Palantir Technologies (PLTR) has become the artificial intelligence (AI) stock that refuses to quit. The data analytics powerhouse surged over 145% year-to-date (YTD) through early November 2025, leaving the Magnificent Seven tech giants in the dust and cementing its position as one of the most electrifying growth stories on Wall Street.

Just hours before the company reported its third-quarter earnings yesterday, Nov. 4, Wedbush Securities analyst Daniel Ives sent shockwaves through the market by slapping a Street-high $230 price target on PLTR—calling it a potential "trillion-dollar company in the making" fueled by its Artificial Intelligence Platform (AIP) and unprecedented demand from both government and commercial sectors. This new target is now the highest on Wall Street, beating out Bank of America's previous Street high of $215.

The timing couldn't be more critical: Palantir delivered a blowout Q3 report, beating revenue expectations with $725.5 million (up 30% year-over-year) and raising its full-year guidance, yet the stock stumbled 6% in after-hours trading as investors questioned whether its sky-high valuation—trading at over 450 times forward earnings—has finally hit a ceiling.

Is this Street-high $230 price target a visionary call on the future of enterprise AI or a dangerous invitation to buy at the peak? Let's dive in.

Palantir’s Financial Backbone

Palantir Technologies has grown into a major player in enterprise AI and machine learning, building and offering software platforms like Foundry, Gotham, and its now-flagship AIP that help businesses and governments turn large amounts of data into clear, useful insights.

Over the past 52 weeks, Palantir shares have jumped 267%, and so far this year, they’re up 148%. That big run has pushed the stock’s valuation very high.

Palantir’s forward price-to-earnings ratio is now 462.68x, far above the sector average of 25.65x, showing that investors are willing to pay a big premium for the company’s expected future growth.

The latest financial results show why the optimism is strong. In the third quarter of 2025, revenue grew 63% from last year and 18% from the previous quarter, hitting $1.18 billion. U.S. revenue was up 77 percent YoY, driven by a 121% jump in U.S. commercial sales to $397 million and a 52% increase in government contracts to $486 million.

Palantir closed 204 deals above $1 million and set a record with a total contract value of $2.76 billion, up 151% from a year ago. Operating income was $393 million with a 33% margin under GAAP, and adjusted operating income hit $601 million at a 51% margin. The company also generated $540 million in adjusted free cash flow, all backed by $6.4 billion in cash and short-term treasury securities.

What’s Powering Palantir’s Ascent?

Palantir’s work with Nvidia (NVDA) is particularly important. Together, they are building a shared technology system for operational AI that combines Palantir Ontology with Nvidia's GPU-powered data processing and optimization tools. This partnership lets enterprises and government agencies set up customized AI agents with the advanced thinking capabilities needed to handle complex situations in retail, healthcare, financial services, and the public sector.

On the infrastructure side, Palantir's multi-year, multi-million dollar deal with Lumen Technologies (LUMN) fills a key need. It connects Palantir's Foundry and AIP with Lumen's newest Connectivity Fabric. This makes it possible for enterprises to launch AI applications faster and with better security across multi-cloud setups, solving one of the main obstacles to getting AI into businesses.

Snowflake's (SNOW) integration with Palantir opens up another growth path. The connection between Foundry and Snowflake Iceberg Tables allows two-way data movement, so customers can build AI applications more quickly with unified and secure data systems.

The most concrete example is Lear Corporation's (LEA) expanded five-year partnership. Lear is using Foundry and AIP across all of its manufacturing locations worldwide, with over 11,000 workers now relying on Palantir's software. The proof is in the numbers. Lear's AI-driven work saved the company more than $30 million in just the first half of 2025, with even bigger benefits expected to accumulate through the rest of the year and into 2026.

Why Wedbush Is Betting Even Bigger on PLTR Stock

Wedbush's new $230 price target for Palantir is a strong show of confidence heading into earnings, particularly given the company's Q4 revenue guidance of up to $1.331 billion and expected adjusted operating income near $699 million.

The bullish sentiment extends beyond Wedbush. Piper Sandler raised its price target from $182 to $201, saying that Palantir's visible deal pipeline of over $7 billion in confirmed contracts plus another $4 billion in potential deals makes it an "AI All-Star."

Piper rejects the notion that Palantir's growth is slowing, arguing instead that the strong deal pipeline shows the company is still accelerating. Bank of America shares that view, raising its Street-high target to $215 in September and pointing to Palantir's distinctive AI technology and its team of engineers working directly with customers as major competitive advantages.

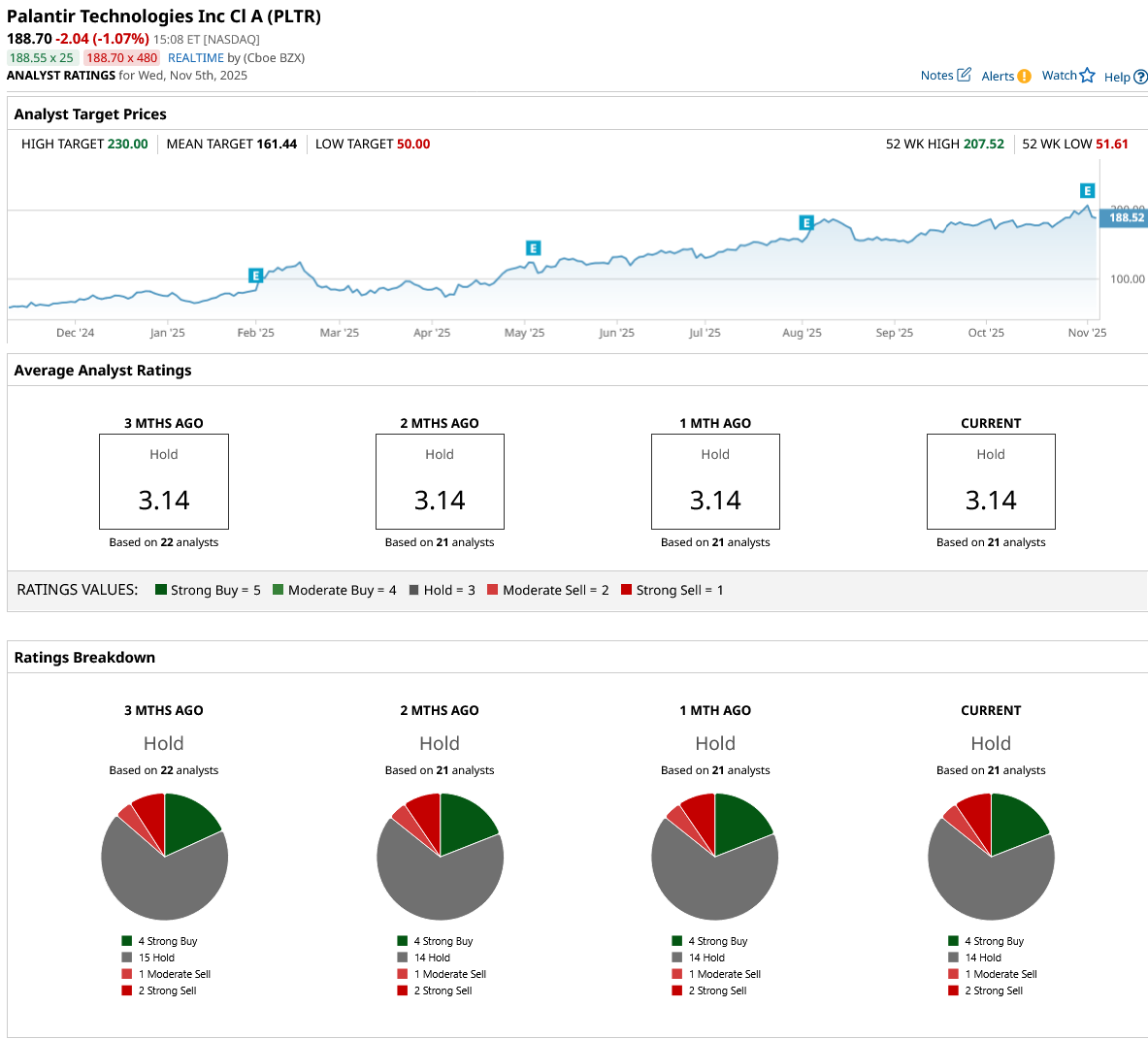

Still, not all of Wall Street is on the same page. Among the 21 analysts surveyed, the consensus for Palantir is a “Hold,” suggesting most are opting for caution and taking a “wait and see” approach. The average price target sits at $161.44, yet the stock is trading at $188.70, which is 17% above where analysts think it should be on average.

Conclusion

Palantir looks like a hold-for-believers and a wait-for-a-better-entry for everyone else: the growth, guidance, and new Street-high call from Wedbush are compelling, but PLTR stock already trades well above the consensus target and at a steep premium on forward earnings, so near-term expectations are razor-thin and missteps could sting. If already long, riding momentum into the print makes sense with tight risk controls; if on the sidelines, stalking a pullback toward consensus or post-earnings volatility is the higher-quality setup. In the near term, shares are more likely to chop or drift higher modestly with elevated volatility rather than extend a straight-line surge.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?

- Cisco Just Got a New Street-High Price Target. Should You Buy CSCO Stock Here?

- Palantir Just Got a New Street-High Price Target. Should You Buy PLTR Stock Here?