Prudential has been treading water for the past six months, holding steady at $107.78. The stock also fell short of the S&P 500’s 16.4% gain during that period.

Is now the time to buy Prudential, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Prudential Will Underperform?

We don't have much confidence in Prudential. Here are three reasons there are better opportunities than PRU and a stock we'd rather own.

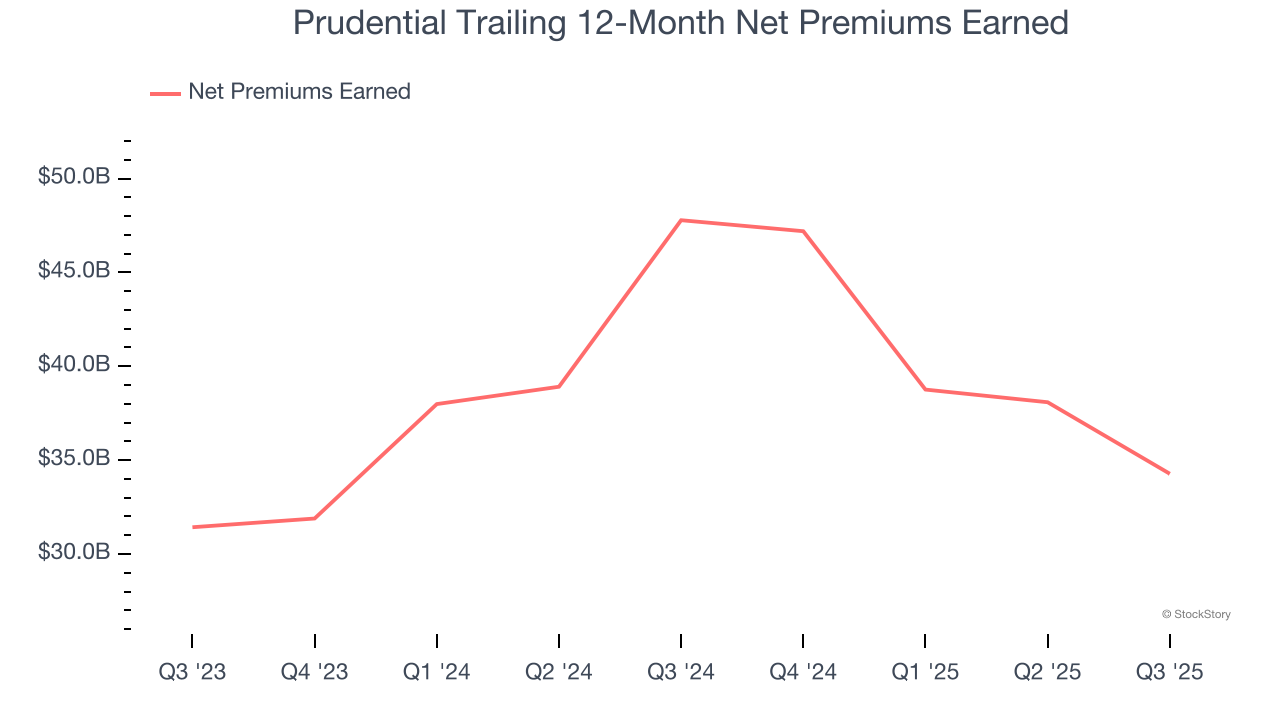

1. Declining Net Premiums Earned Reflect Weakness

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Prudential’s net premiums earned has declined by 3.1% annually over the last five years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

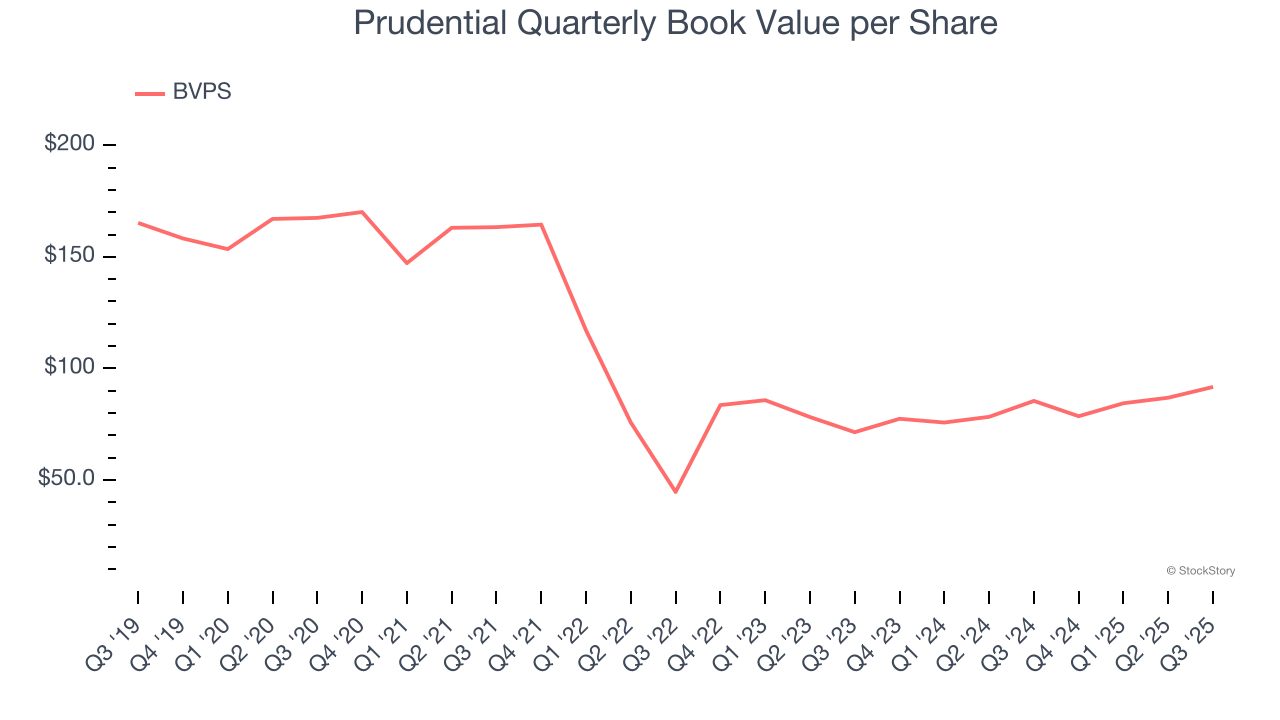

2. BVPS Growth Demonstrates Strong Asset Foundation

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Although Prudential’s BVPS declined at a 11.3% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at a decent 13.3% annual clip (from $71.44 to $91.72 per share).

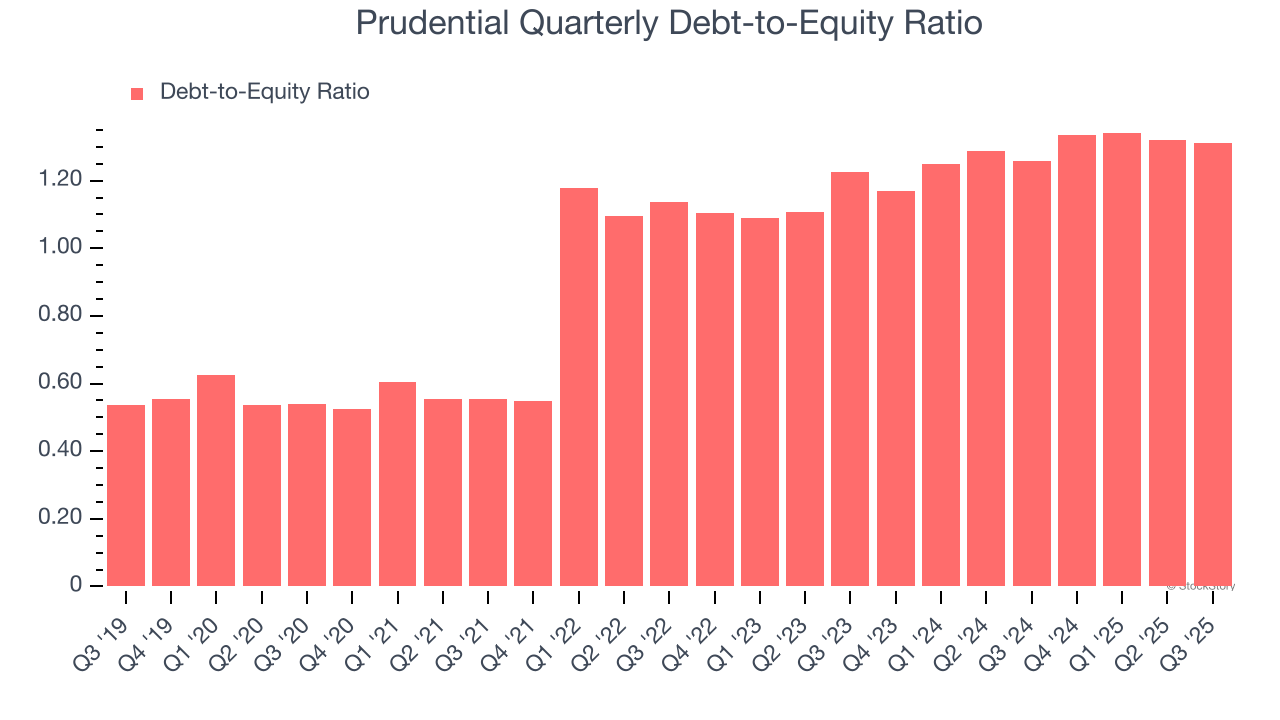

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Prudential currently has $42.59 billion of debt and $32.46 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.3×. We think this is dangerous - for an insurance business, anything above 1.0× raises red flags.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Prudential, we’ll be cheering from the sidelines. With its shares lagging the market recently, the stock trades at 1.2× forward P/B (or $107.78 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Prudential

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.