Over the last six months, Yelp’s shares have sunk to $30.52, producing a disappointing 14.3% loss - a stark contrast to the S&P 500’s 14.4% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Yelp, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Yelp Not Exciting?

Even though the stock has become cheaper, we're swiping left on Yelp for now. Here are three reasons we avoid YELP and a stock we'd rather own.

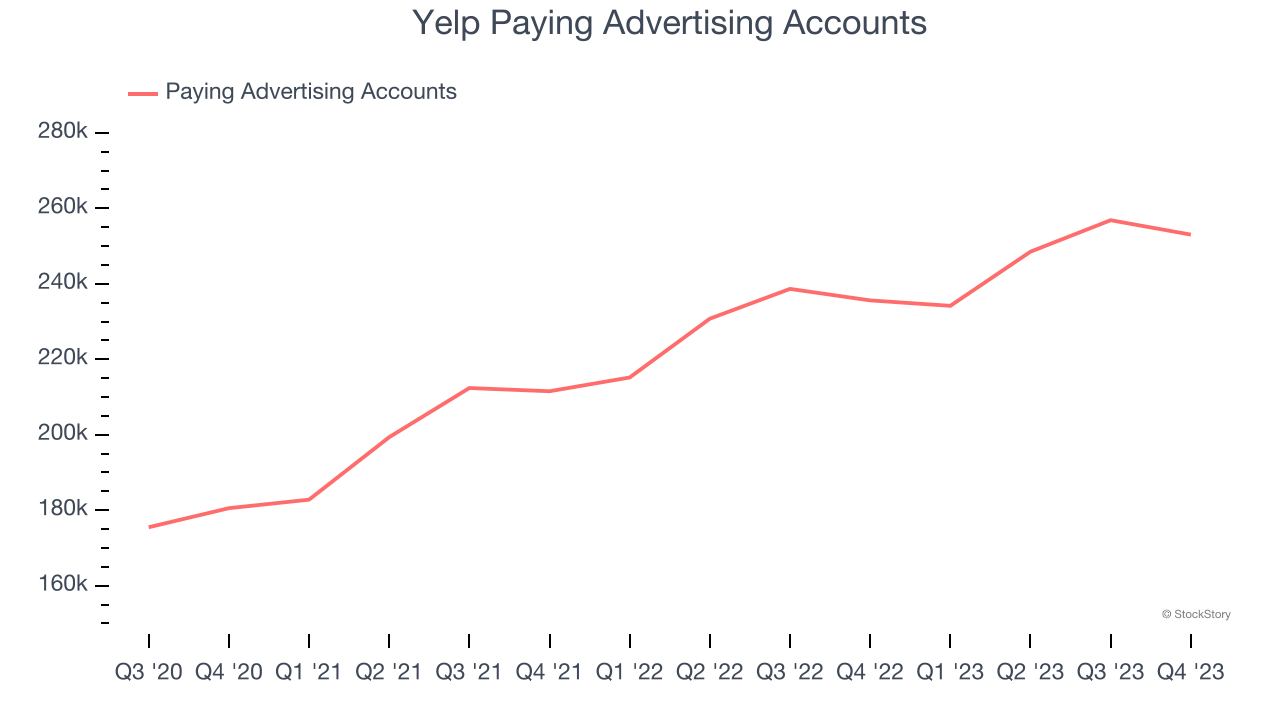

1. Change in Paying Advertising Accounts Points to Soft Demand

As a social network, Yelp generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Yelp’s paying advertising accounts, a key performance metric for the company, increased by 7.4% annually. This growth rate is slightly below average for a consumer internet business. If Yelp wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Growth in Customer Spending Lags Peers

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Yelp’s audience and its ad-targeting capabilities.

Yelp’s ARPU growth has been mediocre over the last two years, averaging 3.1%. This raises questions about its platform’s health and ability to engage its users effectively.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Yelp’s revenue to rise by 1.1%, a deceleration versus This projection doesn't excite us and suggests its products and services will face some demand challenges.

Final Judgment

Yelp isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 5.4× forward EV/EBITDA (or $30.52 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Yelp

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.