When I got into this fascinating business over 40 years ago, I was 20-something-year-old cub markets reporter working right on the trading floors of the Chicago Mercantile Exchange and the Chicago Board of Trade. My first few weeks on the job were tough because I did not know the trading lingo that pit traders would use. But I eventually learned.

While most of the teeming pits and open-outcry trading in Chicago and New York are now history, due to electronic trading, the arcane language of the traders carries on.

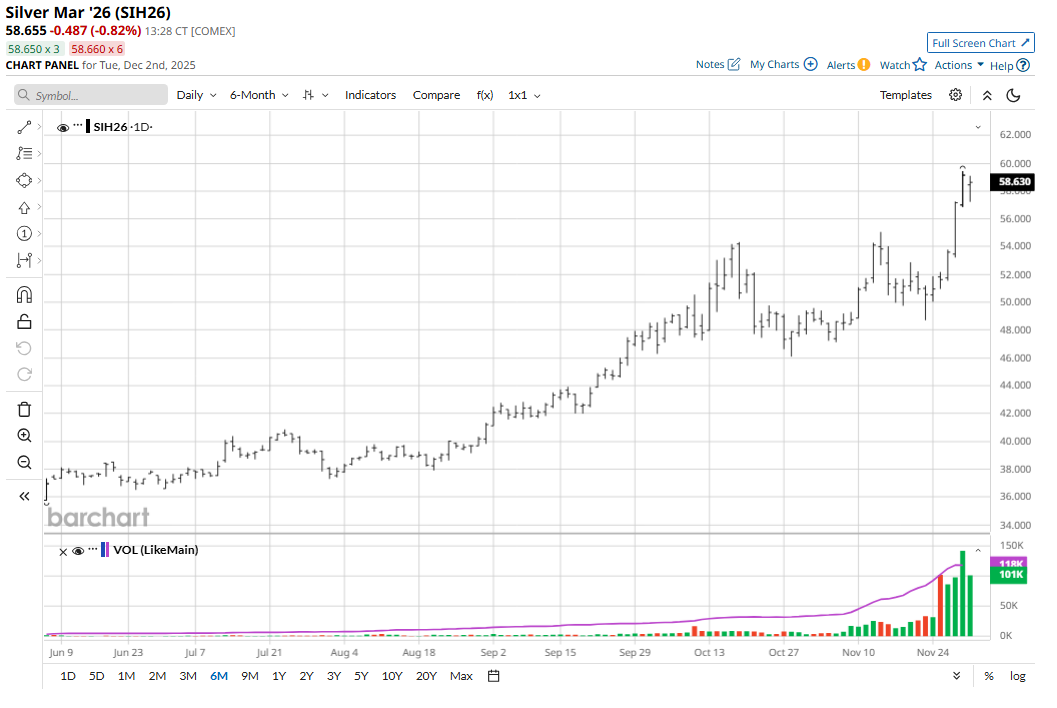

In this feature, I’ll discuss one arcane element that is impacting the silver futures market at present: a short squeeze. I’ll also discuss a more easily understood element: margin calls.

Margin Calls Impacting Silver Traders

I got an email yesterday from a reader asking me to write a story on big banks getting margin calls on their short silver (SIH26) trades. I did some poking around and could find nothing significant regarding large banks getting into trouble recently from big margin calls on their silver trades.

However, given the fact that silver futures prices had at one point Monday rallied over $6.00 an ounce from last Wednesday’s close in March Comex futures, it’s very likely that traders and some financial institutions who were aggressive enough to be “naked” shorts (more trading lingo!) in the silver futures market did get some margin calls from their brokers. Also, the recent spike in silver price volatility prompted increased margin requirements from the MCX, the largest futures exchange in India.

Margin calls from brokerages occur when the value of a client’s assets, such as leveraged silver positions, drops significantly, requiring them to add more capital, or margin money, to their account to cover potential losses. The extremely volatile silver market has turned into a gunslinger’s affair for individual, or retail, traders. That means both the silver bulls and the bears can be whipsawed enough during one trading session to be stopped out, or forced out, of their positions.

What About the Reported ‘Short Squeeze’ in the Silver Market?

Indeed, a significant short squeeze is currently playing out in the silver markets. This is due to combination of declining physical supplies, strong industrial and retail demand, and geopolitical and economic uncertainty causing stockpiling and even hoarding of the metal.

Such has forced short sellers to buy back silver to cover their underwater positions, which has amplified the price rally (squeezed the shorts) and caused a shortage, particularly in the London market.

High silver lease rates and the premium of the London price over the New York price have exacerbated the squeeze. High lease rates for physical silver indicate that lenders are commanding a premium to provide metal, a classic sign of tightness in the physical market. The significant price difference between the London and New York markets created arbitrage opportunities, with traders even shipping silver across the Atlantic to try and capitalize on the price difference.

Expectations of U.S. interest rate cuts by the Federal Reserve, including the next cut likely coming next week, are also boosting demand for precious metals.

Where Will Silver Prices Go from Here?

Despite the high volatility, I’m still overall bullish on gold and silver, based on the bullish longer-term technicals still in place. The shorter-term technical postures for both metals markets have improved in the past few weeks. Silver prices are well back above $50.00, which is a big deal for both silver and gold. I would not be surprised to see $65.00 silver before the end of this year, and $75.00 silver in 2026. However, I will again warn the shorter-term speculative futures traders that the present extremely high daily price volatility is a gunslinger’s market that can quickly burn the fingers of both the bulls and the bears who try to play with fire.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart