Residential solar energy company Sunrun (NASDAQ: RUN) will be announcing earnings results this Thursday after market hours. Here’s what investors should know.

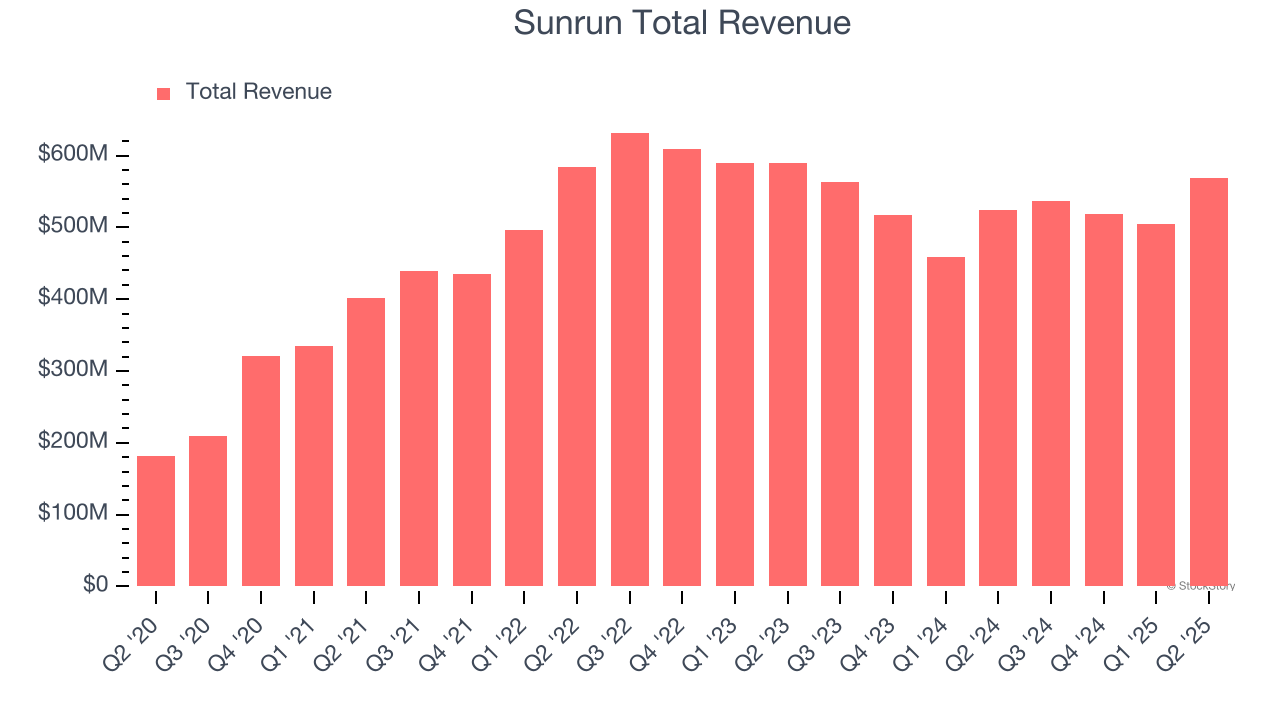

Sunrun beat analysts’ revenue expectations by 4% last quarter, reporting revenues of $569.3 million, up 8.7% year on year. It was a stunning quarter for the company, with an impressive beat of analysts’ customer base estimates and a beat of analysts’ EPS estimates. It added 30,810 customers to reach a total of 1.11 million.

Is Sunrun a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members.

This quarter, analysts are expecting Sunrun’s revenue to grow 10.2% year on year to $592 million, a reversal from the 4.6% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.12 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Sunrun has missed Wall Street’s revenue estimates five times over the last two years.

Looking at Sunrun’s peers in the renewable energy segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Bloom Energy delivered year-on-year revenue growth of 57.1%, beating analysts’ expectations by 22.8%, and Enphase reported revenues up 7.8%, topping estimates by 12%. Bloom Energy traded up 18% following the results while Enphase was down 15.3%.

Read our full analysis of Bloom Energy’s results here and Enphase’s results here.

The euphoria surrounding Trump’s November win lit a fire under major indices, but potential tariffs have caused the market to do a 180 in 2025. While some of the renewable energy stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 2.5% on average over the last month. Sunrun is down 1.3% during the same time and is heading into earnings with an average analyst price target of $21.03 (compared to the current share price of $19.00).

P.S. STOP buying the AI stocks everyone’s talking about. The real money? It’s in the profitable pick nobody’s watching yet. We’ve identified an AI profit machine that’s flying under Wall Street’s radar—for now. We can’t keep this research public forever—grab your FREE copy before we pull it offline. GO HERE NOW.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.