholders and analysts to be confident that significantly more upside is possible.

The average price target is at $25.88 today, and the highest analyst price target of $40 means 83% more upside potential from here.

Analysts are turning even more bullish with time, with 12 of the 19 covering CORZ stock giving it a “Strong Buy.”

All things considered, I'd buy into the momentum. The longer-term potential remains dependent on how the broader AI buildout pays off, which is anyone's guess.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.

- Core Scientific Just Got a New Street-High Price Target. Should You Buy CORZ Stock Here?

- Bitcoin Whales Are Swimming Into ETFs. This Could Transform Crypto or End Up a Jagged Little Pill.