- Aritzia (ATZAF) is an integrated fashion design house showing strong technical momentum and consistent price appreciation.

- Shares are trading at a new all-time high.

- ATZAF has a 100% “Buy” opinion from Barchart and a Trend Seeker “Buy” signal.

- Shares are up 110% over the past year.

Today’s Featured Stock

Valued at $8.26 billion, Aritzia (ATZAF) is an integrated design house of exclusive fashion brands. Its geographical segments include Canada and the United States. The company generates most of its revenue from retail, followed by e-commerce. Aritzia has become increasingly popular due to its relationship with fashion influencers, and has even been showcased by celebrities like Sabrina Carpenter.

What I’m Watching

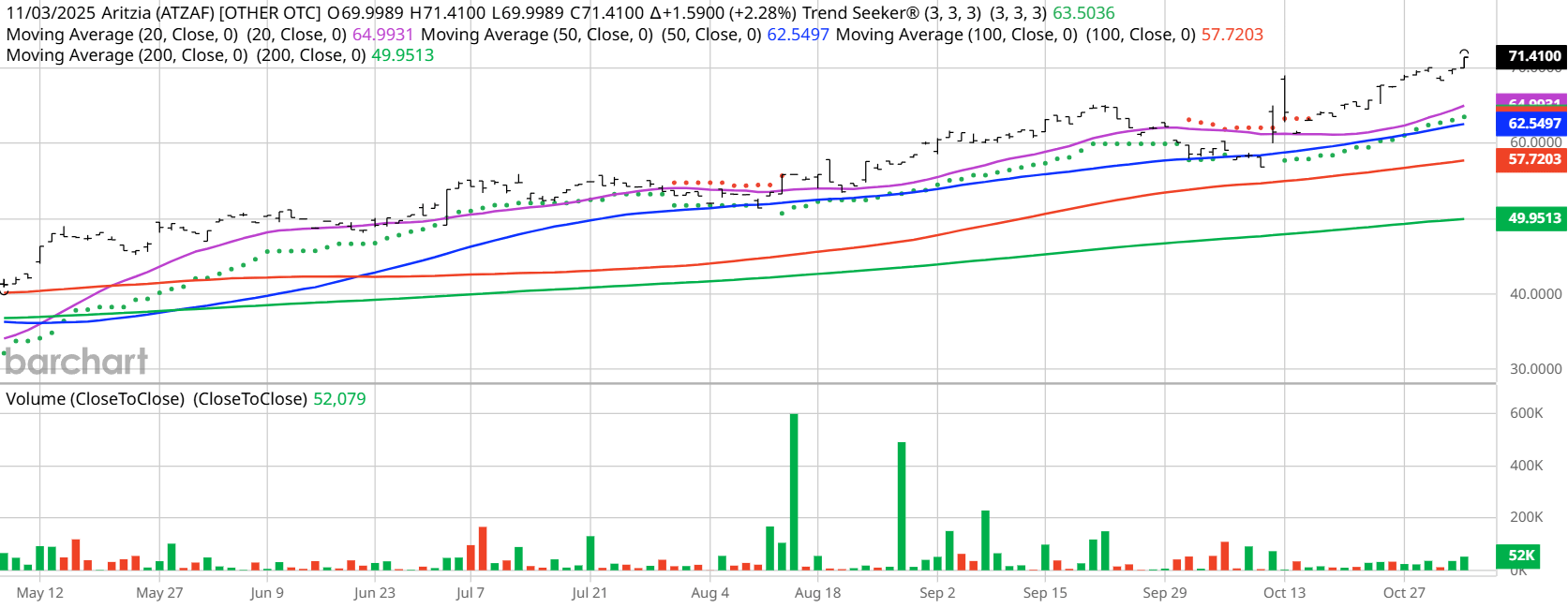

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. ATZAF checks those boxes. Since the Trend Seeker signaled a new “Buy” on Oct. 16, the stock has gained 8.21%.

Barchart Technical Indicators for Aritzia

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

Aritzia hit an all-time high of $71.41 in intraday trading on Nov. 3.

- ATZAF has a Weighted Alpha of +115.58.

- Aritzia has a 100% “Buy” opinion from Barchart.

- The stock gained 109.52% over the past year.

- ATZAF has its Trend Seeker “Buy” signal intact.

- The stock recently traded at $68.43 with a 50-day moving average of $62.79.

- Aritzia has made 7 new highs and gained 16.9% in the last month.

- Relative Strength Index (RSI) is at 58.87.

- There’s a technical support level around $70.49.

Don’t Forget the Fundamentals

- $8.26 billion market capitalization.

- Revenue is projected to grow 22.61% this year and another 13.08% next year.

- Earnings are estimated to increase 33.70% this year and an additional 30.65% next year.

Analyst and Investor Sentiment on Aritzia

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.

It looks like Wall Street analysts are high on ATZAF.

- Value Line rates the stock “Above Average” with a price target of $122.

- CFRA’s MarketScope Advisor rates it a “Buy.”

- Morningstar thinks the stock is 29% overvalued.

- 2,760 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold.”

The Bottom Line on Aritzia

Although Morningstar focuses on the high price-earnings ratio, Wall Street analysts seem to be bullish.

Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Royal Caribbean’s (RCL) Options Implosion Offers Up a Massive Informational Arbitrage Trade

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.

- Core Scientific Just Got a New Street-High Price Target. Should You Buy CORZ Stock Here?