Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at New Mountain Finance (NASDAQ: NMFC) and the best and worst performers in the specialty finance industry.

Specialty finance companies provide targeted lending or financial services for specific industries or needs. They benefit from expertise in particular sectors, often reduced competition in specialized niches, and tailored underwriting that can yield higher margins. Challenges include concentration risk in specific industries, difficulty achieving scale efficiencies, and potential vulnerability during sector-specific downturns affecting their specialized markets.

The 12 specialty finance stocks we track reported a satisfactory Q2. As a group, revenues missed analysts’ consensus estimates by 3.8%.

In light of this news, share prices of the companies have held steady as they are up 2.9% on average since the latest earnings results.

New Mountain Finance (NASDAQ: NMFC)

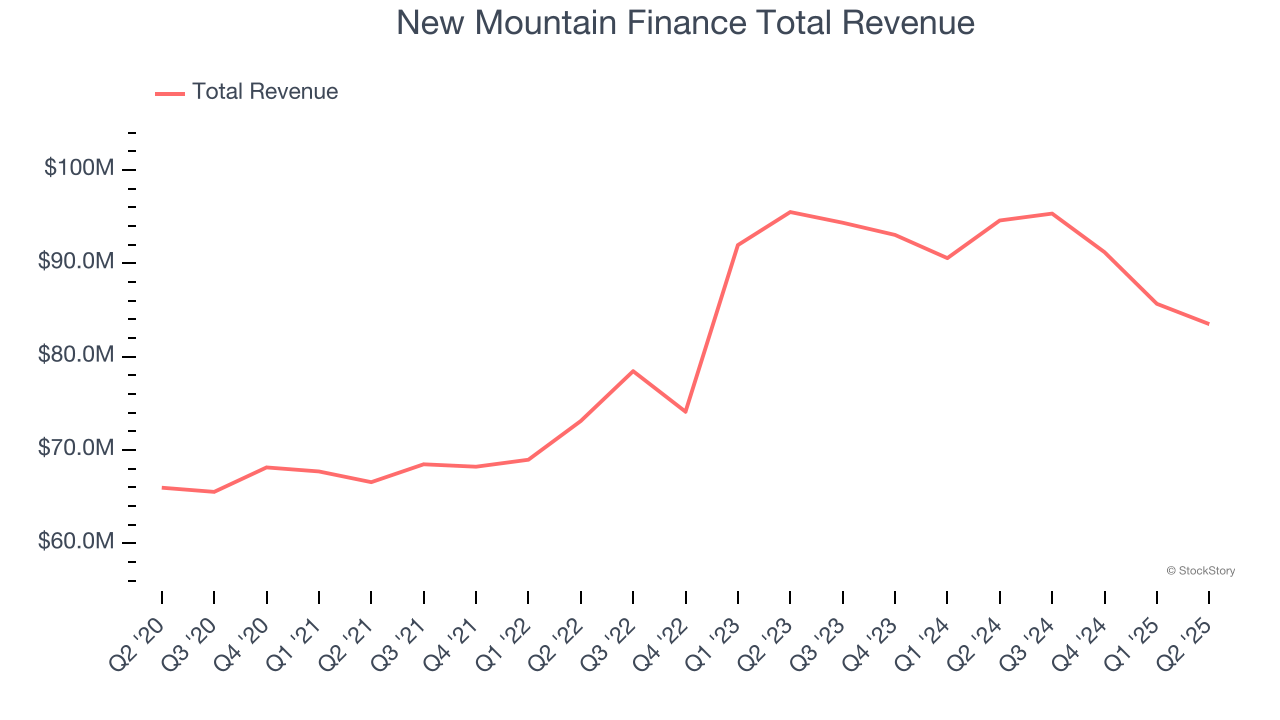

Operating as a financial bridge for growing businesses that might be overlooked by traditional banks, New Mountain Finance (NASDAQ: NMFC) is a business development company that provides loans and debt financing to middle-market companies in defensive growth industries.

New Mountain Finance reported revenues of $83.49 million, down 11.7% year on year. This print fell short of analysts’ expectations by 1.6%. Overall, it was a slower quarter for the company with some shareholders anticipating a better outcome.

“In Q2, NMFC once again delivered its dividend, despite tight credit spreads in the market generally,” said Steven B. Klinsky, NMFC Chairman and New Mountain Capital CEO.

Unsurprisingly, the stock is down 6.7% since reporting and currently trades at $9.61.

Read our full report on New Mountain Finance here, it’s free.

Best Q2: Encore Capital Group (NASDAQ: ECPG)

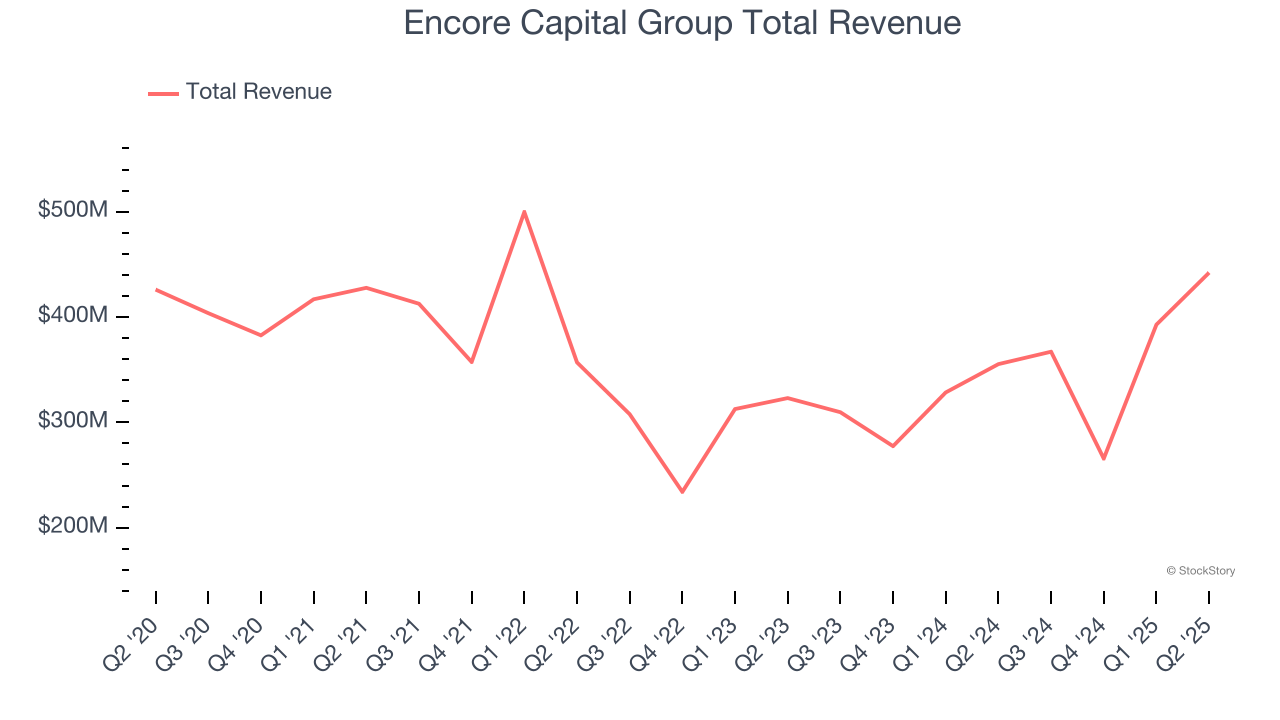

Operating in the often misunderstood world of debt collection since 1999, Encore Capital Group (NASDAQ: ECPG) purchases portfolios of defaulted consumer debt at deep discounts and works with individuals to recover these obligations while helping them toward financial recovery.

Encore Capital Group reported revenues of $442.1 million, up 24.4% year on year, outperforming analysts’ expectations by 15.3%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

Encore Capital Group achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 11.7% since reporting. It currently trades at $41.80.

Is now the time to buy Encore Capital Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Oaktree Specialty Lending (NASDAQ: OCSL)

Managed by Oaktree Capital Management, one of the world's premier alternative investment firms, Oaktree Specialty Lending (NASDAQ: OCSL) is a business development company that provides customized financing solutions to mid-market companies across various industries.

Oaktree Specialty Lending reported revenues of $75.27 million, down 20.7% year on year, falling short of analysts’ expectations by 4.6%. It was a disappointing quarter as it posted a significant miss of analysts’ AUM estimates.

As expected, the stock is down 2.6% since the results and currently trades at $13.15.

Read our full analysis of Oaktree Specialty Lending’s results here.

Ares Capital (NASDAQ: ARCC)

As one of the largest business development companies in the United States with over $20 billion in assets, Ares Capital (NASDAQ: ARCC) is a business development company that provides financing solutions to middle-market companies, primarily through direct loans and equity investments.

Ares Capital reported revenues of $745 million, down 1.3% year on year. This number came in 0.6% below analysts' expectations. All in all, it was a slower quarter for the company.

The stock is down 10.3% since reporting and currently trades at $20.35.

Read our full, actionable report on Ares Capital here, it’s free.

Farmer Mac (NYSE: AGM)

Created by Congress in 1987 to build a bridge between Wall Street and rural America, Farmer Mac (NYSE: AGM) provides a secondary market for agricultural and rural loans, helping lenders increase their liquidity and lending capacity to serve rural America.

Farmer Mac reported revenues of $93.98 million, up 13.1% year on year. This print lagged analysts' expectations by 2.6%. Overall, it was a slower quarter for the company.

The stock is down 2.9% since reporting and currently trades at $167.

Read our full, actionable report on Farmer Mac here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.