HR software provider Asure Software (NASDAQ: ASUR) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 23.7% year on year to $36.25 million. The company expects next quarter’s revenue to be around $39 million, coming in 2.3% above analysts’ estimates. Its GAAP loss of $0.19 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Asure Software? Find out by accessing our full research report, it’s free for active Edge members.

Asure Software (ASUR) Q3 CY2025 Highlights:

- Revenue: $36.25 million vs analyst estimates of $35.69 million (23.7% year-on-year growth, 1.6% beat)

- EPS (GAAP): -$0.19 vs analyst estimates of -$0.05 (significant miss)

- Adjusted EBITDA: $8.10 million vs analyst estimates of $7.97 million (22.3% margin, 1.6% beat)

- Revenue Guidance for Q4 CY2025 is $39 million at the midpoint, above analyst estimates of $38.12 million

- EBITDA guidance for Q4 CY2025 is $11 million at the midpoint, in line with analyst expectations

- Operating Margin: -9.7%, up from -12.4% in the same quarter last year

- Free Cash Flow was $1.85 million, up from -$747,000 in the previous quarter

- Billings: $35.76 million at quarter end, up 26.1% year on year

- Market Capitalization: $223.2 million

Company Overview

Operating in the often-overlooked smaller metropolitan markets where HR expertise can be scarce, Asure Software (NASDAQ: ASUR) provides cloud-based human capital management software and services that help small and medium-sized businesses manage payroll, taxes, time tracking, and HR compliance.

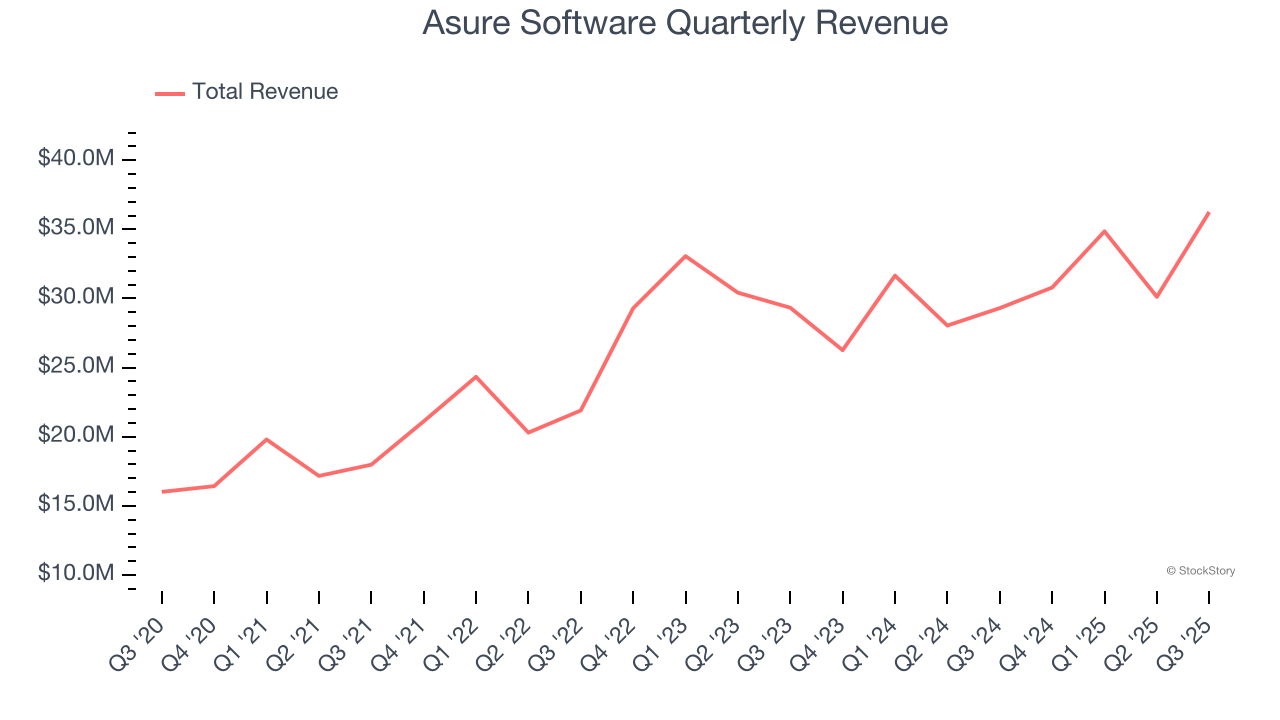

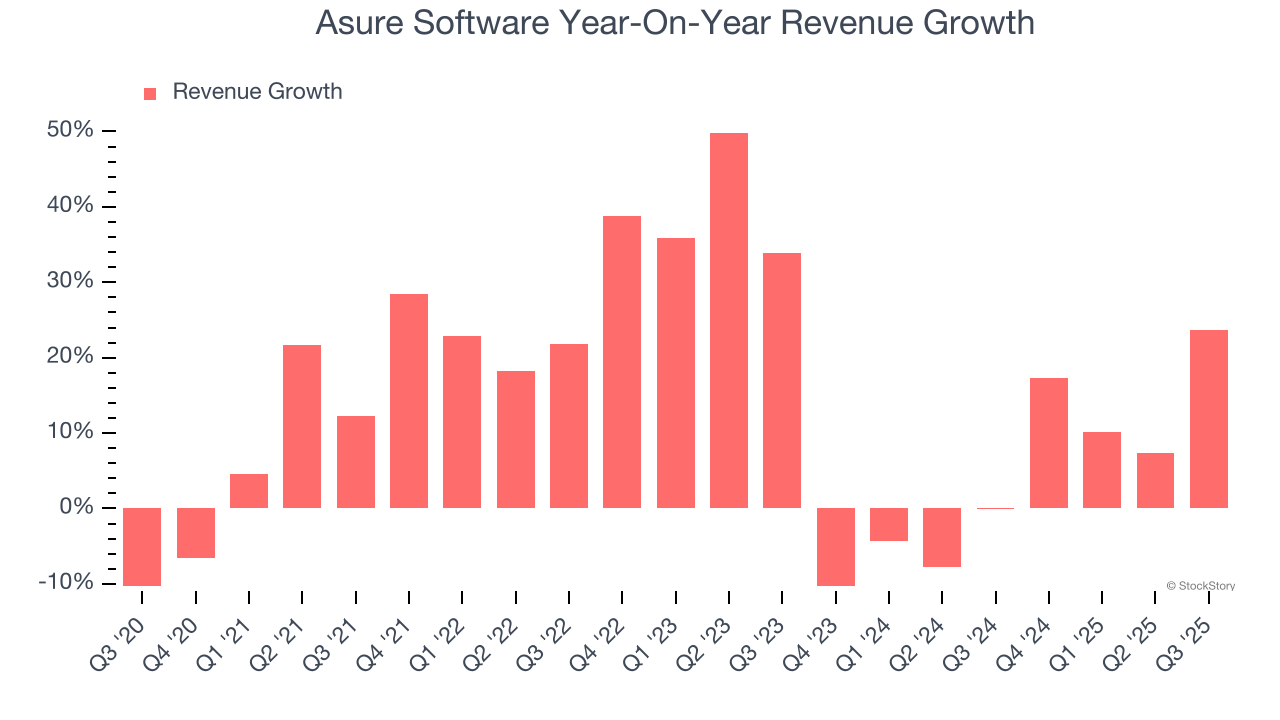

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Asure Software grew its sales at a 14.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Asure Software’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend.

This quarter, Asure Software reported robust year-on-year revenue growth of 23.7%, and its $36.25 million of revenue topped Wall Street estimates by 1.6%. Company management is currently guiding for a 26.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.1% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

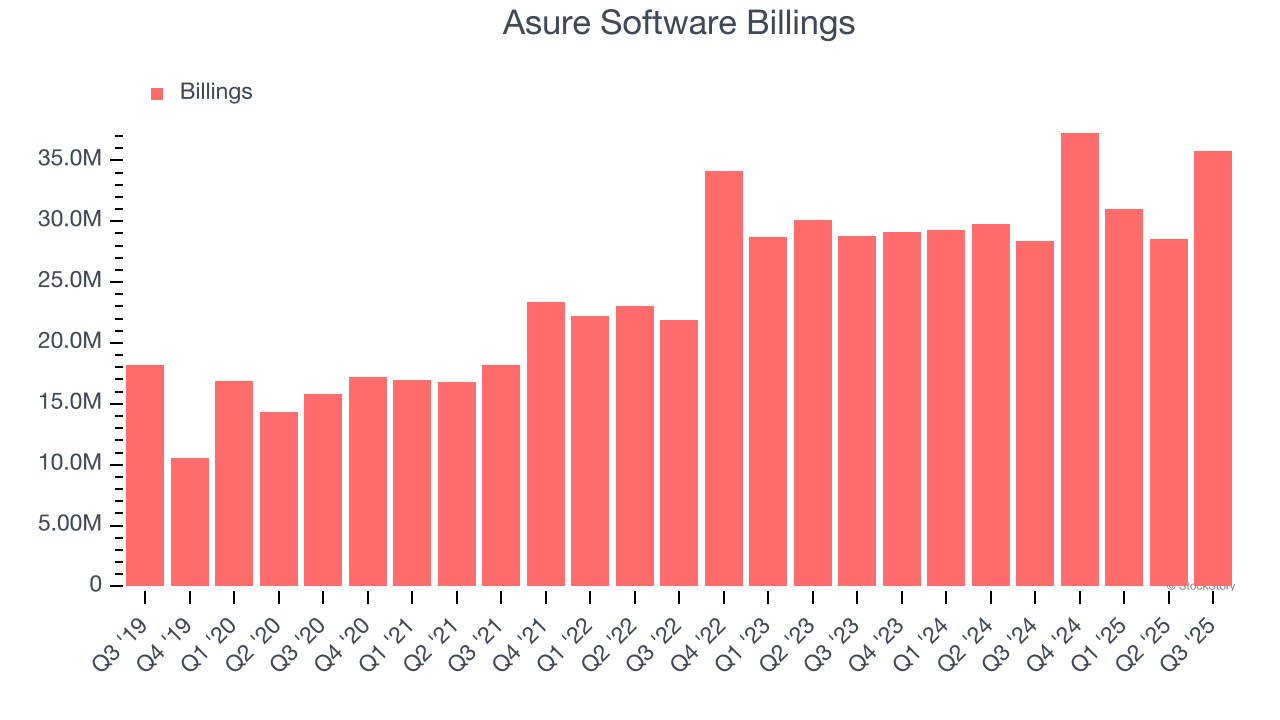

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Asure Software’s billings came in at $35.76 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 14% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Asure Software is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Asure Software’s Q3 Results

We enjoyed seeing Asure Software beat analysts’ billings expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 1.8% to $8.00 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.