All News about ProShares UltraShort Lehman 20 Year Treasury

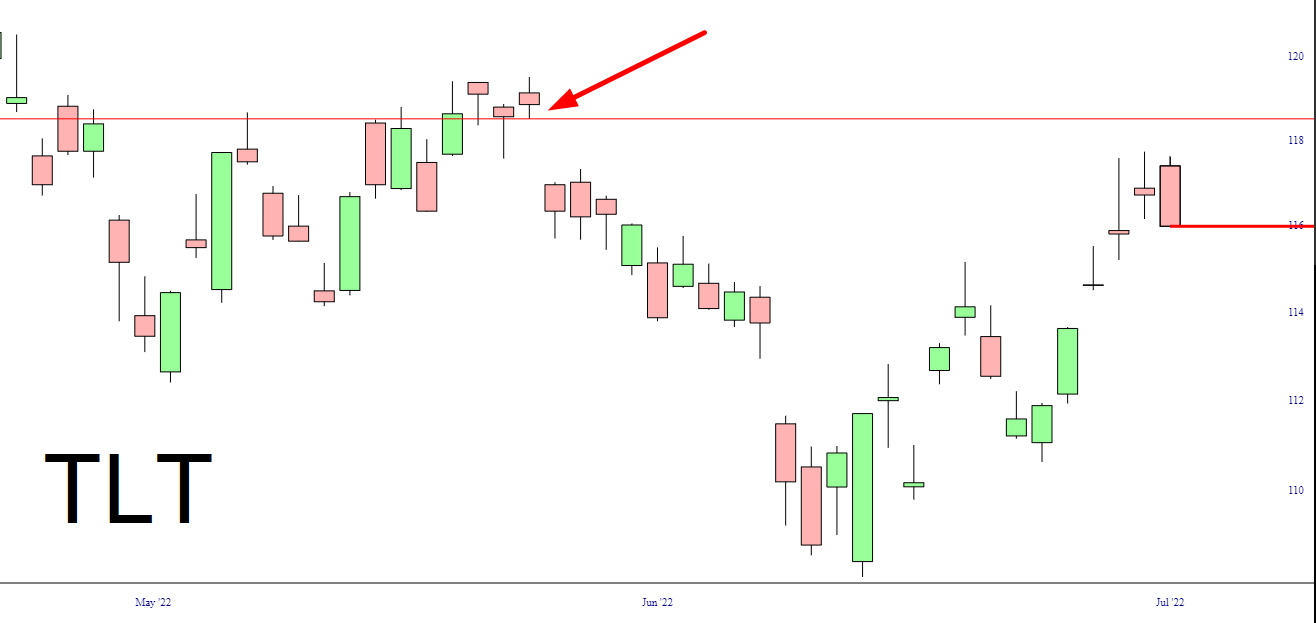

Retail Investors Dive Into Bond Market Wave: Treasury ETFs Attract Interest Amid Stock-Like Volatility

October 05, 2023

Via Benzinga

Exposures

Debt Markets

Score Triple-Digit Gains As The Fed Slashes Its Balance Sheet

September 03, 2022

Via Talk Markets

Via Benzinga

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.