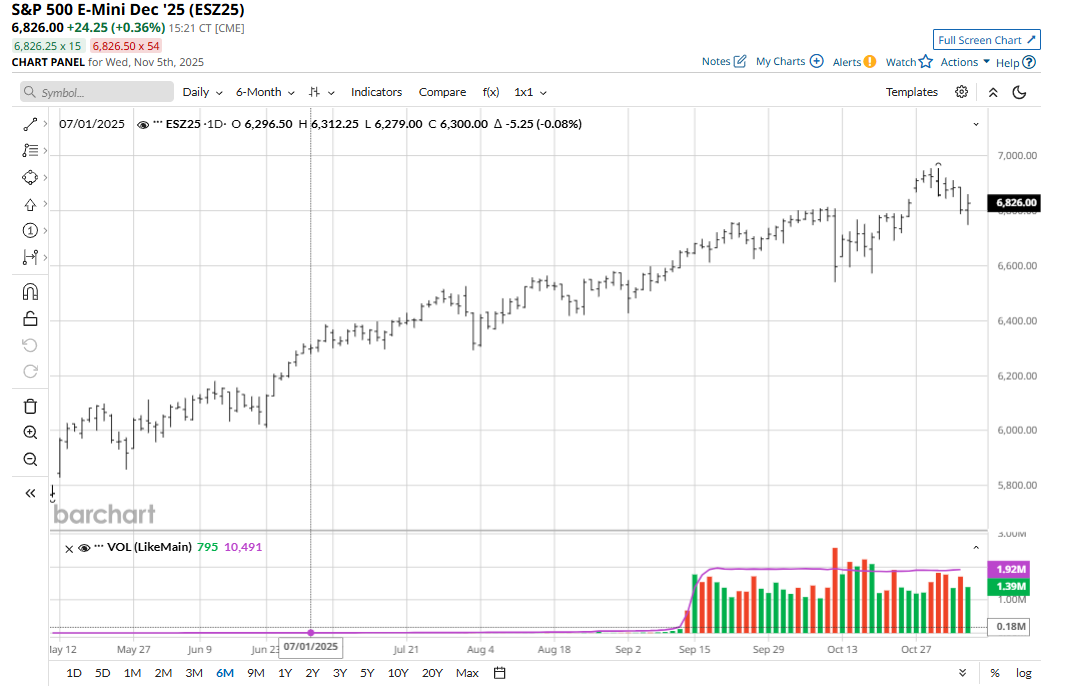

Global stock markets sold off this week as Wall Street execs warned equities are overvalued. Other analysts are worried about an artificial intelligence stock bubble. A Bloomberg report earlier this week said Wall Street chief executives said a U.S. stock market drop of more than 10% in the next 12 to 24 months could occur, and such a correction may be a positive development for the stock market, overall.

In another worrisome sign, Palantir Technologies (PLTR) earlier this week raised its annual revenue outlook to $4.4 billion and outpaced analyst estimates for its third-quarter sales. The company’s revenue increased 63% to $1.18 billion, with profit, excluding some items, at $0.21 a share. Yet, Palantir’s shares fell on the news due to concerns about the company’s lofty valuation after a record run-up, despite the company’s strong quarterly results. When a stock, or a market, cannot rally on fresh, bullish fundamental news, that’s a sign that all the expected bullish news has already been factored into prices.

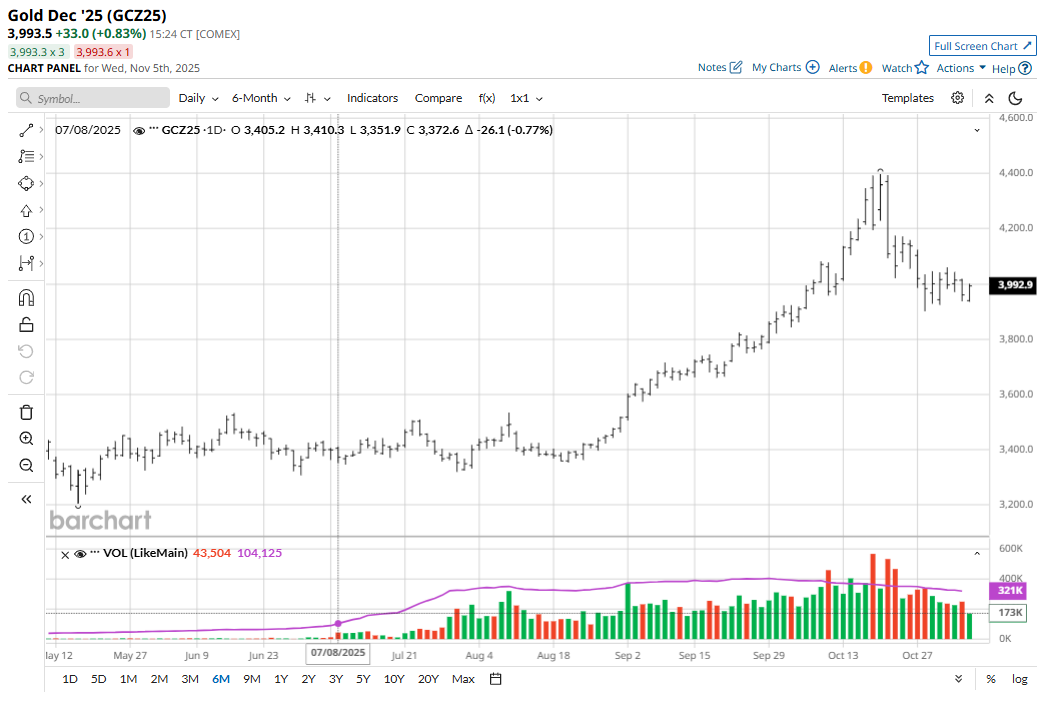

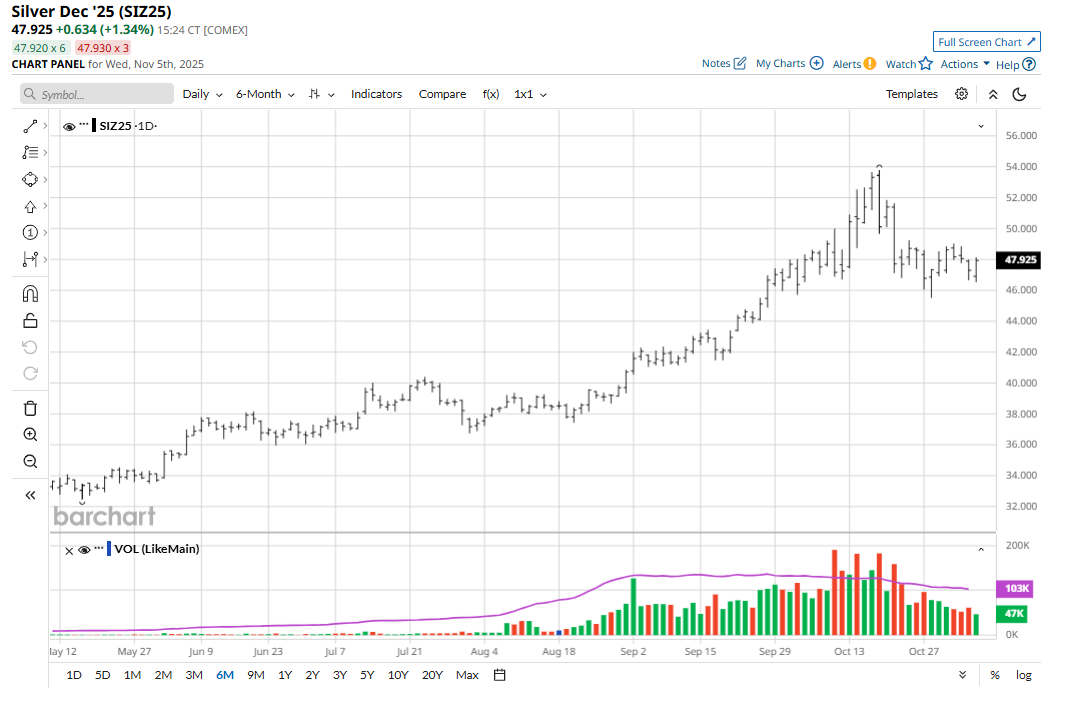

You can bet that wily gold (GCZ25) and silver (SIZ25) market bulls have taken note of the Palantir stock weakness this week, reckoning it could be a harbinger of general stock market weakness into the end of the year.

There Could Be a Bigger Bogeyman Lurking in the Market’s Shadows

Bond traders lately have been extra worried about private credit deals that may not have solid financial footing. From global banks to alternative fund managers, more senior financiers are warning of cracks in private credit.

Bloomberg reports that TCW Group’s CEO Katie Koch told a forum in Hong Kong today that she’s “very nervous” about parts of private credit. Tony Yoseloff, chief investment officer of Davidson Kempner Capital Management LP, said there’s been a “race to the bottom” in terms of covenants.

“Their comments come as private credit — or lending done outside the heavily regulated banking sector — has ballooned to a $1.7 trillion industry. Some banks are making conscious decisions to collaborate with private credit players to earn fees and tap ever-deeper pools of capital, while others say the combinations are risky and could infect the banking sector,” said Bloomberg.

This comes a day after UBS Chairman Colm Kelleher highlighted risks in the U.S. insurance industry, citing weak and complex regulation as private financing booms. U.S. life insurers have ramped up private debt investments over the past few years, allocating close to one-third of their $5.6 trillion in assets to the sector last year, up from 22% a decade ago, according to data compiled by research firm CreditSights and as reported by Bloomberg. Risks are amplified by offshore jurisdictions that don’t have the same regulatory and ratings standards as the U.S.

Some finance executives involved in private credit say the sector is not big enough to produce serious systemic risk.

“Payment-in-kind” debt is a main element raising concern among bond market traders. Private credit funds may be using it to mask a deterioration in loan quality, with the pile of this expensive debt continuing to swell. The focus is on “bad PIK” added during the life of the loan to ease cash-flow pressure, which valuation firm Lincoln International views as a “shadow default rate” that was 6% in their most recent data, according to Bloomberg. “The use of PIK is facing scrutiny at a rocky time for broader credit markets, with some experts warning that kicking the can down the road for struggling borrowers might not last forever and that deferred interest could quickly turn into deferred pain.”

Gold, Silver Markets Seeing Selling Interest Limited Due to Stock, Financial Market Concerns

The past week has seen gold and silver markets’ prices stabilize, following the steep selloffs seen in late October that did produce serious near-term technical damage. Some reckoned that technical damage would lead to additional selling pressure. Instead, gold and silver markets have steadied. It could well be that price floors have been established under gold and silver prices due to underlying worries about the health of the U.S. stock market and the bond markets showing some concern over private credit stresses. A couple weeks ago, respected JPMorgan CEO Jamie Dimon said, “When you see one cockroach, there are probably more.” He used the phrase and warned that “everyone should be forewarned,” that the bankruptcies of companies like First Brands and Tricolor Holdings were signs of deeper problems within the credit markets.

This 40-year-long gold and silver market watcher believes the recent stabilization in gold and silver markets suggests marketplace risk aversion has up-ticked — not to the elevated level where gold and silver prices are pushing solidly higher, but to the point where the gold and silver market bears are presently afraid to play the short sides due to potential storm clouds on the marketplace horizon. Stay tuned!

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Cockroach’ Bankruptcies and Palantir Stock’s Post-Earnings Selloff: A Ticking Time Bomb Puts a Price Floor Under Gold, Silver

- Should We Be Cautious with Precious Metals?

- How Much Lower Will Silver Prices Go?

- Silver to $100? Here’s What That Would Mean for Gold Prices, Based on the Gold-Silver Ratio