Shares of LiDAR company Luminar Technologies (LAZR) popped by more than 17% in yesterday's trading session after the company recently revealed that it has entered into a forbearance deal with a group of its debt holders. After failing to make interest payments on its 9.0% Convertible Second Lien Senior Secured Notes due 2030 and 11.5% Convertible Second Lien Senior Secured Notes due 2030, the noteholders have given their nod to not exercising their rights and remedies until Nov. 6.

And since Nov. 6 is at the doorstep, with the company's financial situation not expected to show any improvement, the only remedy left for Luminar is to renegotiate the terms with this group of debt holders. Though the management expects to work out longer forbearance agreements, the same confidence cannot be evoked from its track record.

About Luminar Technologies

Founded in 2012, Luminar specializes in LiDAR sensors and associated software/vision systems targeting automotive, commercial truck, and autonomous vehicle applications. These sensors help vehicles “see” in 3D, detecting obstacles, mapping surroundings, enabling advanced driver-assist systems (ADAS), and future autonomy. Luminar’s product portfolio includes sensors (Iris, Halo), software platforms (Sentinel, etc.), and integration into OEM (original equipment manufacturer) vehicles.

Valued at a market cap of $79.8 million, the LAZR stock is down 76% on a year-to-date (YTD) basis. For context regarding the sheer scale of the shareholder value lost since its listing, Luminar commanded a peak market cap of about $11 billion in December 2020.

So, should investors see the LAZR stock in a new light now, or is there only darkness in its future? I reckon it is the latter, and here are some of the reasons why.

Unprofitable: Forever & Ever

Financially, Luminar has been an unmitigated disaster. A disaster that has finally culminated in it missing its debt repayments. Moreover, over the past two years, Luminar's quarterly losses have come in narrower than Street expectations on just two occasions. The results for the latest quarter were along the same lines as well, with both revenue and earnings missing estimates.

For Q2 2025, revenue was $15.6 million, down 5% from the previous year, as net loss per share widened to $1.49 from $0.62. The Street was expecting a loss figure of $1.18 per share.

Although service revenue grew by 5x from the previous year to $3.7 million, core product revenues declined by 24% from the previous year to $12 million. Interest expense for the quarter jumped substantially to $12.3 million from $2.8 million in the prior year, hurting profitability.

Net cash used in operating activities for the first six months of 2025 fell to about $98 million from $158.9 million in the prior-year period. Although this was an encouraging development, its cash balance of $48.2 million appeared minuscule in front of its total debt levels of $429.7 million.

No Light At The End Of The Tunnel (Unless….)

Luminar has set several business milestones for the coming quarters. For instance, it is seeking to send its high-volume production line live in Thailand by the end of this year and the low-volume Halo prototype line launch by the end of the first quarter of 2026. However, on the other hand, the company has also raised doubts about its continuance as a going concern, as its biggest customer, Volvo (VLVLY), informed the company that beginning in April 2026, it will no longer make Luminar's Iris LiDAR standard on its EX90 and ES90 vehicles.

These contradictions hint towards perhaps the company being a takeover target. But why would a company look to acquire Luminar given its dire straits? Well, Luminar has some strengths that make it unique.

Halo is one of them. Luminar's Halo marks a fresh chapter in its LiDAR offerings, built from the ground up to outpace current ADAS tech or other sensors in speed, detection range, and pinpoint accuracy. At just one inch thick, a single kilogram, and consuming only 10 watts on average, it fits neatly into all sorts of vehicle spots without any hassle. Compared to the Iris from before, Halo takes a cleaner, more straightforward design that works across the board for customers. This means Luminar can focus on developing one main version instead of tweaking Iris setups for every different buyer.

To keep things lean, the company is also narrowing down to what matters most: the lasers, receivers, custom chips, light sensors, and the software that ties it all together. Anything less central gets outsourced to outside experts for building. Those partnerships kick in around 2026 and could shave off more than $80 million in expenses by tapping into specialists who handle that side better.

Analyst Opinion

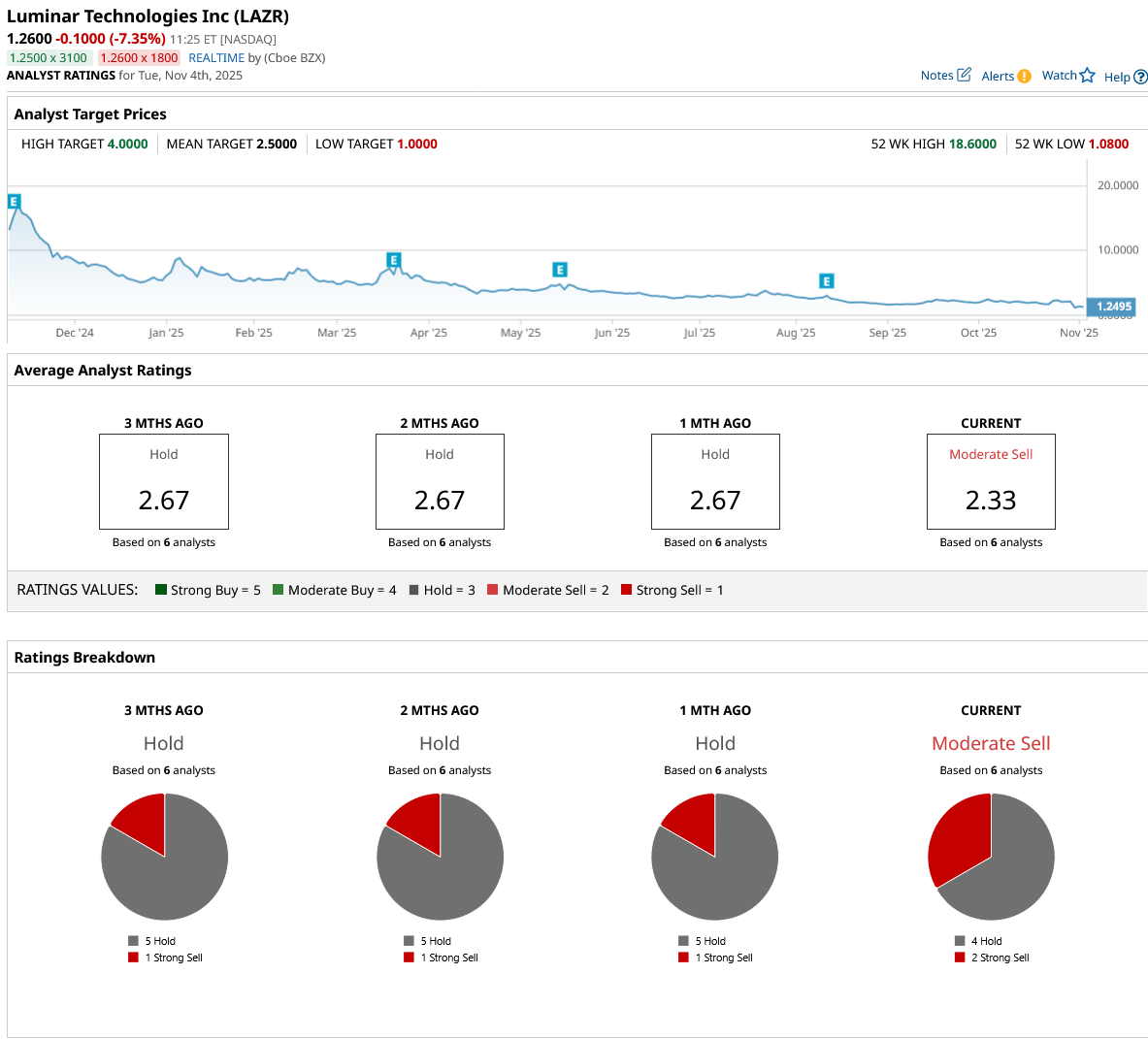

Overall, analysts have deemed the LAZR stock to still be a “Moderate Sell,” with a mean target price of $2.50. This denotes an upside potential of about 98% from current levels. Out of six analysts covering the stock, four have a “Hold” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.

- Core Scientific Just Got a New Street-High Price Target. Should You Buy CORZ Stock Here?

- Top 100 Stocks to Buy: Two Penny Stocks Moved Up 51 Spots. Should You Buy Either?