It doesn’t seem like it at first glance but baseball utilizes a heavy dosage of Russian axioms. Borrowing from the foundational work of Andrey Kolmogorov, what we know as sabermetrics is essentially applied probability theory. Fundamentally, every MLB team conducts forward distributions, expectation values, state transitions (i.e. Markov chains), Bayesian updating and regressions.

With the benefits of advanced analytics so obvious to even casual onlookers, it raises an uncomfortable but necessary question: if a children’s game utilizes the relevant and logical frameworks of Russian axioms, how is it that the financial publication industry lags so far behind?

At the core, the defensive analytics used allow players to best position themselves to disrupt the opposing team’s offensive intentions. For example, most people bat right-handed and they tend to pull the ball to the left side of the field. As such, the shortstop will statistically see the most action and therefore, it’s one of the most demanding positions.

What investors are slowly starting to understand, though, is that the stock market operates in a similar fashion. Certain securities tend to pull the ball, so to speak. Under specific quantitative structures — such as extended period of buying or selling activities — the balls that are put in play tend to cluster in certain areas more so than others.

By understanding these tendencies, you can position your trades accordingly, thereby taking advantage of the potential delta between expected results and empirically realistic outcomes.

Colloquially, this is the heart of quantitative analysis and it’s arguably the most groundbreaking innovation in finance. That’s because you’re no longer guessing where a public security may end up. Instead, you’re focusing on where the target stock is likely to cluster, improving your odds and minimizing your losses.

Colgate-Palmolive (CL)

One of the global leaders in the oral care hygiene market, Colgate-Palmolive (CL) on paper represents an intriguing idea amid broader economic pressures. Basically, no matter what happens, people have to brush their teeth. However, the market hasn’t quite seen it that way, with CL stock losing more than 13% on a year-to-date basis. Also, the Barchart Technical Opinion indicator rates Colgate as an 88% Strong Sell.

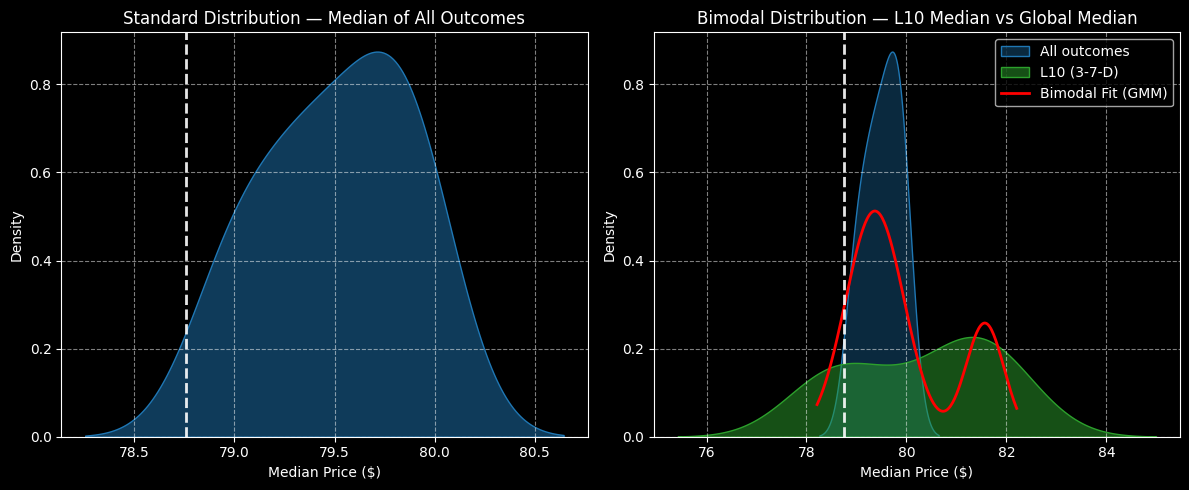

Despite the red ink, CL stock could be an intriguing idea for a possible comeback. Using Russian axioms on a dataset going back to January 2019, Colgate’s forward 10-week median returns can be arranged in a distributive curve, with prices ranging between $78.20 and $80.70 (assuming an anchor price of $78.76). Further, price clustering would be expected to be predominant at $79.70.

However, the current quantitative structure of CL stock is arranged in a 3-7-D formation: in the last 10 weeks, CL printed three up weeks and seven down weeks, with an overall downward slope. Under this sequence, prices can be expected to range between $76 and $85. Most importantly, price clustering may predominantly occur around $81.50.

Based on the price density dynamics and using the information provided by Barchart Premier, we can identify the 80/82.50 bull call spread expiring Dec. 19 as arguably the most sensible trade. Here, the maximum payout stands at over 127% if CL stock rises through the second-leg strike. Also, the breakeven price is contextually manageable at $81.10.

Home Depot (HD)

Another “boring” idea for traders to consider is Home Depot (HD). Under the prior paradigm, when investors were falling head over heels for various tech entities, HD stock would have been almost completely irrelevant. Now, with broader jitters affecting sentiment, the home improvement retailer seems like a reasonable investment. What’s more, market participants can use the leverage of options to boost return potential.

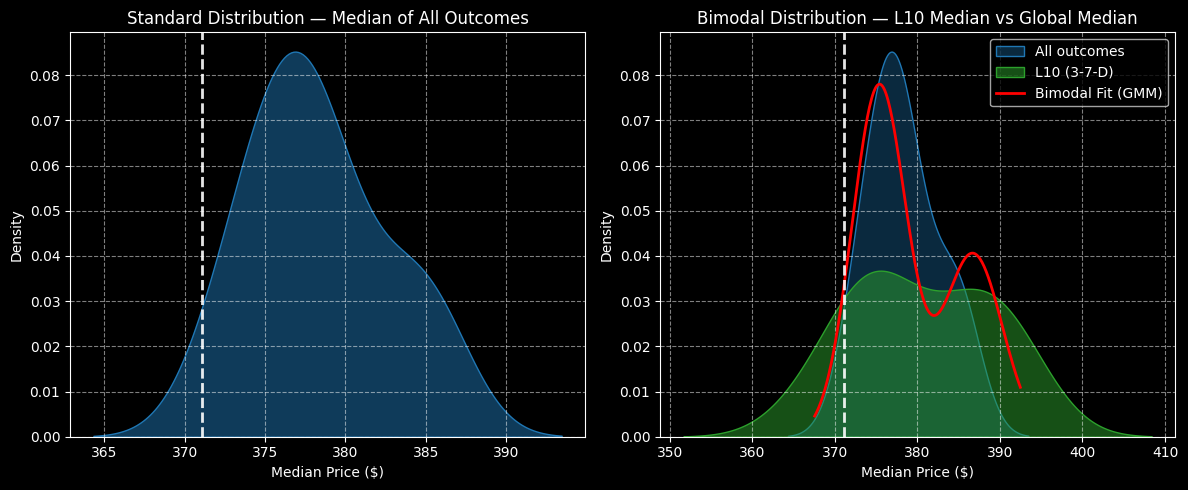

Again, using Russian axioms on a dataset going back to January 2019, Home Depot’s forward 10-week median returns can be arranged as a distributive curve, with outcomes ranging between $365 and $393 (assuming an anchor of $371.11). Further, price clustering will likely be predominant at $377.

However, HD stock is not in a homeostatic state but in a highly distributive state. For example, in the past month, the security lost more than 3%. In the last 10 weeks, HD has been quantitatively arranged in a 3-7-D sequence. Under this condition, the forward 10-week outcomes would be expected to range between $352 and $408.

To be fair, primary price clustering would likely occur at around $374, which is a bit lower than the standard state. However, secondary clustering may materialize at about $388. Based on this data, aggressive traders may consider the 380/390 bull spread expiring Dec. 19, which carries a payout of nearly 144%.

Kraft Heinz (KHC)

Finally, we’ll end today’s list with another boring name that could be due for a sentiment reversal. Kraft Heinz (KHC) manufactures and markets food and beverage products in the U.S. and other international regions. Theoretically, this business should benefit from the trade-down effect as consumers eschew eating out and other luxuries for grocery-related fare. That just hasn’t happened, at least in the case of KHC stock.

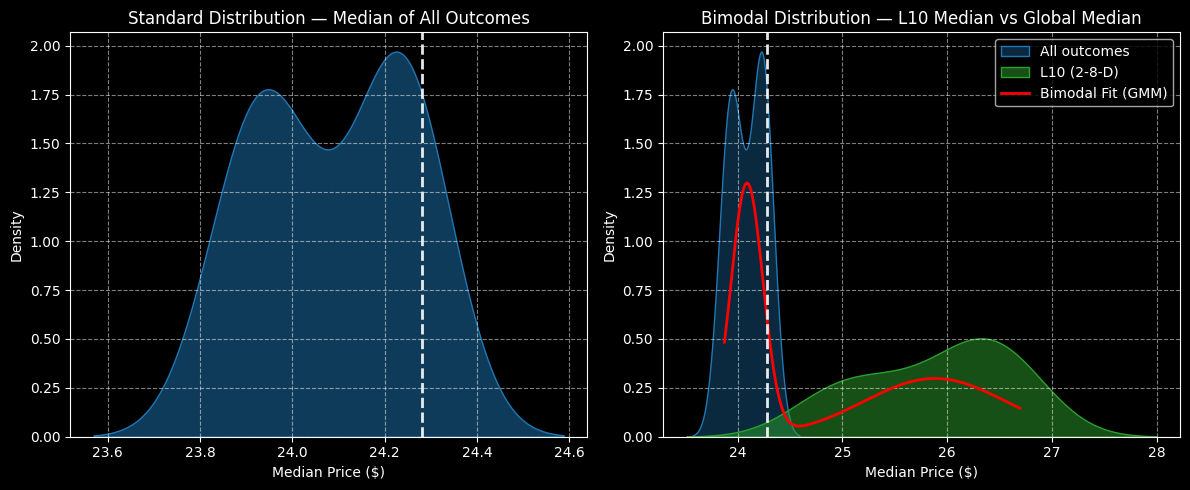

However, there could be a turnaround brewing. While KHC stock did lose about 2% last week, on Friday, it managed to move up 2.36%. That’s encouraging for a security that’s down nearly 21% YTD. Of course, KHC has a negative bias, with its forward 10-week returns likely to range between $23.60 and $24.60 (assuming an anchor of $24.28). Further, primary and secondary clustering will likely occur at $24.25 and $23.85, respectively, which is rather poor.

What makes KHC stock appealing to risk-takers, though, is that it’s quantitatively structured in a 2-8-D sequence. Under this condition, the risk-reward spectrum shifts firmly to the right (positive), with outcomes ranging between $23.20 and $28. Critically, primary clustering may occur at $26.40.

Those who want to be aggressive may consider the 22.50/27.50 bull spread expiring Dec. 19, which features a maximum payout of over 155%. Those who are super-aggressive may consider the 25/27.50 bull spread, also expiring on Dec. 19. The payout here stands at a whopping 525%.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: How the Game of Baseball Can Be Used to Effectively Trade Options

- Core Scientific Just Rejected CoreWeave’s Bid. Should You Buy CRWV Stock Here or Stay Far Away?

- This Little-Known Stock Just Got a Major Trump Boost and Analysts Think It Can Gain 95% from Here

- 5 Best Dividend Stocks Wall Street Calls Strong Buys