Specialty food company The Marzetti Company (NASDAQ: MZTI) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 5% year on year to $475.4 million. Its GAAP profit of $1.18 per share was 11.4% below analysts’ consensus estimates.

Is now the time to buy The Marzetti Company? Find out by accessing our full research report, it’s free.

The Marzetti Company (MZTI) Q2 CY2025 Highlights:

- Revenue: $475.4 million vs analyst estimates of $456.9 million (5% year-on-year growth, 4.1% beat)

- EPS (GAAP): $1.18 vs analyst expectations of $1.33 (11.4% miss)

- Operating Margin: 8.2%, down from 9.2% in the same quarter last year

- Sales Volumes rose 2.1% year on year, in line with the same quarter last year

- Market Capitalization: $4.92 billion

Company Overview

Known for its frozen garlic bread and Parkerhouse rolls, The Marzetti Company (NASDAQ: MZTI) sells bread, dressing, and dips to the retail and food service channels.

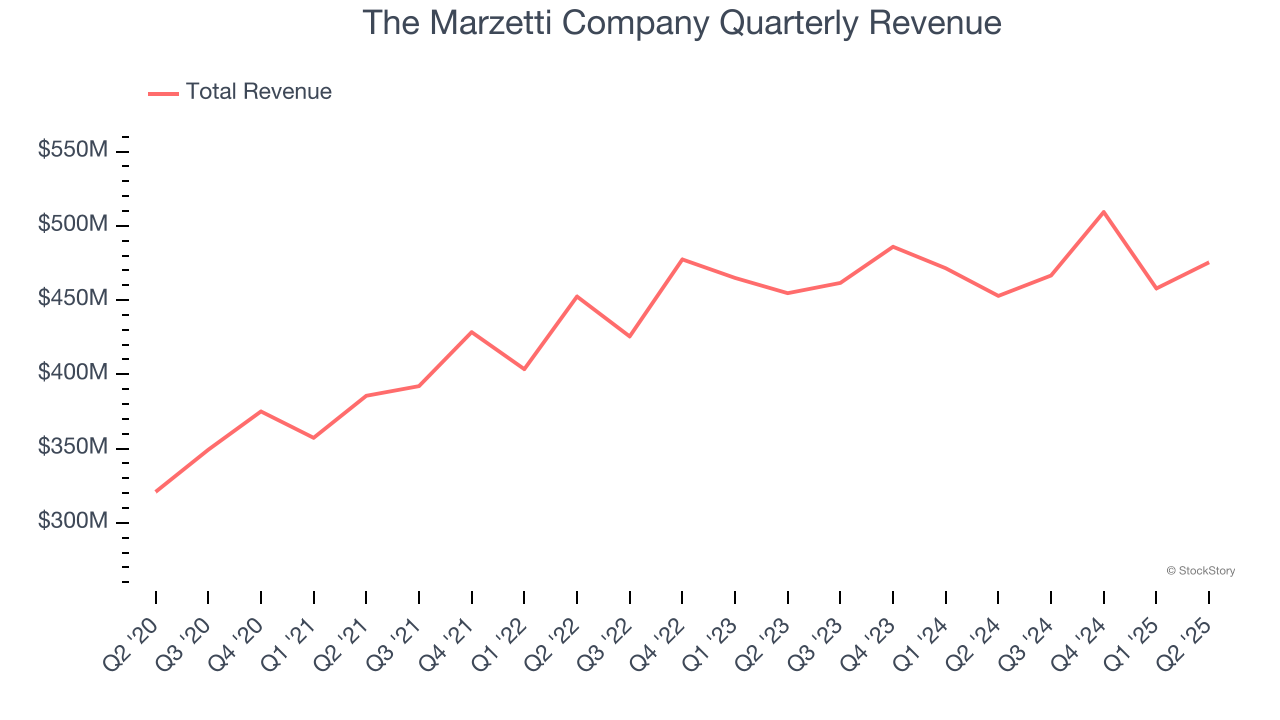

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.91 billion in revenue over the past 12 months, The Marzetti Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, The Marzetti Company’s sales grew at a tepid 4.4% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, The Marzetti Company reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

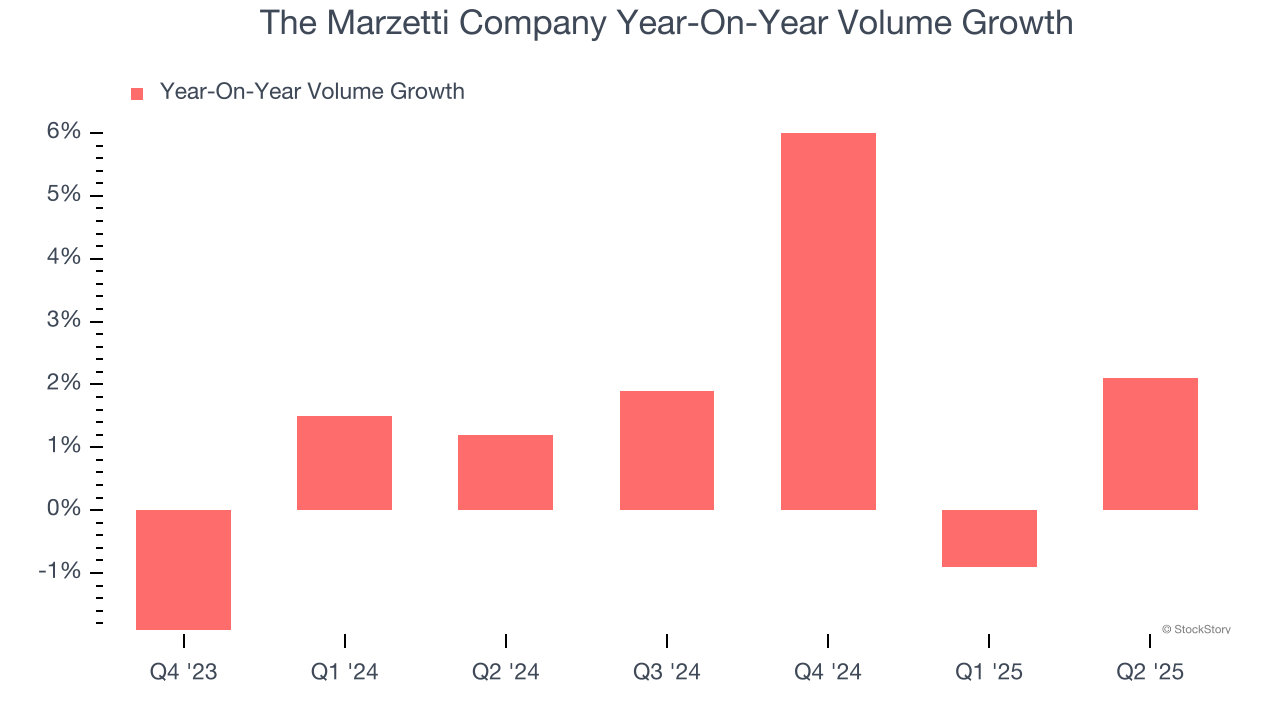

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

The Marzetti Company’s average quarterly volume growth was a healthy 1.4% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In The Marzetti Company’s Q2 2025, sales volumes jumped 2.1% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from The Marzetti Company’s Q2 Results

We enjoyed seeing The Marzetti Company beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its gross margin fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $178.32 immediately following the results.

The Marzetti Company didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.