Valued at a market cap of $52.3 billion, MetLife, Inc. (MET) is a financial services company that provides insurance, annuities, employee benefits, and asset management services. The New York-based company is recognized for its financial strength, global reach, and focus on helping customers build a more secure financial future.

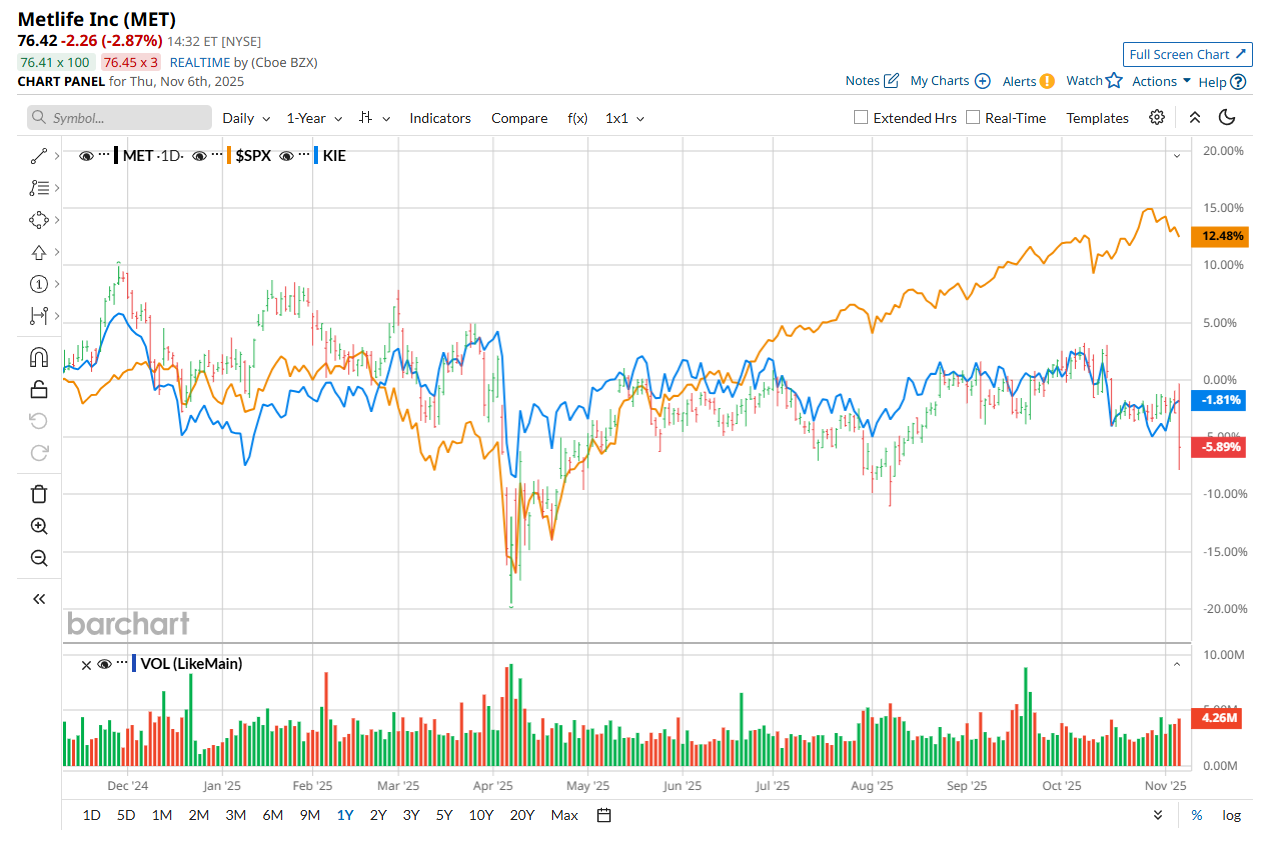

This financial services company has underperformed the broader market over the past 52 weeks. Shares of MET have declined 8.7% over this time frame, while the broader S&P 500 Index ($SPX) has surged 13.7%. Moreover, on a YTD basis, the stock is down 7.2%, compared to SPX’s 14.6% return.

Narrowing the focus, MET has also lagged the SPDR S&P Insurance ETF (KIE), which is down 1.8% over the past 52 weeks and up 1.9% on a YTD basis.

MET released mixed Q3 earnings results after the market closed on Nov. 5. The company’s total revenue declined 5.9% year-over-year to $17.4 billion and missed analyst estimates by 8.4% as net investment losses and derivatives losses pressured the top line. Nonetheless, its adjusted EPS of $2.37 improved 21.5% from the year-ago quarter, surpassing consensus expectations of $2.32.

For the current fiscal year, ending in December, analysts expect MET’s EPS to grow 7.2% year over year to $8.69. The company’s earnings surprise history is disappointing. It missed the consensus estimates in three of the last four quarters, while surpassing on another occasion.

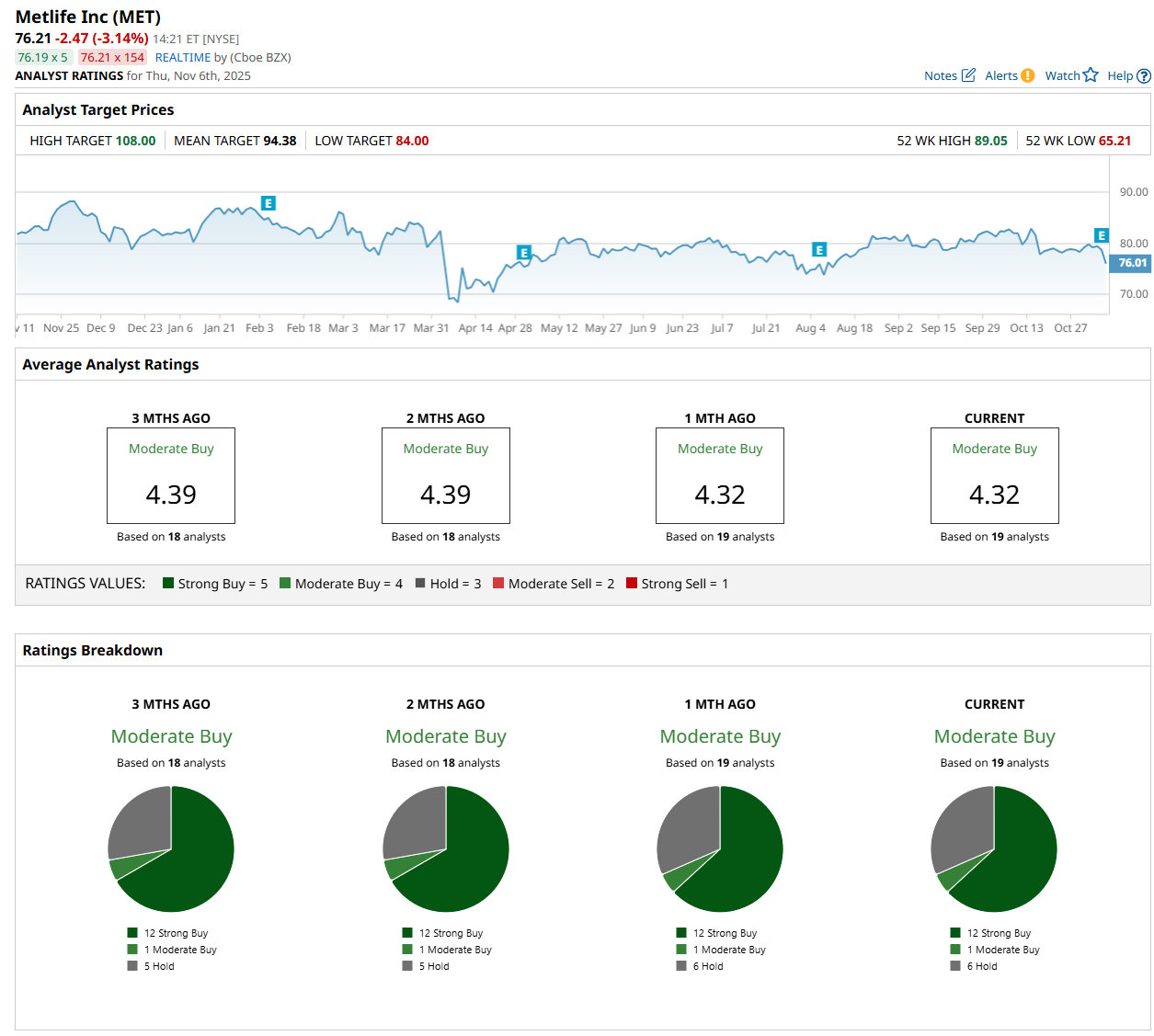

Among the 19 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” one “Moderate Buy,” and six "Hold” ratings.

The configuration has remained fairly stable over the past three months.

On Nov. 6, UBS Group AG (UBS) analyst Michael Ward CFA maintained a "Buy" rating on MET and set a price target of $95, indicating a 24.7% potential upside from the current levels.

The mean price target of $94.38 represents a 23.8% premium from MET’s current price levels, while the Street-high price target of $108 suggests an upside potential of 41.7%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Tesla Faces Another Sales Hit in Europe. Should You Ditch TSLA Stock Now?

- Should You Buy the Post-Earnings Dip in Axon Stock or Stay Far, Far Away?

- Michael Burry Abandons UnitedHealth Stock With Shares Down 35% YTD. Should You Sell UNH or Buy the Dip?

- Should You Buy the Post-Earnings Plunge in Celsius Stock?