Over the past six months, Vita Coco’s stock price fell to $33.25. Shareholders have lost 16.4% of their capital, which is disappointing considering the S&P 500 has climbed by 5.4%. This may have investors wondering how to approach the situation.

Following the drawdown, is now a good time to buy COCO? Find out in our full research report, it’s free.

Why Does Vita Coco Spark Debate?

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Two Things to Like:

1. Elevated Demand Drives Higher Sales Volumes

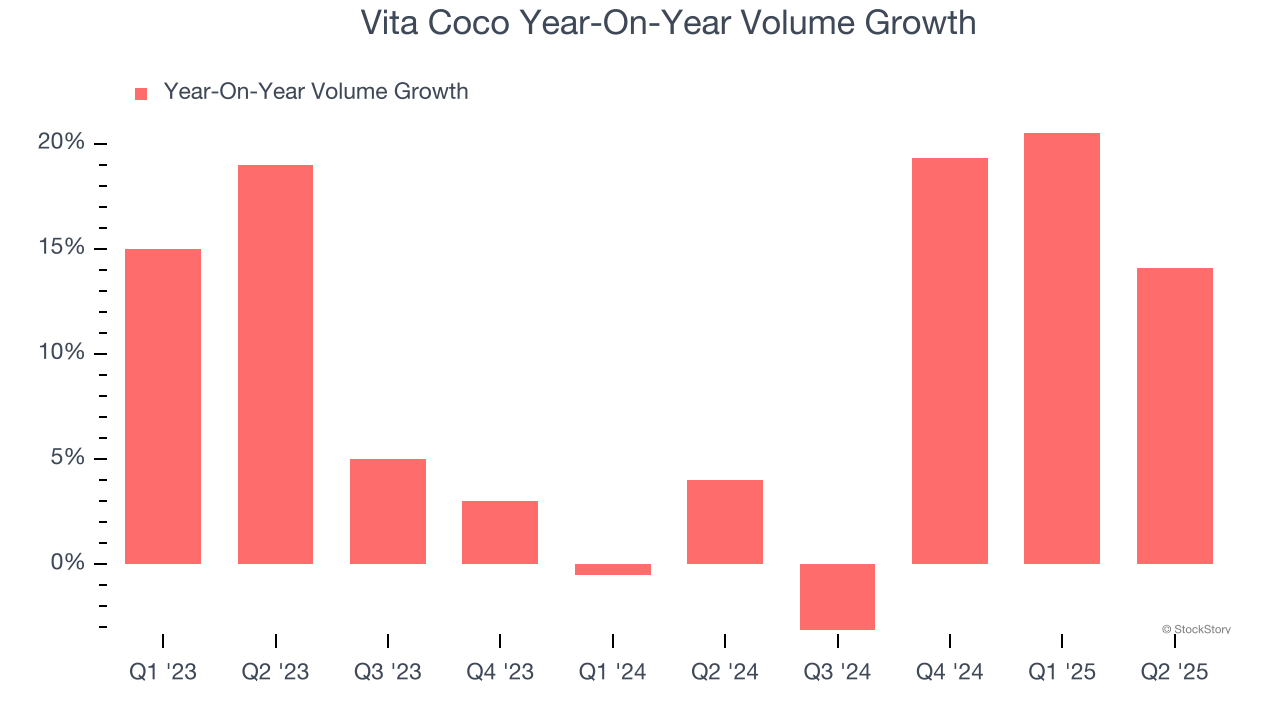

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Vita Coco’s average quarterly volume growth was a robust 7.8% over the last two years. This is good because meaningful volume growth is hard to come by in the stable consumer staples sector.

2. Outstanding Long-Term EPS Growth

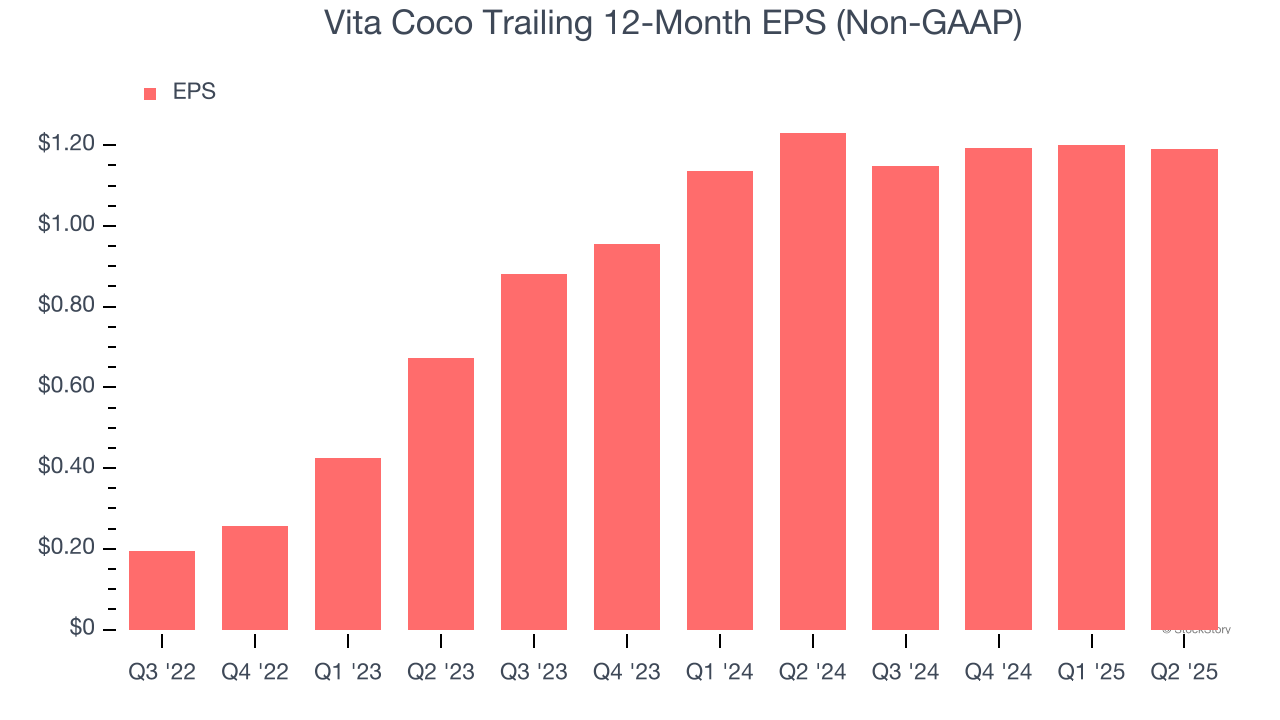

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Vita Coco’s EPS grew at an astounding 195% compounded annual growth rate over the last three years, higher than its 10.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Free Cash Flow Margin Dropping

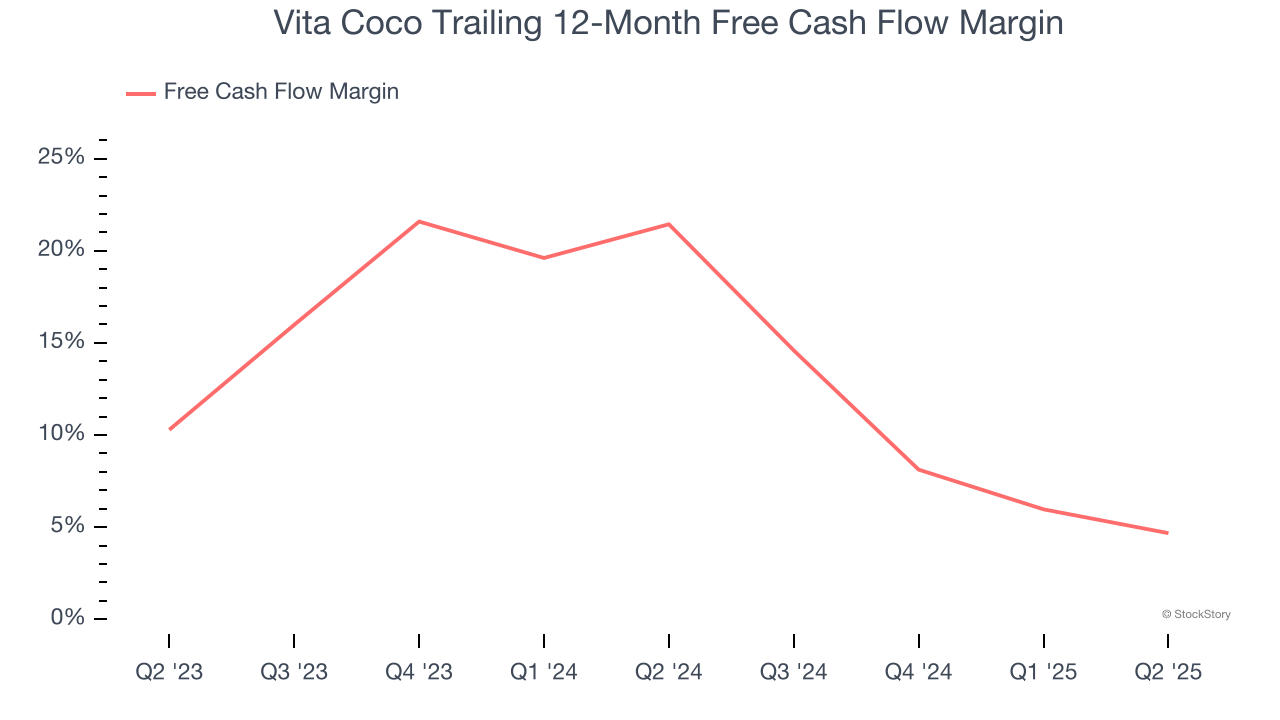

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Vita Coco’s margin dropped by 16.8 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. Vita Coco’s free cash flow margin for the trailing 12 months was 4.7%.

Final Judgment

Vita Coco’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 25.2× forward P/E (or $33.25 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.