Returns on PayPal (PYPL) stock have been negative for the year 2025. However, after touching lows of $55.85 in April 2025, PYPL stock has trended higher by almost 25%.

The rally from oversold levels has been supported by results beating expectations and the company setting a foundation for innovation-driven growth.

With Q3 2025 results beating expectations, the positive momentum is likely to stay. Further, the company’s first-ever dividend paves the way for continued shareholder value creation.

About PayPal Stock

Headquartered in San Jose, PayPal is a provider of digital payments for merchants and consumers globally. The company has a presence in 200 markets globally with a focus on multiple financial products with a big addressable market.

For Q3 2025, the company’s total payment volumes were $458.1 billion with active accounts of 438 million. PYPL stock has been in focus on the back of the company’s recent agentic commerce partnership with OpenAI.

As PayPal promises to be a turnaround story, PYPL stock has marginally inched higher by 5% in the last six months.

Strong Q3 Results

For Q3 2025, PayPal reported an earnings beat with growth in payment volumes coupled with a decline in expenses. Net revenue increased by 7% to $8.4 billion, and total payment volume increased by 8% to $458.1 billion.

Buy now, pay later (BNPL) and Venmo were the most notable growth areas. For BNPL, the company expects $40 billion in total payment volume for 2025. Further, Venmo is expected to deliver revenue of $1.7 billion for the year.

Another important point to note is that the company reported operating and free cash flow of $2 billion and $1.7 billion, respectively, for Q2. Healthy cash flows coupled with a cash buffer of $14.4 billion provide ample financial headroom for investing in growth and innovation.

Innovating for Long-Term Growth

Besides the current growth acceleration, PayPal is also building for an agentic AI future. For this, the company has already partnered with Google (GOOG) (GOOGL), OpenAI, and Perplexity.

As an example, OpenAI and PayPal recently partnered for instant checkout and agentic commerce in ChatGPT. This will allow businesses globally to sell within ChatGPT. With the latter having more than 700 million weekly users, the potential for growth is significant.

PayPal World transaction (currently in the pilot stage) is another part of the company’s long-term growth strategy. The company continues to add global payment partners with rapid fund distribution available in more than 200 countries.

In addition to these, as the global adoption of crypto increases, PayPal is positioned to benefit from crypto integration within PayPal P2P.

An important point to note is that PayPal has around 20% market penetration in the $125 billion online payments total addressable market. Further, the company’s penetration is less than 1% in the $200 billion offline payments total addressable market. These numbers indicate significant potential for growth as PayPal innovates and expands its product offering.

What Analysts Say About PYPL Stock

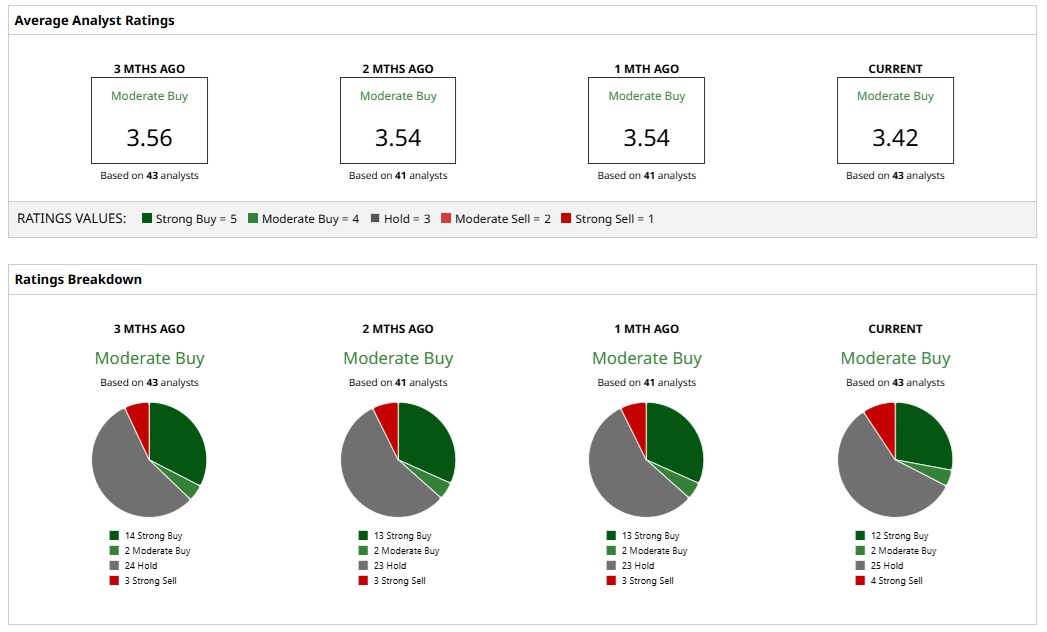

Based on the rating from 43 analysts, PYPL stock is a “Moderate Buy.” While 12 analysts have a “Strong Buy” rating for the stock, 25 analysts opine that PYPL stock is a “Hold.”

Considering the mean price target of $80.88, PYPL stock has an upside potential of 17% from current levels. Further, the most bullish price target of $105 implies an upside potential of 52%.

From a valuation perspective, PYPL stock trades at a forward P/E and price-earnings-to-growth ratio of 13.4 and 1.1, respectively. Valuations seem attractive considering the fact that the S&P 500 Index ($SPX) trades at a P/E of 32.

PayPal has also initiated a quarterly dividend of $0.14. While the annualized dividend yield is 0.8%, it’s likely that dividends will continue to swell in the coming years. Additionally, a target of $6 billion in share repurchase for FY 2025 will also support value creation.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Is Paying Its First-Ever Dividend. Should You Snap Up PYPL Stock Now?

- Jensen Huang Says AI Is ‘Work,’ Not a ‘Tool.’ This 1 Blue-Chip Dividend Stock Is Bringing that Work to America

- Why PayPal Stock Deserves a Second Look Before 2025 Ends

- Is This Defensive Giant a Good Stock to Buy in a Volatile Market?