With a market cap of $20.5 billion, NiSource Inc. (NI) is a regulated energy holding company that provides natural gas and electric utility services across the United States. Operating through its Columbia and NIPSCO segments, the company serves millions of customers and manages a diverse energy portfolio that includes coal, gas, hydro, wind, and solar generation assets.

Shares of the Merrillville, Indiana-based company have outperformed the broader market over the past 52 weeks. NI stock has increased 21.7% over this time frame, while the broader S&P 500 Index ($SPX) has risen 17.5%. Moreover, shares of the company are up 16.6% on a YTD basis, compared to SPX’s 15.6% gain.

Focusing more closely, shares of the energy holding company have also outpaced the Utilities Select Sector SPDR Fund’s (XLU) 13.4% return over the past 52 weeks.

Despite NiSource’s better-than-expected Q3 2025 revenue of $1.27 billion, its stock fell 2.1% on Oct. 29. The company’s adjusted EPS of $0.19 missed the consensus estimate and declined from $0.20 in the prior-year quarter. Additionally, investors likely reacted cautiously to the announcement of a massive $28 billion capital expenditure plan - a 45% increase over the prior plan.

For the fiscal year ending in December 2025, analysts expect NI’s adjusted EPS to grow 7.4% year-over-year to $1.88. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

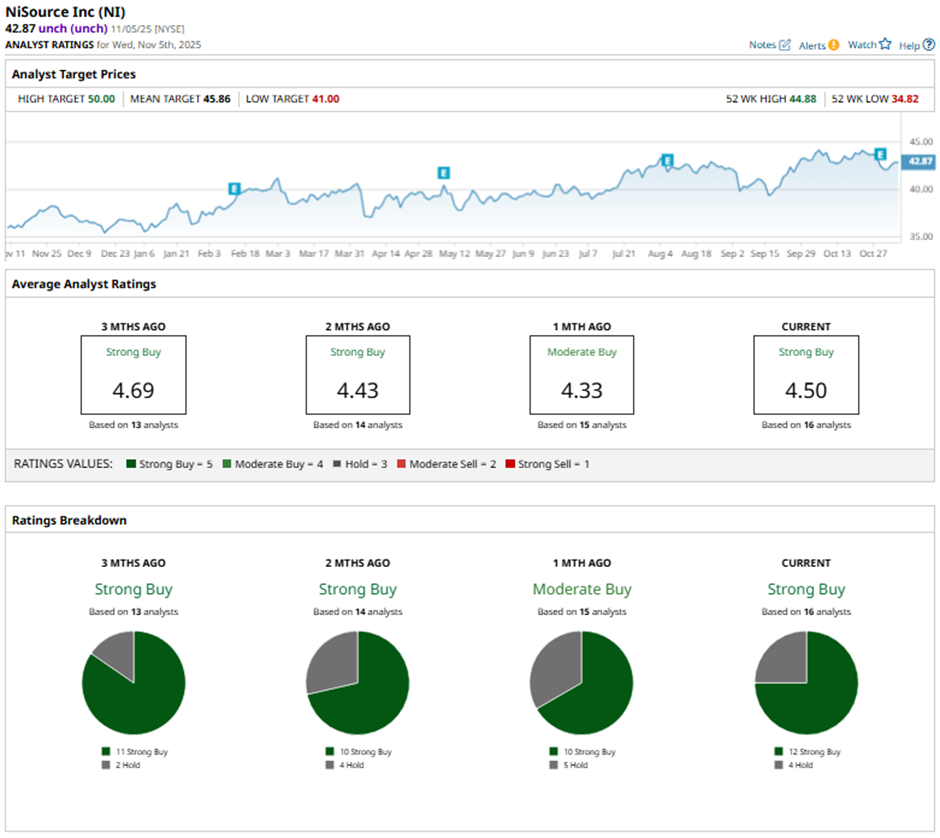

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 12 “Strong Buys” and four “Holds.”

This configuration is slightly more bullish than three months ago, with 11 “Strong Buy” ratings on the stock.

On Oct. 31, Jefferies upgraded NiSource to Buy with a price target of $50.

The mean price target of $45.86 represents a premium of nearly 7% to NI's current levels. The Street-high price target of $50 implies a potential upside of 16.6% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart