Aerospace and defense company AXON (NASDAQ: AXON) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 33.6% year on year to $575.1 million. The company’s full-year revenue guidance of $2.6 billion at the midpoint came in 1.8% above analysts’ estimates. Its non-GAAP profit of $2.08 per share was 48.2% above analysts’ consensus estimates.

Is now the time to buy Axon? Find out by accessing our full research report, it’s free.

Axon (AXON) Q4 CY2024 Highlights:

- Revenue: $575.1 million vs analyst estimates of $566.7 million (33.6% year-on-year growth, 1.5% beat)

- Adjusted EPS: $2.08 vs analyst estimates of $1.40 (48.2% beat)

- Adjusted EBITDA: $141.6 million vs analyst estimates of $135.7 million (24.6% margin, 4.3% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.6 billion at the midpoint, beating analyst estimates by 1.8% and implying 24.8% growth (vs 33.6% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $655 million at the midpoint, in line with analyst expectations

- Operating Margin: -2.7%, down from 9.9% in the same quarter last year

- Free Cash Flow Margin: 39.2%, up from 28.1% in the same quarter last year

- Market Capitalization: $38.11 billion

Company Overview

Providing body cameras and tasers for first responders, AXON (NASDAQ: AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

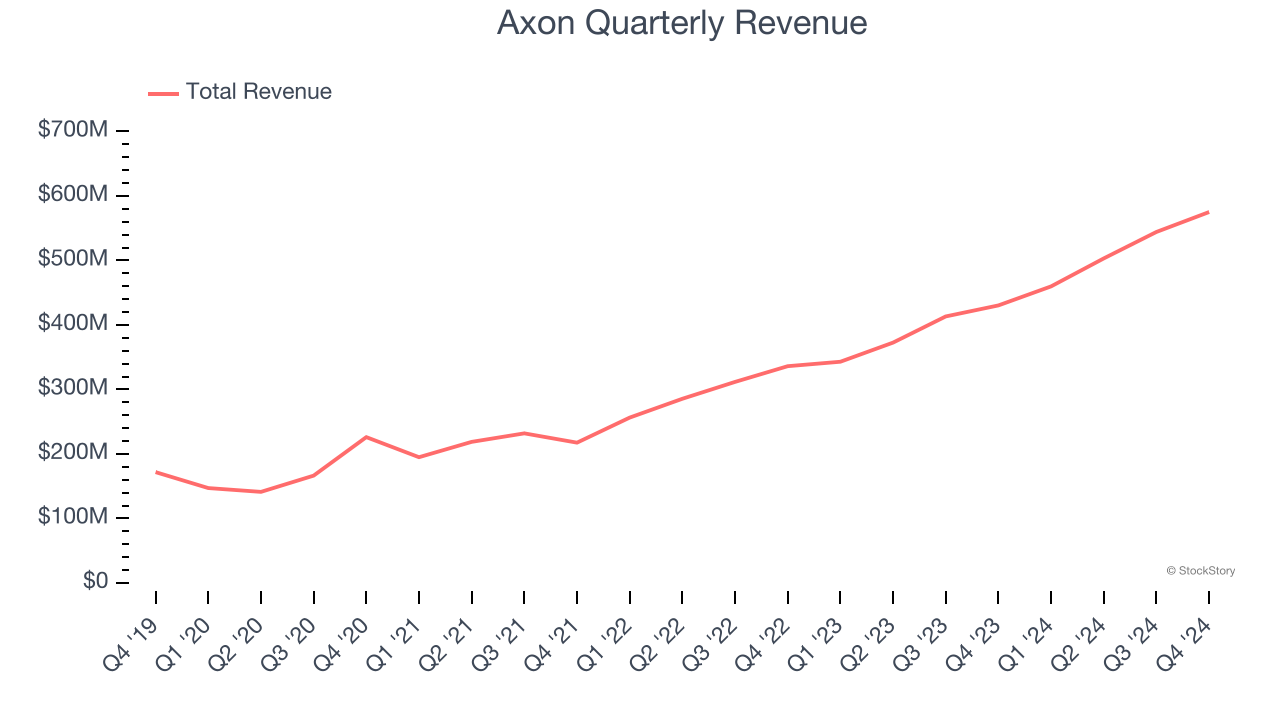

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Axon’s sales grew at an incredible 31.4% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Axon’s annualized revenue growth of 32.3% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Axon reported wonderful year-on-year revenue growth of 33.6%, and its $575.1 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 23% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and indicates the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

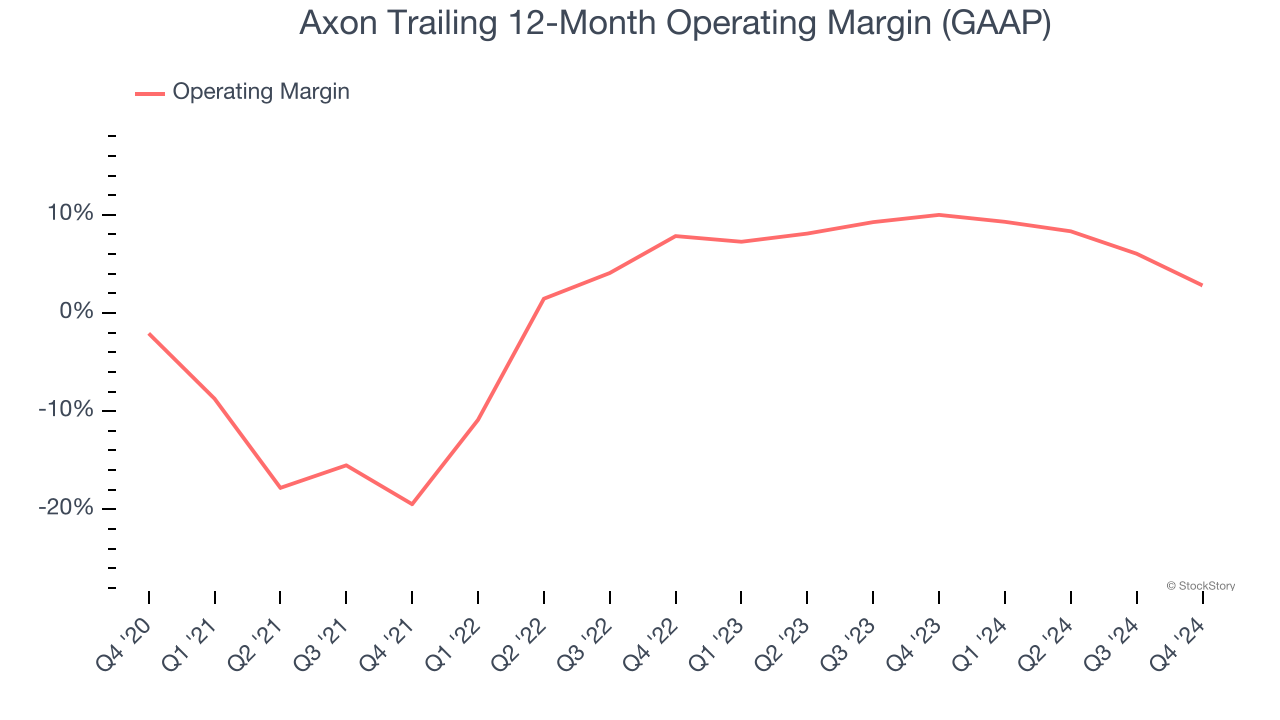

Operating Margin

Axon was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for an industrials business.

On the plus side, Axon’s operating margin rose by 4.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Axon generated an operating profit margin of negative 2.7%, down 12.7 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

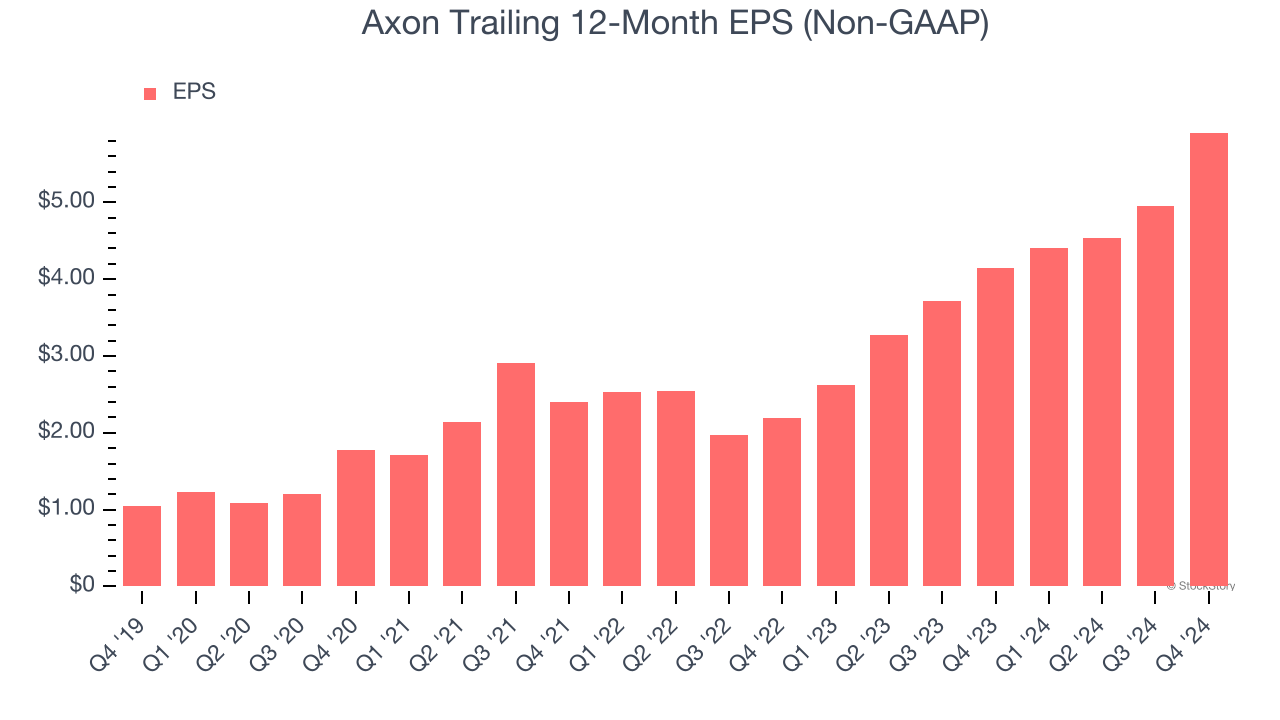

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Axon’s EPS grew at an astounding 41.5% compounded annual growth rate over the last five years, higher than its 31.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Axon’s earnings to better understand the drivers of its performance. As we mentioned earlier, Axon’s operating margin declined this quarter but expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Axon, its two-year annual EPS growth of 64.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Axon reported EPS at $2.08, up from $1.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Axon’s full-year EPS of $5.91 to grow 5.3%.

Key Takeaways from Axon’s Q4 Results

We were impressed by how significantly Axon blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 11.5% to $554.96 immediately following the results.

Axon put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.