(TSV:SLVR)

All News about SLVR

OPEC+ Maintains Production Quotas. Mexican Peso Strengthens As New President Takes Office ↗

October 03, 2024

Via Talk Markets

Topics

Stocks

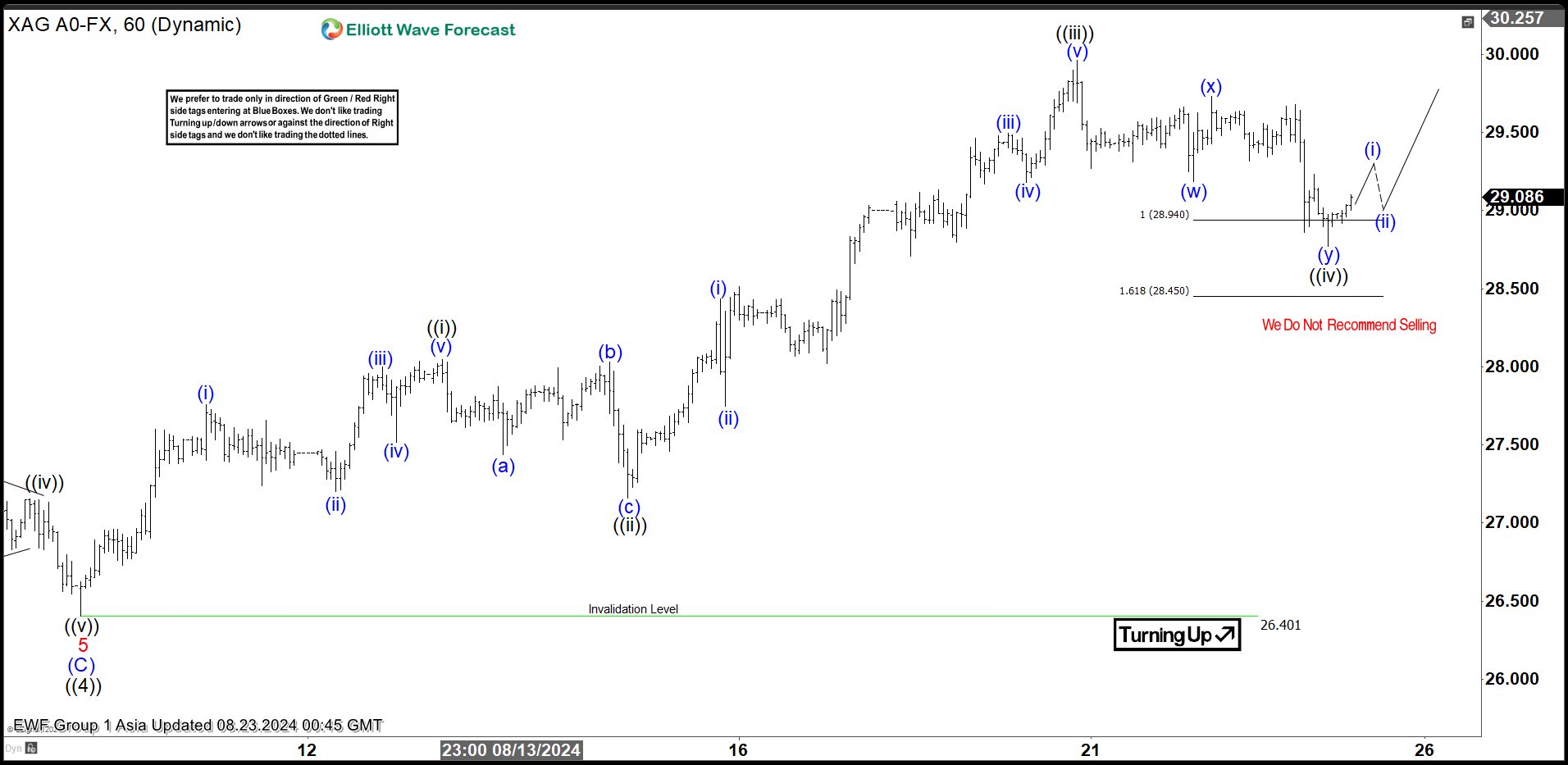

XAGUSD Commodity Elliott Wave Technical Analysis - Thursday, September 26 ↗

September 26, 2024

Via Talk Markets

Chinese Indices Rise On PBoC Stimulus. In Australia, Inflationary Pressures Are Easing ↗

September 25, 2024

Via Talk Markets

Topics

Stocks

SILVER Trading Strategy, Analysis & Forecast - Saturday, September 21 ↗

September 21, 2024

Via Talk Markets

Gold And Silver Shine As The Fed Cuts Rates: What’s Next? ↗

September 20, 2024

Via Talk Markets

Topics

Economy

SILVER Trading Strategy, XAGUSD Analysis & XAGUSD Forecast - Monday, September 9 ↗

September 09, 2024

Via Talk Markets

.thumb.png.1478f12489d6c0799dbe9fd0c93cc130.png)

Silver Price Forecast: XAG/USD Hovers Near $29.50 Due To Caution Ahead Of Fed Minutes ↗

August 21, 2024

Via Talk Markets

Topics

Economy

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.