iShares 1-3 Year Treasury Bond ETF (NQ:SHY)

Headline News about iShares 1-3 Year Treasury Bond ETF

Next SPX Move Will Surprise You

April 20, 2025

Via Talk Markets

Loonie Going Loco…

December 30, 2024

Via Talk Markets

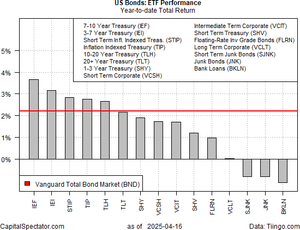

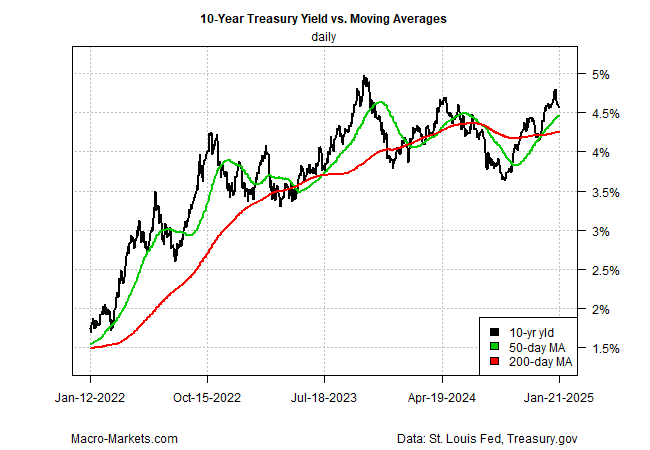

Markets Focus On Reflation Risk After Fed Cuts Rates

December 19, 2024

Via Talk Markets

Via Talk Markets

A Fed Rate Cut May Be Near, But Not Today

March 19, 2025

Via Talk Markets

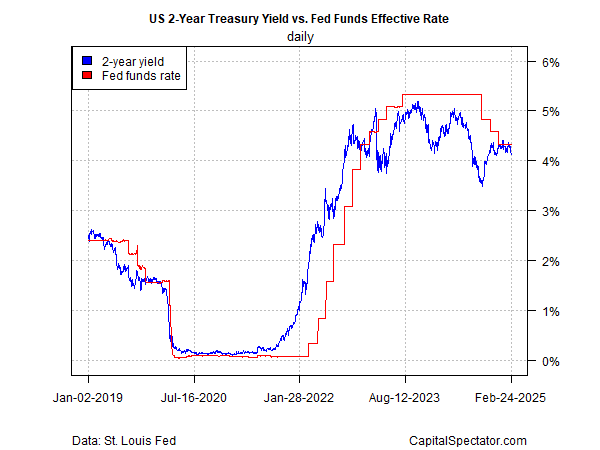

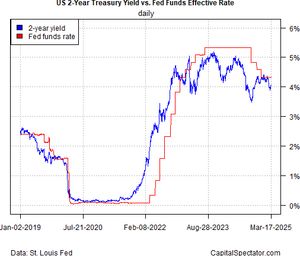

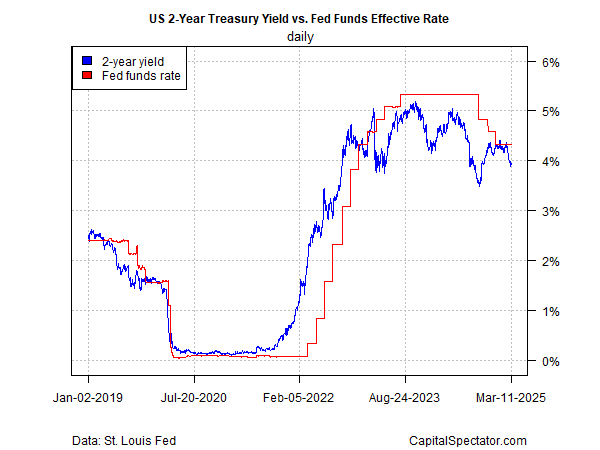

Treasury Market Pricing In Higher Odds For Rate Cuts

March 12, 2025

Via Talk Markets

Via Talk Markets

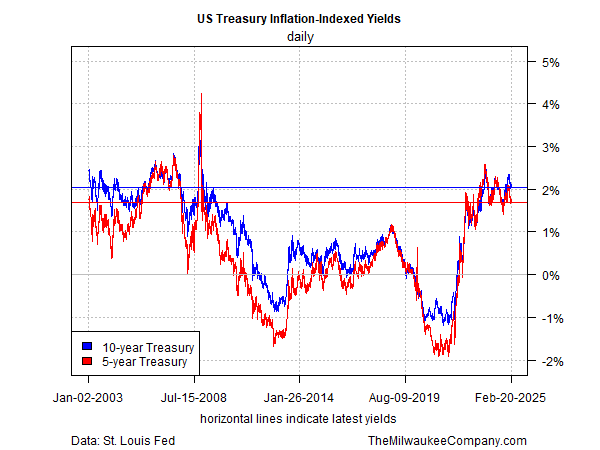

Real (Inflation-Adjusted) Treasury Yields Remain Elevated

February 21, 2025

Via Talk Markets

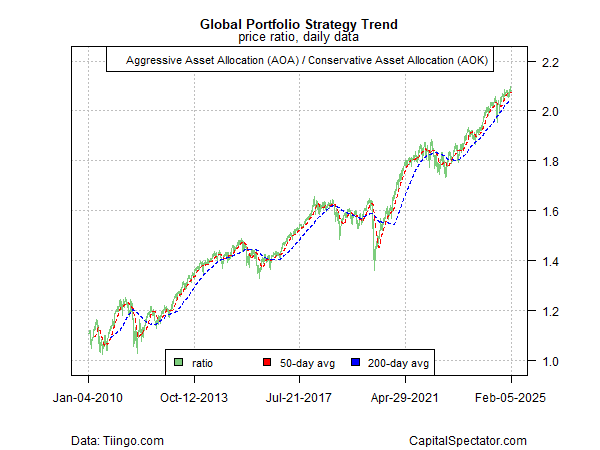

Risk-On Sentiment Endures, Despite Trade Uncertainty

February 06, 2025

Via Talk Markets

Weekly Market Pulse: Is The Honeymoon Over Already?

January 27, 2025

Via Talk Markets

Via Talk Markets

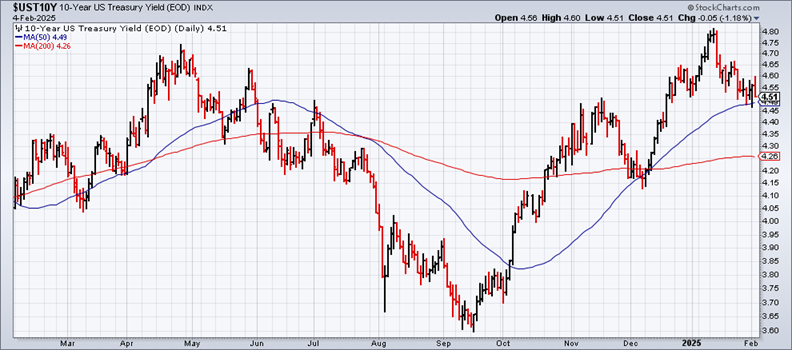

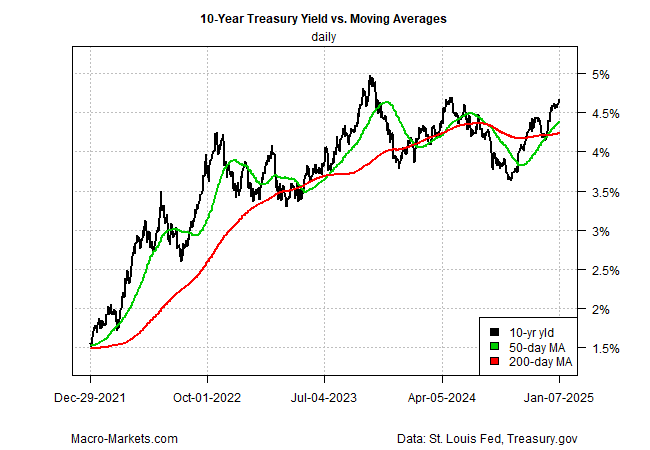

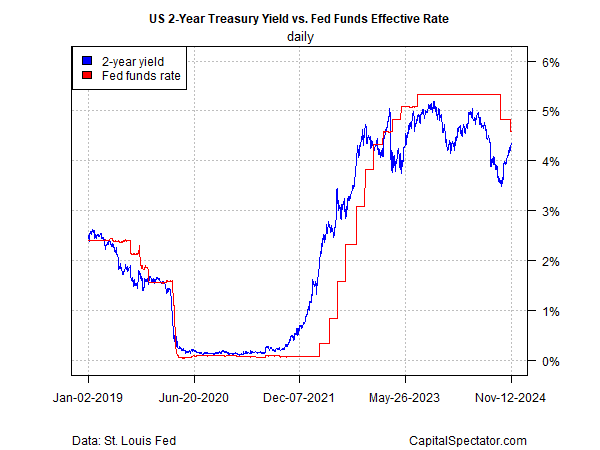

Rising Treasury Yields Raise Doubts About Another Fed Rate Cut

November 13, 2024

Via Talk Markets

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.