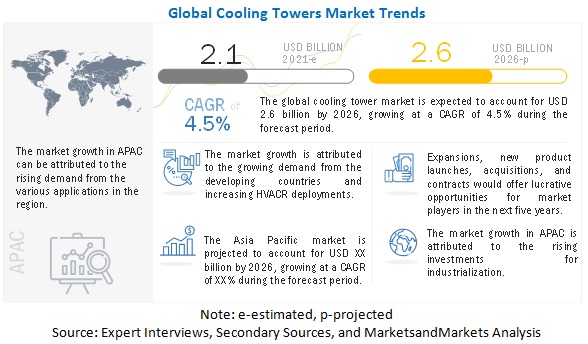

The global cooling tower market size is projected to reach USD 2.6 billion by 2026 growing at a CAGR of 4.5% from 2021 to 2026. The increasing demand for cooling tower in developing countries, rise in HVACR deployments are driving the market for cooling tower.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=268219049

The increase in demand for cooling tower and the growing industrial development in the emerging economies, such as APAC and South America, are driving the market. The key players in this market are EVAPCO (US), Baltimore Aircoil Company Inc. (US), SPX Corporation (US), Artech Cooling Towers Pvt. Ltd. (India), Babcock & Wilcox Enterprises (US), Brentwood Industries (US), Johnson Controls Inc. (Ireland), Paharpur Cooling Tower Ltd. (India), Enexio (Germany), and Hamon & CIE International (Belgium). These players have adopted various strategies such as investment & expansion, merger & acquisition, partnership & agreement, and new product launch in order to strengthen their market position. For instance, in July 2021, Baltimore Aircoil Company Inc. acquired Eurocoil Spa (Italy), a prominent European commercial and refrigeration manufacturer. This acquisition has further strengthened its position in the global cooling market.

Power generation is the largest application of cooling towers in the Asia Pacific. The availability of low-cost raw materials and labor, coupled with increasing domestic demand, makes Asia Pacific an attractive investment destination for cooling tower manufacturers. The rising population, urbanization, and industrialization along with rising concerns related to infrastructure development in China and India are some of the factors expected to drive the market in this region.

Request Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=268219049

Baltimore Aircoil Company Inc. operates as a subsidiary of Amsted Industries Incorporated (US). The company develops and manufactures evaporative cooling towers, thermal storage, and heat transfer equipment. It offers a wide range of cooling towers, such as closed-circuit cooling towers and evaporative cooling towers. The company’s cooling towers are used in various applications such as district cooling plants, heating, ventilation, air conditioning, refrigeration, light/industrial manufacturing, and chemical & petroleum processing.

Hamon & CIE International SA (Belgium) is one of the leaders in cooling towers and operates through its five major business segments: cooling systems, heat exchangers, air quality systems, HRSG-WHB, and chimneys. The company offers various custom-designed dry and wet cooling towers through its cooling system business segment. Furthermore, the company exclusively offers dry cooling systems through its subsidiary Research Cottrell Dry Cooling (US) under the cooling system business segment. Hamon & Cie International SA (Belgium) serves end-use industries, such as electric power plants, oil & gas, and petrochemical industries, followed by other heavy industries, such as steel, cement, minerals, glass, and waste incineration. The cooling systems offered by the company have major applications in nuclear power plants.

Speak with Our Expert for More Details: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=268219049

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The Knowledge Store™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/cooling-towers-market-268219049.html